Bitcoin saw another day of sideways price action as bulls struggled to break past the $85,000 psychological resistance level.

With fresh bearish news hitting an already rattled market, tech markets like cryptocurrencies shed a notable chunk of their valuation.

By late Asian trading hours on April 16, the total crypto market capitalisation had slipped nearly 0.6% to $2.74 trillion.

Market sentiment also weakened, dropping 9 points to 29, firmly back in fear territory, which also kept most of the top altcoins from hitting double-digit gains.

Why is Bitcoin down today?

Several factors are weighing on Bitcoin and the broader crypto market today.

For starters, Wall Street turned red after the Trump administration imposed new restrictions on Nvidia’s chip exports to China.

That spooked investors and sparked fears of another round of aggressive trade tariffs, dragging down risk assets across the board.

Nasdaq 100 futures slipped over 2.3%, and chipmakers like ASML tanked more than 7% on demand concerns.

The weakness in tech quickly rippled into crypto, which has remained tightly correlated with US equities since mid-2020.

Adding to the pressure, reports emerged that China may be offloading its seized Bitcoin holdings.

Local authorities across multiple municipalities are allegedly selling around 15,000 BTC, worth over $1.4 billion, via offshore exchanges.

That’s a sharp contrast to the US, which is looking to hold confiscated crypto as part of a national reserve.

The risk-off mood was further reflected in gold markets. The precious metal hit a new all-time high of over $3,317 per ounce, confirming that investor sentiment was more skewed towards safe-haven assets.

Bitcoin’s role as a safe-haven asset also appears to be fading, at least for now.

Gold has clearly stolen the spotlight this year, climbing 26.5% year-to-date, while Bitcoin has slipped 11.5% in the same period.

That performance gap has tilted investor preference toward the yellow metal, especially during periods of heightened geopolitical uncertainty.

Meanwhile, demand for spot Bitcoin ETFs, once a major source of institutional momentum, has started to cool off.

Between March 28 and April 15, spot Bitcoin ETFs saw nearly $964 million in net outflows, according to data from Farside Investors.

With institutional inflows drying up, weakened demand is now visibly capping Bitcoin’s price momentum.

What’s next for Bitcoin?

As previously reported by Invezz, Bitcoin has been trying to break past a key resistance zone near $85,000 for several weeks now, and that ceiling is proving stubborn.

Technical indicators such as the Ichimoku Cloud further reinforce this resistance level.

The cloud currently aligns with the $85K region, effectively capping Bitcoin’s upside and limiting any sustained bullish momentum.

Historically, this level has posed challenges. The last two rejections, on April 2 and February 21, both led to sharp corrections, pulling Bitcoin back down toward the $75,000 range.

Unless Bitcoin can establish a decisive breakout above this resistance, the likelihood of another downside move remains elevated.

Key support levels on the way down are the $80,000 psychological level.

Further down, the main area of interest lies between the $74,400 range low (from April 7) and the $76,600 low reached on March 11.

These are important levels for Bitcoin to maintain a bullish structure, according to MN Capital founder Michael van de Poppe.

According to MN Capital founder Michael van de Poppe, Bitcoin needs to hold the zone between $74,400 and $76,600 to maintain its broader bullish structure in the short term.

This range includes key recent lows from April 7 and March 11 and will likely be the main area of interest if the $80,000 psychological support gives way. A break below that could open the door to a deeper correction in the near term.

BTC/USDT 4 hour chart. Source: Michaël van de Poppe.

However, on the monthly setup, Bitcoin technicals remain bullish, according to analyst Crypto Rover.

In a chart shared on X, Rover compared Bitcoin’s current price structure with gold’s historic Elliott Wave pattern.

Both assets appear to be following a similar 5-wave formation, where Bitcoin is now completing wave 4 and potentially gearing up for a strong wave 5 breakout.

Rover highlighted how gold rallied massively after a similar pullback in its fourth wave, and suggested that Bitcoin might be nearing a comparable turning point.

Other indicators like Bitcoin market cap dominance also support a bullish case for the top crypto if we consider historical trends.

According to Crypto Banter, Bitcoin’s dominance has just hit its highest level since 2021, now sitting at around 64%.

That’s a key level many analysts keep an eye on, as it often marks major turning points in the market cycle.

Last time BTC dominance reached this range, Bitcoin rallied from $20,000 to $69,000 in just a few months.

If history repeats, this could signal the early stages of a fresh leg up for Bitcoin.

Nevertheless, macroeconomic headwinds and geopolitical developments will remain key drivers in shaping Bitcoin’s next major move.

When writing, Bitcoin was up just 0.1%, hovering just below the $85k mark.

Altcoins stay silent

Altcoins followed Bitcoin’s lead, with most of the market trading in the red.

Only a handful of the top 99 altcoins saw gains, while a few small-cap tokens managed to post double-digit rallies.

The total altcoin market cap held relatively steady, dipping just 0.19% as traders adopted a wait-and-see approach amid weak risk appetite and low activity.

According to the Altcoin Season Index, the market is currently still in Bitcoin Season, with the index reading at 16, well below the 75 threshold that would mark a true altcoin cycle.

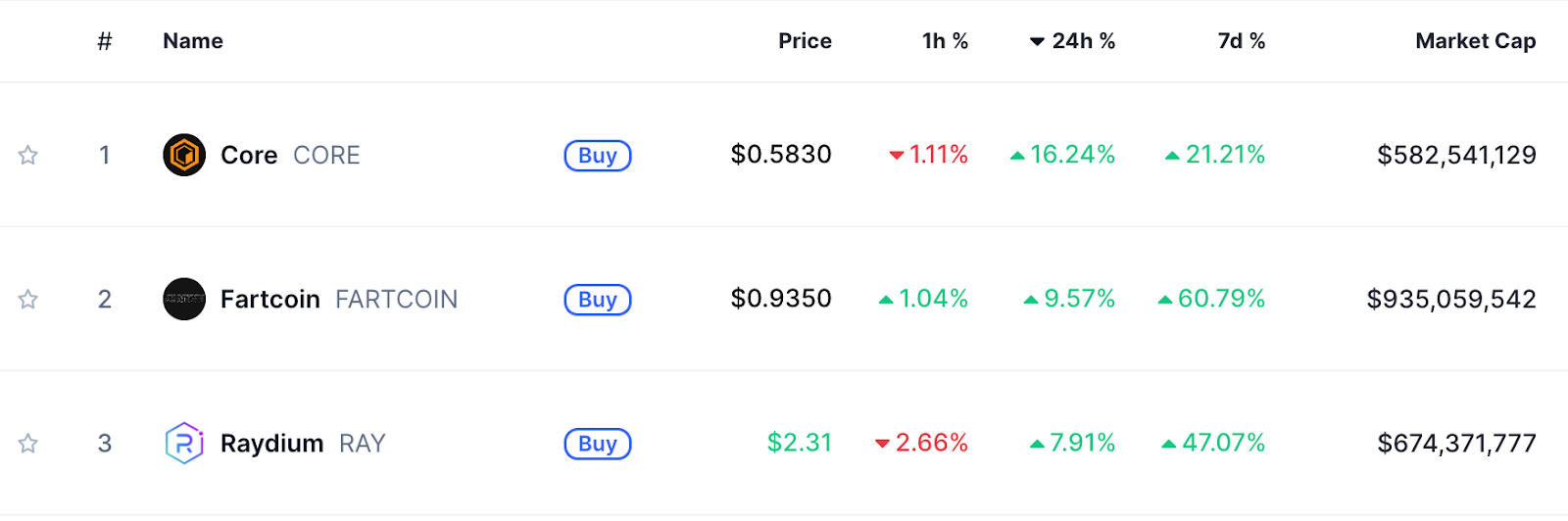

Bitcoin’s proof-of-stake layer Core led the day’s gains, climbing over 16% at press time amid renewed investor interest surrounding its one-year anniversary.

The milestone marks a year since Core introduced self-custodial BTC staking, allowing users to earn yield on the Proof-of-Work asset without wrapping, bridging, or giving up custody.

Analysts say Core might keep climbing toward $1 now that it’s finally broken past the $0.58 resistance level, which it hadn’t been able to break since early February.

Source: CoinMarketCap

Fartcoin (FARTCOIN) was up a little over 9%, consistent with typical speculative trends in the sector.

At the same time, Raydium (RAY) recorded gains of roughly 8% following the launch of its new token launchpad to rival competitors like Pump.fun and Sun Pump.

The post Crypto prices today: Bitcoin stays range-bound near $85K, CORE rallies 16% against market trend appeared first on Invezz