Summary

- PayPoint Plc had reported a decline of 10.8% in its underlying net revenue from continuing operations to £24.5 million during Q3 FY2021 ended on 31 December 2020.

- PAY had completed the acquisition of Handepay Limited (“Handepay”) and Merchant Rentals Limited (“Merchant Rentals”) on 04 February 2021.

- PAY had declared H1 FY2021 interim dividend of 15.6 pence per share.

- PAY had witnessed a substantial growth of 46.2% to 49.7 million card payment transactions during Q3 FY2021

PayPoint Plc (LON:PAY) is the LSE listed industrial stock. PAY’s shares have generated a return of about negative 36.79% in the last 12 months. It is listed on the FTSE All-Share Index. It was incorporated in 1998.

Business Model

PayPoint is the leading technology provider based out in UK and Romania. It had enabled its services in around 27,700 stores across the UK. PayPoint helped its customers to make easy payments via several channels and various devices.

(Source: Company presentation)

Recent News

On 10 February 2021, PAY had announced that it would acquire RSM 2000 Ltd. This transaction would be completed by Q1 FY22. The Company would strengthen its position in the digital payment segment, as it would enhance the digital payment capability of the Company. PayPoint would like to take advantage of this Covid-19 situation as more customers were opting for digital payments instead of cash payment.

On 04 February 2021, the Company updated that it had completed the acquisition of Handepay Limited (“Handepay”) and Merchant Rentals Limited (“Merchant Rentals”) for a cash consideration of around £70 million.

Trading Update (for three months ending 31 December 2020 (Q3 FY21), as on 21 January 2021)

(Source: Company update)

- The Group reported a decline of 10.8% in its underlying net revenue from continuing operations to £24.5 million during Q3 FY20/21 compared to Q3 FY19/20.

- The net revenue across UK retail services was plunged by 1.4% during the period despite an increase in card payment transactions and PayPoint One service fees.

- PAY had witnessed a substantial growth of 46.2% to 49.7 million card payment transactions during Q3 FY20/21 compared to Q3 FY19/20.

- The Company demonstrated a 6.6% jump in UK parcel transactions during the period.

- PAY had shown a surge of 25.8% in eMoney transactions during the period, showing significant digital payments growth.

- The Company had expanded its UK retail network to 27,758 sites during the period, while it was 26,829 as of 31 March 2020.

- However, the UK bill payments net revenue had shown a decline of 33.5% during the period.

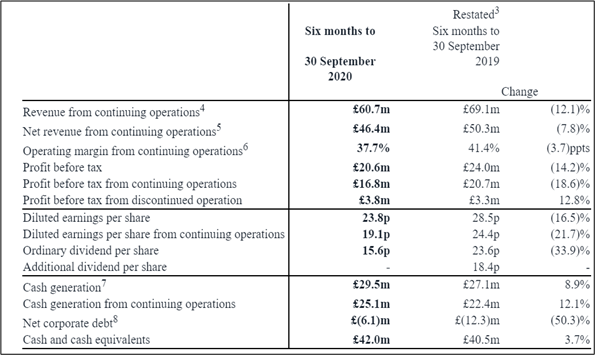

H1 FY2021 Financial Highlights (for six months period ended 30 September 2020, as on 26 November 2020)

(Source: Company result)

- PAY had reported a decrease of 7.8% in its net revenue from continuing operations to £46.4 million during H1 FY20/21 ended on 30 September 2020 compared to H1 FY19/20. However, the prior period consisted of revenue from the British Gas contract.

- Similarly, profit before tax from continuing operations was declined by 18.6% due to net revenue reduction and end of a British Gas Contract.

- The Company had reduced its net corporate debt from £12.3 million as of 30 September 2019 to £6.1 million as of 30 September 2020.

- During the period, the diluted earnings per share from continuing operations stood at 19.1 pence .

- The Company had cash & cash equivalent of £42.0 million as of 30 September 2020.

- PAY had declared H1 FY20/21 interim dividend of 15.6 pence per share.

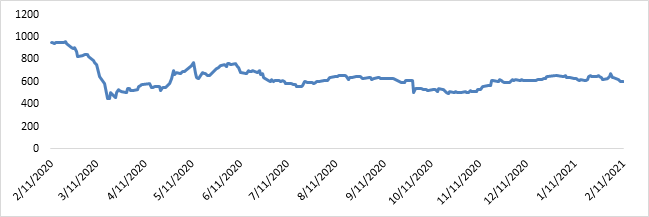

Share Price Performance Analysis of PayPoint Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of PayPoint Plc were trading at GBX 602.45 and were down by close to 0.09% against the previous closing price as on 11 February 2021, (before the market close at 11:07 AM GMT). PAY's 52-week Low and High were GBX 389.00 and GBX 980.00, respectively. PayPoint Plc had a market capitalization of around £413.94 million.

Business Outlook

The Company had delivered resilient trading performance amid government restrictions. It has a progressive dividend policy illustrating a long term confidence in the business. The Group had recently completed a few acquisitions to seize various market opportunities. The volumes across card payment and digital payment would continue to perform on expected lines. However, volumes across bill payment and ATM had witnessed several headwinds created by Covid-19 pandemic and changing consumer behaviour. The Company is well-positioned to grab benefits of the shift in consumer payment patterns from cash payment to digital payment. PayPoint had highlighted that its Q4 FY20/21 trading performance would remain robust. The transaction related to the disposal of its Romania business would be expected to be completed by March 2021.