Summary

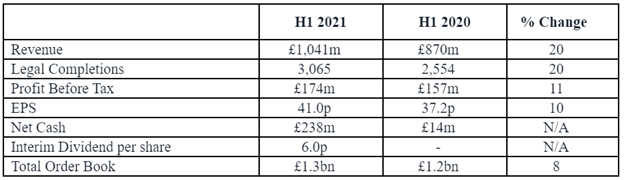

- Redrow Plc had reported an increase in revenue of 20% to £1,041 million during H1 FY21 ended on 27 December 2020.

- The legal completions grew by 20.0% during H1 FY21.

- RDW had unsecured banking facilities of £366.0 million as of 27 December 2020.

- RDW had a total order book of £1.30 billion as of 27 December 2020.

Redrow Plc (LON:RDW) is the LSE listed construction stock. RDW’s shares have generated a return of about negative 26.26% in the last 12 months. It is listed on the FTSE 250 Index. It was incorporated in 1993.

Business Model

The Company is engaged in the construction of homes across England & Wales. Some of the various products of RDW are mentioned below –

- Heritage Collection

- Regent Collection

- Abode Collection

- Bespoke Collection

The total order book stood at £1.30 billion as of 27 December 2020. RDW has 116 outlets as of 27 December 2020.

(Source: Company presentation)

Trading Update (for six weeks ending 05 February 2021, as on 10 February 2021)

- The Company had reported average private reservation value at £265,000 per outlet per week for the period, while it was £298,000 per outlet per week for a similar period of the prior year.

- RDW had achieved private sales rate of 0.67 per outlet per week for the period.

- The Cancellation rate remained 14% during the period.

H1 FY21 Financial Highlights (for six months period ended 27 December 2020, as on 10 February 2021)

(Source: Company result)

- RDW had reported a 20% surge in revenues from £870 million during H1 FY20 to £1,041 million during H1 FY21 driven by an increase in legal completions. The private houses sales went up by 15% during the period.

- The Completions had shown a 20% growth and were 3,065 homes during H1 FY21, benefitted by the record opening forward order book.

- On the profitability front, the gross margin was dropped by 260 basis points to 21.3% for H1 FY21 due to high cost because of Covid-19 pandemic. The earnings per share went up by 10% to 41.0 pence during the period, while it was 37.2 pence during the comparative period of the prior year.

- The Company had managed to reduce its administrative expenses during the period.

- Regarding the financial position, RDW had witnessed a turnaround as it had a net debt position at the start of H1 FY21 and it had managed to reverse that into net cash position by the end of H1 FY21. The Group had net cash of £238.0 million at the end of December 2020.

- RDW had witnessed a 13% growth on a LFL basis in its private revenue per outlet per week during H1 FY21 compared to H1 FY20. It was £274,000 for H1 FY21.

- The private average selling price remained the same as that of the prior year, and it stood at £387,000 during the period.

- RDW will pay an interim dividend of 6.0 pence per share on 09 April 2021 driven by the robust cash position and strong order book. The Company did not pay any interim dividend in the prior year.

- RDW had unsecured banking facilities of £366.0 million as of 27 December 2020.

H1 FY21 Operational Highlights (for six months period ended 27 December 2020, as on 10 February 2021)

- The Company had achieved a forward sale of 95% so far for the current financial year.

- RDW retained five-star customer service ratings after the launch of a new Homeowner Support portal.

- The total contracted land holdings with planning were 26,130 plots at the end of the period.

- The Company had acquired 1,280 plots during the period.

- 72% of the total order book was contracted at the end of the period.

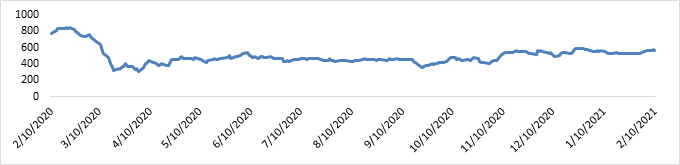

Share Price Performance Analysis of Redrow Plc

(Source: Refinitiv, chart created by Kalkine group)

Shares of Redrow Plc were trading at GBX 558.50 and were down by close to 2.27% against the previous closing price as on 10 February 2021, (before the market close at 12:03 PM GMT). RDW's 52-week Low and High were GBX 293.00 and GBX 850.76, respectively. Redrow Plc had a market capitalization of around £2.01 billion.

Business Outlook

RDW had kickstarted its H2 FY21 on an optimistic note after delivering resilient financial performance during its H1 FY21. The strong first-half performance was driven by several factors like pent up demand and stamp duty holiday. The Company had anticipated its total revenue to remain in excess of £1.8 billion and operating margin of at least 15.5% for FY21. RDW remained well-positioned to tackle future business challenges and several operational headwinds as it had expected net cash position of over £100 million by the end of FY21. However, the net cash would decline in H2 FY21 due to an increased land investment. The Q4 FY21 had expected to generate least revenues for FY21. The Company had a strong order book at the end of H1 FY21.

Redrow had adapted well towards changing buyer behaviour and developed relevant strategies accordingly. The Company had strong fundamentals to achieve its goals aligned with the business growth.