Highlights

- Stagecoach recorded revenue of £928.2 million for the financial year ended 1 May 2021.

- In February 2021, Marston’s completed the acquisition of pub operations of SA Brain in Wales.

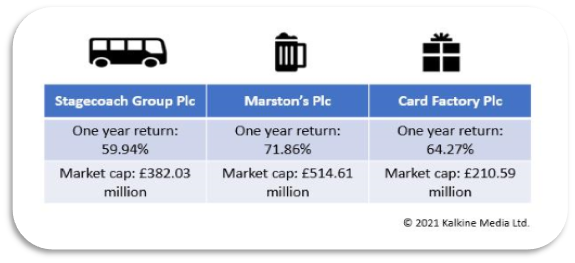

- Stagecoach, Marston’s, and Card Factory shares have returned anywhere between 55-70% in last one year.

Reopening of the economy, easing of COVID-19 related restrictions, and rising vaccination rates have driven businesses to resume normal operations. However, the rising spread of new variants and imposition of new travel-related restrictions is keeping business activities somewhat restricted. Still, there are many stocks that have given decent returns to their investors.

(Data source: Refinitiv)

Investors, however, must evaluate and analyse company performance and prospects before investing in stocks. Here we take a look at 3 FTSE stocks trading with gains of 55-70% in last one year and explore the investment prospect in them.

Stagecoach Group Plc (LON: SGC)

Stagecoach Group is a Scotland-based transport company engaged in the operations of express coaches, buses, and tram services. For the financial year ended 1 May 2021, the company recorded a revenue of £928.2 million compared to the previous year’s £1,417.6 million. Its pre-tax profits also declined to £17.0 million for FY 2021 from £90.9 million in FY 2020. Stagecoach reported more than £875 million of available liquidity as of 28 June 2021.

The shares of Stagecoach Group last traded at GBX 69.35 on 9 September 2021. The shares of the company have returned 59.94% in the last one year to shareholders, and the market cap stood at £382.03 million.

Marston’s Plc (LON: MARS)

Marston’s is a brewing and pub retailing business and operates more than 1,500 pubs in the UK. The company reported revenue of £77.2 million for the 26-week period ending 3 April 2021 compared to £510.5 million during the same period in 2020.

In February 2021, Marston’s completed the acquisition of pub operations of SA Brain in Wales. In October 2020, Marston's completed the disposal of Marston’s Beer Company into the CMBC joint venture with Carlsberg UK.

Marston’s shares last traded at GBX 81.15 on 9 September 2021. The shares of the company have returned 71.86% in the last one year to shareholders, and the market cap stood at £514.61 million.

Card Factory Plc (LON:CARD)

Card Factory is a UK-based retailer of gifts and greeting cards. The total number of stores of the company for the financial year ended 31 January 2021 was 1,016 compared to 1,022 as of 31 January 2020.

Card Factory recorded a decline in revenue from £451.1 million in the financial year ended 31 January 2020 to £285.1 million in FY 2021. The company’s underlying loss before tax for FY 2021 was £15.2 million compared to profit before tax of £67.2 million in FY 2020.

The shares of Card Factory last traded at GBX 61.60 on 9 September 2021. The shares of the company have returned 64.27% in the last one year to shareholders, and the market cap stood at £210.59 million.

.jpg)