US stocks continued to move higher for the second straight day on Tuesday, October 18, as better than previously anticipated third-quarter corporate earnings have buoyed the investors' spirit.

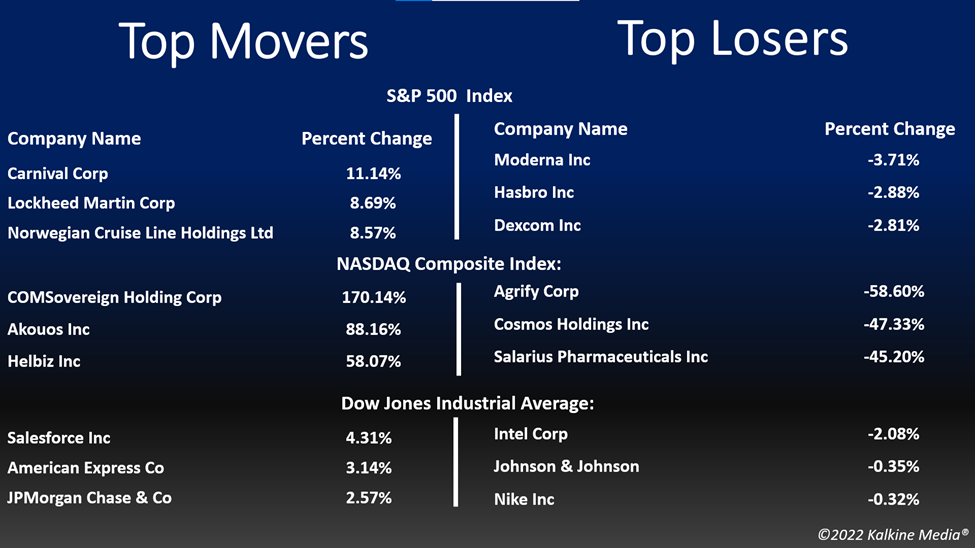

The S&P 500 rose 1.14 per cent to 3,719.98. The Dow Jones was up 1.12 per cent to 30,523.80. The NASDAQ Composite gained 0.90 per cent to 10,772.40, and the small-cap Russell 2000 rose 1.16 per cent to 1,755.96.

The rising interest rates have initially spurred fears of a substantial hit to the earnings of the companies, while the volatile trading in the market amid stubbornly high inflation has left the investors in cold.

However, the earnings from the companies, especially the banks, showed resilience to the economic challenges so far, while boosting the traders' confidence. Federal Reserve's fight against inflation with the jump in interest rates has also raised concern over a potential recession.

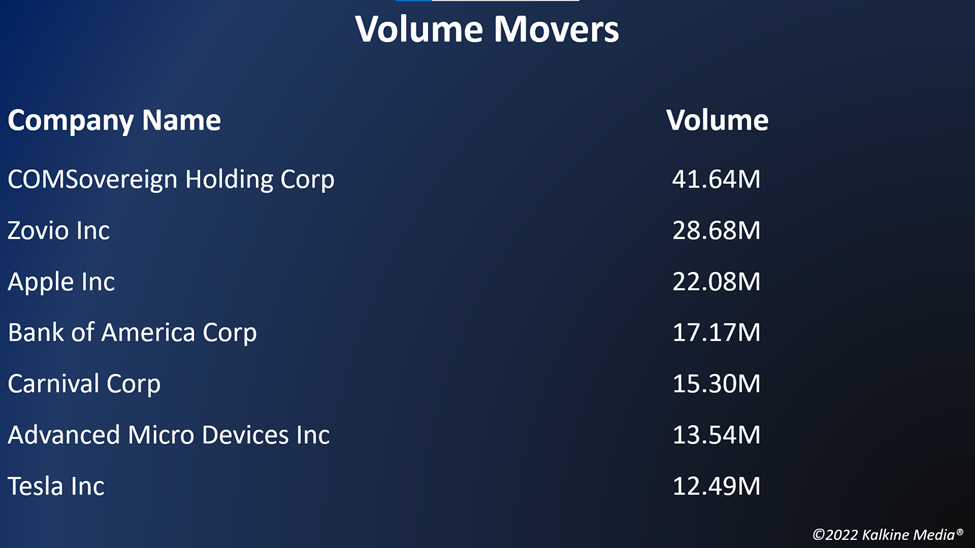

So far, the third quarter earnings have proved to be a boon for the overall market, with all three indices closing in green for the second consecutive day. Many other big companies like Tesla, Inc. (NASDAQ: TSLA), among others would report their earnings later this week, while Netflix, Inc. (NASDAQ:NFLX) would post its operating results after the market close.

On Tuesday, October 18, the industrials, materials, and utilities sectors were the highest percentage gainers in the S&P 500 index, while the information technology segment provided the highest boost. All 11 segments of the index stayed in green on Tuesday.

Shares of the aerospace and defense company, Lockheed Martin Corporation (NYSE: LMT) soars over eight per cent in the intraday trading on Tuesday, after the company reported its earnings results for the latest quarter.

The major banking company, Goldman Sachs Group Inc. (NYSE:GS) jumped more than two per cent in the intraday session on October 18, after the firm reported its latest quarterly earnings results that may have come above the market expectations.

In the industrials sector, United Parcel Service, Inc. (UPS) jumped 1.38 per cent, Raytheon Technologies Corporation (RTX) rose 3.42 per cent, and Union Pacific Corporation (UNP) gained 1.53 per cent. Honeywell International Inc. (HON) and Deere & Company (DE) advanced 1.60 per cent and 2.40 per cent, respectively.

In materials stocks, Linde plc (LIN) was up 1.41 per cent, Vale S.A. (VALE) soared 2.71 per cent, and The Sherwin-Williams Company (SHW) added 1.68 per cent. Air Products and Chemicals, Inc. (APD) and Nutrien Ltd. (NTR) shot up 2.11 per cent and 2.72 per cent, respectively.

Futures & Commodities

Gold futures were down 0.41 per cent to US$1,657.10 per ounce. Silver decreased by 0.25 per cent to US$18.672 per ounce, while copper fell 1.59 per cent to US$3.3613.

Brent oil futures decreased by 1.42 per cent to US$90.32 per barrel and WTI crude was down 2.34 per cent to US$82.55.

Bond Market

The 30-year Treasury bond yields were up 0.21 per cent to 4.024, while the 10-year bond yields fell 0.31 per cent to 4.003.

US Dollar Futures Index decreased by 0.04 per cent to US$111.862.