Highlights

- Dividend investing is one of the most common investment strategies, where investors seek to generate a stable income from dividend payouts obtained from equity investments.

- Stable businesses with a solid financial performance are more likely to pay better dividends.

Dividend investing is one of the most common investment strategies, where investors seek to generate a stable income from dividend payouts obtained from equity investments. Several stocks listed on the London Stock Exchange (LSE) offer a high dividend and are a valuable addition to an investor’s portfolio. Stable businesses with a solid financial performance are more likely to pay better dividends.

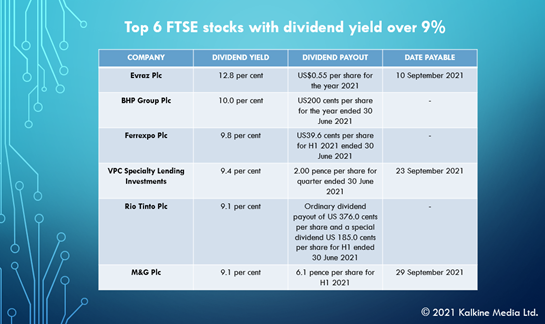

In this article, we will look at the top 6 LSE listed stocks with a dividend yield of over 9 per cent.

Evraz Plc (LON:EVR)

EVRAZ is a UK-based vertically-integrated steel manufacturing and mining company with operations in Russia, Ukraine, Italy, Kazakhstan, the Czech Republic, South Africa, the US and Canada. For the H1 ended 30 June 2021, the company recorded a free cash flow of US$836 million, up from US$315 million in the same period in 2020. The company’s net profits totalled US$1,212 million compared to US$513 million in H1 2020.

On 5 August 2021, EVRAZ’s board declared an interim dividend of US$0.55 per share or US$802.3 million for the year 2021, payable on 10 September 2021 to shareholders registered as of 13 August 2021.

Evraz’s dividend yield stood at 12.8 per cent as of 3 September 2021, and its market cap was £8,644.20 million.

BHP Group Plc (LON:BHP)

BHP is a company engaged in the extraction and processing of minerals, and oil & gas, primarily in the Americas and Australia. For the year ended 30 June 2021, the company’s profit from operations stood at US$25.9 billion, a year-on-year increase of 80%, and its underlying EBITDA was US$37.4 billion. The net operating cash flow of the company stood at US$27.2 billion, and free cash flow was US$19.4 billion on account of high iron ore and copper prices.

On 17 August 2021, BHP’s Board announced a final dividend payout of US200 cents per share to shareholders for the full year ended 30 June 2021.

BHP Group’s dividend yield stood at 10.0 per cent as of 3 September 2021, and its market cap was at £44,754.80 million.

Ferrexpo Plc (LON:FXPO)

Ferrexpo is a Switzerland-based company engaged in commodity trading and mining. It is also one of the largest exporters of iron ore pellets across the globe. For the H1 2021 ended 30 June 2021, revenues of the company rose year-on-year by 74% to US$1,353 million, driven by market conditions and rising investments to improve pellet quality. The company recorded a profit after tax of US$661 million, up by 165% (H1 2020: US$250 million).

For the six months ended 30 June 2021, Ferrexpo’s board announced an interim dividend payout of US 39.6 cents per share (H1 2020: 13.2 US cents per share) to shareholders.

Ferrexpo’s dividend yield stood at 9.8 per cent as of 3 September 2021, and its market cap was at £2,295.63 million.

VPC Specialty Lending Investments Plc (LON:VSL)

VPC Specialty Lending Investments is an investment management firm engaged in investing in the alternative lending market via specialty lending platforms.

VPC Specialty Lending Investments’ board declared an interim dividend payout of 2.00 pence per share for the quarter ended 30 June 2021, payable 23 September 2021 to shareholders registered as of 27 August 2021.

VPC Specialty Lending Investments’ dividend yield stood at 9.4 per cent as of 3 September 2021, and its market cap was at £237.65 million.

Rio Tinto Plc (LON:RIO)

Rio Tinto is a global mining company engaged in exploring, mining and processing mineral resources. For the H1 2021, the company recorded US$13,661 million net cash from operating activities and an EBITDA of US$21,037 million.

Rio Tinto declared an ordinary dividend payout of US376.0 cents per share and a special dividend of US 185.0 cents per share for the six months ended 30 June 2021.

Rio Tinto’s dividend yield stood at 9.1 per cent as of 3 September 2021, and its market cap was at £67,485.71 million.

M&G Plc (LON:MNG)

M&G is a UK-based global investment management firm. It is engaged in investing and managing equities, fixed income and real estate. The company announced an adjusted operating profit before tax of £327 million, up by 6% compared to the same period in 2020.

M&G announced an interim dividend of 6.1 pence per share or £155 million to shareholders for the H1 2021, payable on 29 September 2021.

M&G’s dividend yield stood at 9.1 per cent as of 3 September 2021, and its market cap was at £5,262.21 million.

.jpg)