Highlights

- Whitbread secured planning permission from The City of London Corporation to convert Grade II Listed Snow Hill Police Station into a Premier Inn hotel.

- Wetherspoon’s total sales for the financial year 2021 were £772.6 million, a year-on-year decline of 38.8%.

- InterContinental Hotels Group’s revenue from reportable segments increased by 16% year-on-year to $565 million in H1 2021 compared to $488 million in the previous year

The hospitality sector in the UK outpaced growth in the rest of the economy last month for the first time in over nine years. According to The Lloyds (LON: LLOY) Bank UK Recovery Tracker, the tourism and recreation sector that encompasses hotels, pubs, restaurants and travel agents recorded 62.2 in September. The sector registered the fastest growth among the 14 monitored sectors, for the first time since 2012, due to the easing of lockdown restrictions.

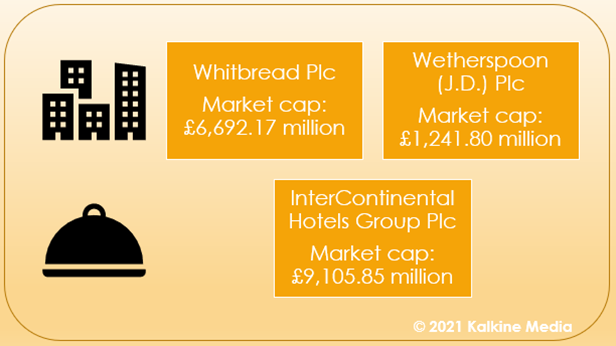

High demand for largescale events such as music festivals and concerts, and the easing of international travel regulations in England have significantly boosted growth in the tourism sector. Here is a detailed review of the investment prospect in 3 FTSE hospitality stocks – Whitbread, Wetherspoon and InterContinental Hotels Group.

(Data source: Refinitiv)

Whitbread Plc (LON: WTB)

Whitbread is an FTSE 100-listed hospitality company and the owner of Premier Inn, a leading hotel brand in the UK. Recently, the company secured planning permission from The City of London Corporation to convert Grade II Listed Snow Hill Police Station into a Premier Inn hotel. The total revenue of the company during 2020/21 was £590 million compared to £2,072 million in 2019/20.

The shares of Whitbread last traded at GBX 3,369.00, up by 1.69% at the close of the day’s trade on 15 October 2021. The market cap of the company stands at £6,692.17 million. In the last one year, the shares of Whitbread returned 51.48% to shareholders.

Whitbread’s UK accommodation sales in the quarter ended May 2021 were 60.9% behind Q1 FY20 due to government restrictions. The food and beverage sales of the company were 86.0% behind Q1 FY20 as all restaurants were closed from the beginning of the quarter until 12 April.

Wetherspoon (J.D.) Plc (LON: JDW)

Wetherspoon is an FTSE 250 listed pub chain operating in the UK and Ireland. The company’s total sales for the financial year 2021 were £772.6 million, a year-on-year decline of 38.8%. Its hotel room and food sales decreased by 27.1% and 37.4%, respectively.

The shares of Wetherspoon last traded at GBX 965.00, up by 0.05% at the close of the day’s trade on 15 October 2021. The market cap of the company stands at £1,241.80 million. In the last one year, the shares of Wetherspoon returned 24.46% to shareholders.

Wetherspoon recorded a loss before tax of £167.2 million in FY 2021 (ended 25 July 2021) compared to £27.5 million in the previous year. The company’s bar sales decreased by year-on-year 42.2% and slot/fruit machine sales by 52.5% in FY 2021.

InterContinental Hotels Group Plc (LON: IHG)

InterContinental Hotels Group is a leading hospitality group in the UK. For the half-year ended 30 June 2021, InterContinental Hotels Group’s revenue from reportable segments increased by 16% year-on-year to $565 million compared to $488 million in the previous year.

The shares of Intercontinental Hotels Group last traded at GBX 5,098.00, up by 2.58% on 15 October 2021. The market cap of the company stands at £9,105.85 million.

IHG’s operating profit from reportable segments for H1 2021 was $188 million, representing an increase of year-on-year 262% compared to $52 million in the same period in 2020.

In the last one year, the shares of Intercontinental Hotels Group returned 24.46% to shareholders.