Summary

- Mitchells & Butlers Plc had reported a decline of 34.1% to £1,475 million during FY20.

- The Company did not have any site opened as of 30 December 2020 in the UK.

- The Company had reported its monthly cash burn of approximately £35 million to £40 million.

- The adjusted operating profit also dropped by 68.8% to £99 million during FY20.

Mitchells & Butlers Plc is the FTSE 250 listed consumer company which is the leading operator of restaurant and pub chains based in the UK. The Company was established in 1898 and providing enriching eating and drinking out experiences through its reputed brands. The Company is listed on London Stock Exchange since April 2003, and is a constituent of FTSE 250 Index. The Company is operating one of the best portfolios of restaurant and pub brands in the UK. Based on its 1-year performance, shares of MAB have generated a return of about negative 45.96%.

Business Model

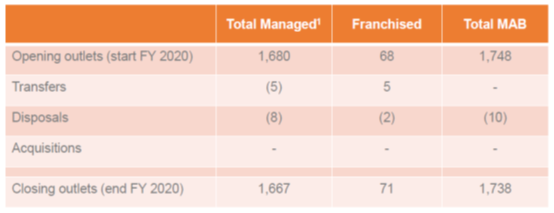

The Company is managing well-reputed brands across the UK and Germany. The Company is having two broader business segments: Retailing operating business and Property business. The Company had total 1,748 outlets operational at the start of FY20, while at the end of FY20, the number of operational outcomes falls down to 1,738.

(Source: Company presentation)

Some of the well-known brands of the Company are -

- Harvester

- Toby Carvery

- All Bar One

- Miller & Carter

- Premium Country Pubs

- Sizzling Pubs

- Castle

- Nicholson's

- O'Neill's

- Stonehouse

- Vintage Inns

- Browns

- Ember Inns

Q1FY21 Trading Update (for 14 weeks ended 02 January 2021, as on 07 January 2021)

- The Company had reported a decline of 67.1% during Q1 FY21 ended on 02 January 2021 from the equivalent period of the prior year. However, the trading went down by 30.1% on a like-for-like basis during Q1 FY21.

- The Company did not have any site opened in the UK as of 30 December 2020 as the UK government announced reallocating regions in England between tiers.

- The Company had a cash balance of £125 million as of 02 January 2021.

- The Company had reported its monthly cash burn of approximately £35 million to £40 million prior to payment of debt service of £50 million per quarter. The next due date for its debt service is 15 March 2021.

- The festive season sales were impacted by the reduced sales activity across both the UK and Germany.

FY20 results (ended 26 September 2020) as reported on 26 November 2020

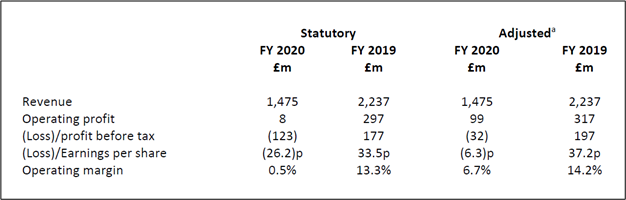

(Source: Company result)

- The adjusted revenue of the Company was declined by 34.1% to £1,475 million during FY20 due to closure of the majority of operations in response to Covid-19 pandemic. The like-for-like sales just reduced by 3.5% over the period. This full-year consisted of a period of closure from 20 March 2020 to 04 July 2020.

- The like-for-like food sales were declined by 0.5%, whereas drink sales fell by 7.3%. It was also benefitted by a reduction of VAT rates by the UK Government.

- Similarly, the adjusted operating profit also dropped by 68.8% to £99 million during FY20. The Company had reported an underlying loss before tax of negative £32 million during the period.

- The adjusted earning per share also dropped to negative 6.3 pence during the period, while it was 37.2 pence per share during FY19.

- Regarding its financial position, the Company had a cash balance of £125 million as of 25 November 2020. The net debt, including lease liability, stood at £2,104 million as of 26 September 2020.

- The Company had generated £127 million of cash flow from operating activities during FY20, although it had reported a shortfall in trading. It had generated £266 million of cash flow from operating activities during its prior year.

- On the liquidity front, the Company had total liquidity of £225 million as of 25 November 2020.

- The Company had incurred capital expenditure of £108 million, of which £104 million was incurred on the purchase of property, plant and equipment and £4 million was spent on the purchase of intangible assets.

- The Company had reported £93 million of the cost incurred related to valuation and impairment of properties, which includes -

- a £43 million emerging from the revaluation of freehold and long leasehold sites.

- a £10 million related to freehold and long leasehold tenant's furniture and fittings.

- a £7 million impairment of short leasehold and unlicensed properties.

- a £33 million impairment of right-of-use assets.

- The Company had incurred £11 million of cost in response to Covid-19 pandemic related to the disposal of stock items on the sites.

- The Company had reported £10 million of deferred tax charges post the enactment of legislation on 17 March 2020.

Share Price Performance Analysis of Mitchells & Butlers Plc

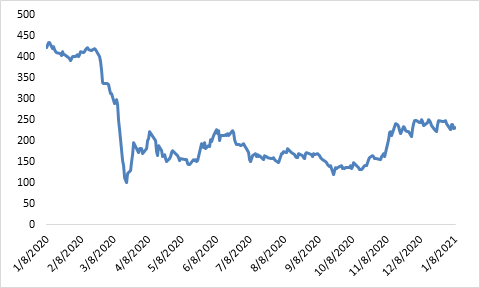

(Source: Refinitiv, chart created by Kalkine group)

Shares of Mitchells & Butlers Plc were trading at GBX 238.50 and were up by close to 3.70% against the previous closing price as on 08 January 2021, (before the market close at 08:30 AM GMT). MAB's 52-week High and Low were GBX 448.50 and GBX 92.30, respectively. Mitchells & Butlers Plc had a market capitalization of around £987.16 million.

Business Outlook

The Company is riding high on the positive news of Covid-19 vaccine and is hopeful that it would turn back the tides. However, the Company had also highlighted the fact that the outlook of the entire hospitality sector would continue to remain uncertain for a long time. The UK Government had announced third nationwide lockdown which would make the things worse for the entire hospitality chain and make a recovery pretty tough.

The Company is cautiously confident that it would emerge to pre-Covid levels once the restrictions are lifted. The Company would focus on cost management and reducing its capital expenditure to compensate for the loss in trading revenue. The Company won’t be able to provide proper financial guidance amid elevated levels of uncertainties. The Company had announced its plan for its equity capital fundraising to achieve financial and operational flexibility.