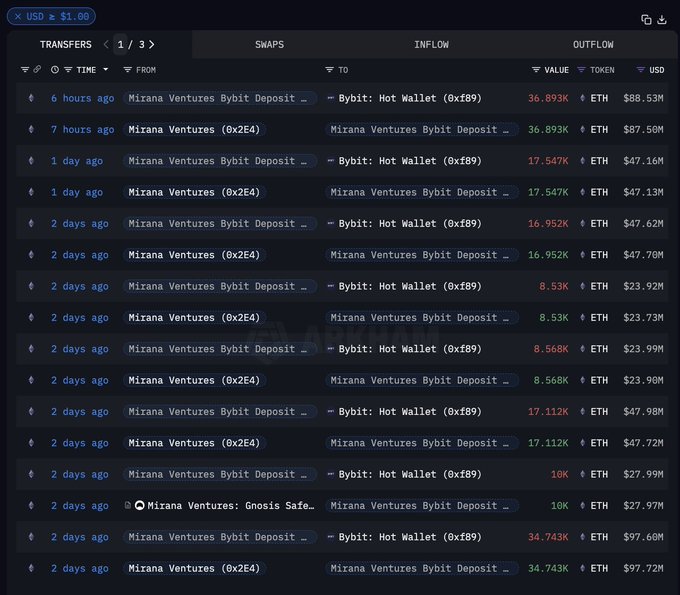

Bybit, one of the world’s largest cryptocurrency exchanges, has received a $600 million Ethereum (ETH) deposit from Mirana Ventures following a $1.5 billion security breach that drained ETH-based assets from the platform.

The injection of funds, sourced from Bitcoin (BTC) and Tether (USDT) liquidations, comes as Bybit works to mitigate the fallout from one of the largest crypto hacks in recent history.

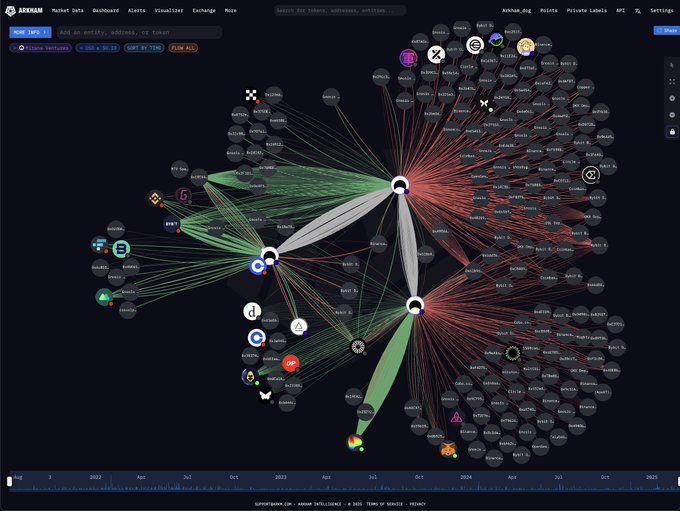

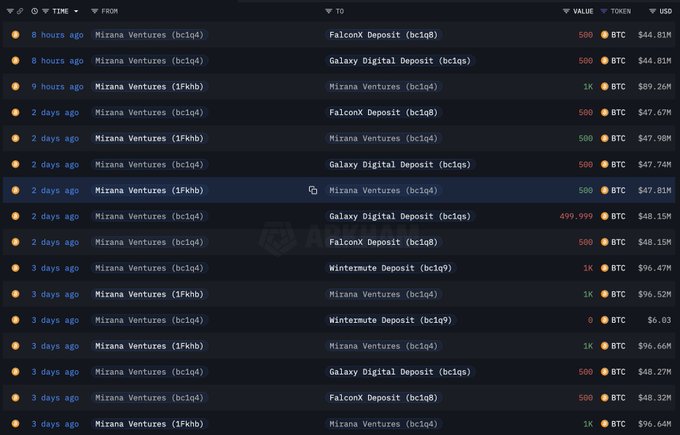

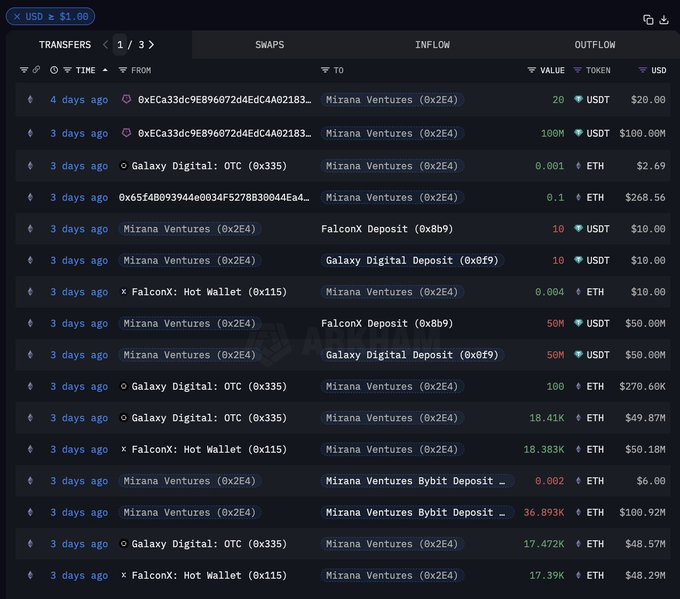

Arkham Intelligence reported that Mirana Ventures, a venture capital firm connected to Bybit’s co-founders, sold $500 million worth of BTC and $100 million worth of USDT to acquire the ETH before transferring it to Bybit’s reserves.

BYBIT HACK UPDATE: $600M OUT OF $1.5B ETH BOUGHT AND SENT TO BYBIT $600M of ETH has been deposited to Bybit in the past 3 days by Mirana Ventures – making them the largest ETH depositor after the hack. Mirana Ventures appears to have acquired this ETH by selling $500M BTC and…

The transactions were facilitated through prominent OTC desks, including FalconX, Galaxy Digital, and Wintermute.

This move signals an effort to stabilize the exchange’s liquidity and reassure users following the major breach.

Bybit’s liquidity improves post-hack

Mirana Ventures played a pivotal role in replenishing Bybit’s depleted Ethereum reserves.

Over three days, the firm became the largest ETH depositor to Bybit since the attack, helping the exchange restore liquidity after the massive outflow of funds.

The venture firm opted for OTC transactions to secure Ethereum in a way that minimized market disruption, allowing it to efficiently inject liquidity without significantly impacting ETH’s price.

Bybit had previously obtained a bridge loan to facilitate user withdrawals and maintain market confidence.

Following the injection of ETH from Mirana Ventures, withdrawal pressure on the exchange has eased, suggesting that fears over Bybit’s solvency are subsiding.

With a $1.5 billion shortfall, the exchange is still working to recover from the attack fully.

Lazarus Group linked to $1.5B breach

Investigators have traced the Bybit hack to the North Korean cybercriminal organization Lazarus Group.

Known for orchestrating some of the largest cryptocurrency thefts, Lazarus Group has been implicated in multiple high-profile security breaches targeting digital asset exchanges and financial institutions.

The hackers deployed sophisticated malware to infiltrate Bybit’s security infrastructure, moving stolen ETH across multiple wallet addresses to obfuscate the trail.

Cybersecurity firms and law enforcement agencies continue to track the movement of stolen assets, but recovery efforts remain challenging due to the complexity of blockchain-based laundering techniques.

The attack on Bybit follows a broader pattern of large-scale crypto heists, many of which have been linked to state-sponsored actors.

With this latest breach, Lazarus Group has reinforced its reputation as one of the most formidable threats in the digital asset space.

Bybit restores $700M ETH in 48 hours

In response to the hack, Bybit has taken several measures to secure its platform and restore user confidence.

Within 48 hours of the breach, the exchange recovered nearly $700 million worth of ETH through a combination of OTC deals and institutional loans.

Bybit CEO Ben Zhou has reassured users that the platform now maintains full 1:1 client asset backing, ensuring that all customer funds remain protected.

The exchange has resumed normal operations, signaling that its emergency liquidity measures have helped mitigate the impact of the attack.

While Bybit has made significant progress in replenishing its reserves, the event underscores the persistent security risks facing centralized exchanges.

The platform is expected to introduce further security enhancements in the coming months to prevent future breaches and reinforce investor trust.

The post Bybit gets $600M ETH injection from Mirana Ventures after massive $1.5B hack appeared first on Invezz