Highlights

- Macfarlane’s turnover was £133.5 million for the half-year ended 30 June 2021, representing an increase of 26.5% year-on-year from £105.5 million in H1 2020.

- DS Smith’s board announced a dividend payout of 12.1 pence per share for FY 2021.

- Mondi’s underlying EBITDA for Q3 2021 was €388 million, up by 27% compared to €306 million in Q3 2020.

Most businesses in the UK struggled due to the disruptions caused by the coronavirus pandemic, with several unable to stay operational as a result of the imposition of lockdowns and restrictions on movement. However, companies operating in the packaging flourished on being deemed essential, as more people shopped online and goods needed to be shipped to homes and businesses with proper packaging.

More recently, packaging businesses in the UK are being confronted with inflationary pressures due to a shortage of drivers and rising costs of transport, energy, and chemicals.

(Data source: Company release and Refinitiv)

Let us explore the investment potential of 3 dividend paying packaging stocks listed on the LSE.

Macfarlane Group Plc (LON: MACF)

Macfarlane Group is a packaging and labelling company. For the half-year ended 30 June 2021, the company’s turnover was £133.5 million, representing a growth of 26.5% year-on-year from £105.5 million in H1 2020.

The shares of Macfarlane Group are trading at GBX 134.00, up by 1.52% at 10:15 AM BST on 7 October 2021.

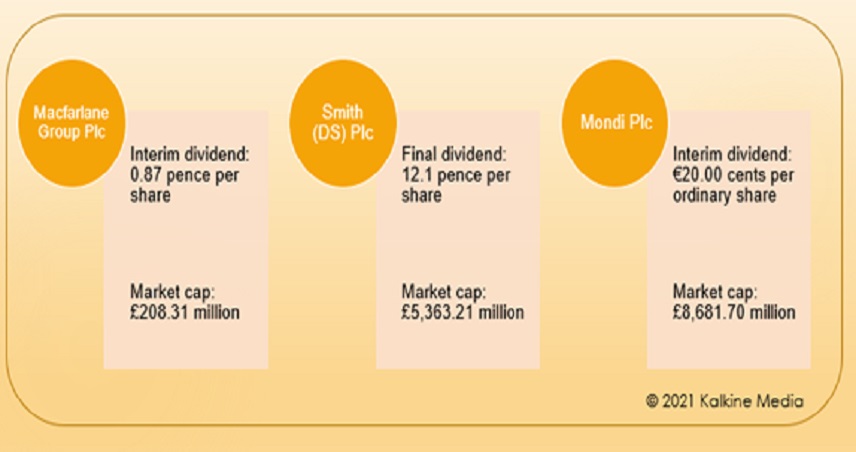

Growing by over 120% year-on-year, Macfarlane’s pre-tax profit reached £7.8 million in H1 2021 compared to £3.5 million in H1 2020. The company announced a 24.3% year-on-year increase in its interim dividend from 0.70 pence per share in H1 2020 to 0.87 pence per share in H1 2021.

The shares of Macfarlane Group gave a return of 59.52% in the last one year to shareholders, and the market cap is £208.31 million as of 7 October 2021.

Smith (DS) Plc (LON: SMDS)

DS Smith is a packaging company that provides plastic-free and sustainable packaging and integrated recycling services. For the financial year 2021, DS Smith recorded revenue of £5,976 million compared to £6,043 million in 2020. Its adjusted operating profit stood at £502 million in 2021 compared to £660 million in 2020.

The shares of DS Smith are trading at GBX 389.30, down by 0.28% at 10:22 AM BST on 7 October 2021.

DS Smith’s board announced a dividend payout of 12.1 pence per share for FY 2021.

The shares of DS Smith gave a return of 26.63% in the last one year to shareholders, and the market cap is £5,363.21 million as of 7 October 2021.

Mondi Plc (LON: MNDI)

Mondi is a FTSE 250 listed packaging and paper group based in the UK. The company announced a hike in its prices as a measure to tackle inflationary pressures from higher resins, energy, chemical and transport costs. However, the company continued to witness strong growth in demand.

The shares of Mondi are trading at GBX 1,810.00, up by 1.23% at 10:32 AM BST on 7 October 2021.

Mondi’s underlying EBITDA for Q3 2021 was €388 million, representing an increase of 27% compared to €306 million in Q3 2020. Mondi announced an interim dividend of €20.00 cents per ordinary share for the year ended 31 December 2021.

The shares of Mondi gave a return of 8.84% in the last one year to shareholders, and the market cap is £8,681.70 million as of 7 October 2021.