The Zimbabwe dollar (ZWL) has staged a strong comeback, which has helped it recover some of its previous losses. The USD/ZWL exchange rate dropped to 4,876 this week, down from the year-to-date high of over 10,000.

Zimbabwe election ahead

The Zimbabwe dollar has made a strong recovery in the past few months as investors cheer some of the recent reforms by the government. Some of these reforms include liberalization the forex market, changing taxes, and raising interest rates. The central bank hiked interest rates to 150% in June. These actions have helped to stabilize the currency market.

The ZIM dollar value has also gained because of a change in sentiment by investors and businesses. Some of them believe that the local dollar had become highly over-depreciated. In a note, the head of the Bankers Association of Zimbabwe said that the fair value of the ZWD will be at 5,000. He added:

“The rate had run ahead of itself. It had over-depreciate. It took us two weeks before banks were all operating at the same rate, but it will take much longer in the wider market.”

It is unclear whether the rebound of the Zimbabwe dollar will hold. A likely issue is the fact that Zimbabwe is heading to an election in the coming months. This election pits Emmerson Mnangagwa of the ruling ZANU PF party against Nelson Chamisa of the Movement for Democratic Change.

Zimbabwe’s election will happen on August 23rd. Historically, emerging and frontier market currencies tend to decline ahead of a major national election. In most cases, foreign investors move their money from these countries to avoid potential uncertainties.

Outlook for the Zimbabwe dollar

The sharp comeback of the Zimbabwe dollar is having a major impact for the economy. For one, many companies that moved to the US dollar are seeing substantial losses as the local currency gains.

The same is true for many Zimbabwean savers who have seen the value of their investments drop sharply in the past few weeks.

Still, I believe that this rebound is a dead cat bounce because Zimbabwe’s fundamentals are not all that good. Inflation remains sharply high even after the strong ZWL comeback. At the same time, the unemployment rate remains high while the prices of its biggest export like tobacco, nickel, and platinum have been sluggish lately.

A dead cat bounce is a situation where a falling asset jumps suddenly and then resumes the bearish trend.

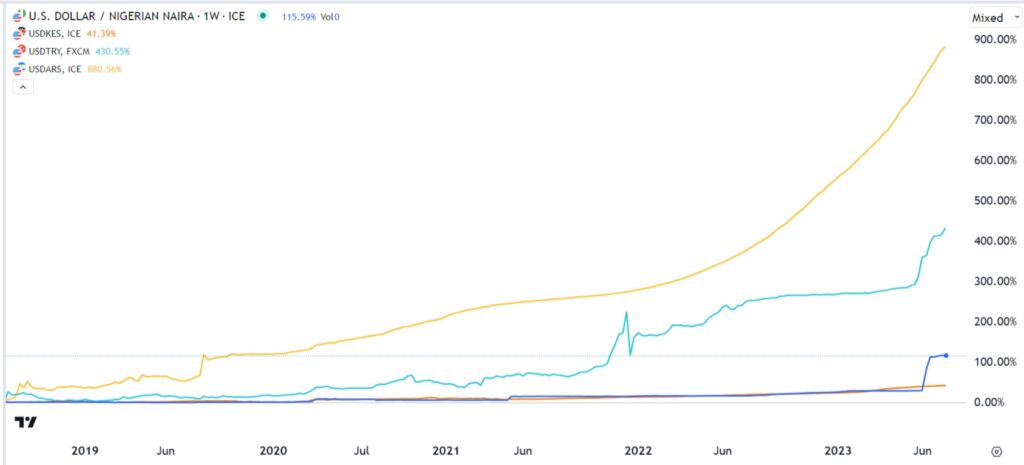

USD/KES, USD/NGN, USD/TRY, and USD/ARS

Most importantly, most emerging and frontier markets currencies tend to drop against the US dollar in an extended period. For example, currencies like the Kenyan shilling, Nigerian naira, and South African rand have fallen in the past decades.

The post “It had over-depreciated” – Bank pro sees Zimbabwe dollar stabilising appeared first on Invezz.