Highlights

- GSTechnologies launched GS Money protocol on the Coalculus platform and successfully tested all four enterprise chains provided by Wise MPay.

- Smartspace Software’s revenues rose by 8.8% year-on-year to £2.52 million for the six months ended 31 July 2021 compared to the previous year’s £2.32 million.

- Feedback’s revenue stood at £0.29 million for the full year ended 31 May 2021 compared to £0.45 million in 2020.

Tech stocks represent some of the most lucrative investments options for investors. These are companies from sectors like gadget manufacturers, software developers and providers, wireless service providers, semiconductor firms, streaming service companies, and cloud computing providers.

Let us review in detail the investment opportunity in 3 technology stocks - GSTechnologies, Smartspace & Feedback.

(Data source: Refinitiv)

GSTechnologies Ltd (LON: GST)

GSTechnologies Ltd is a provider of information and communications technology (ICT) solutions. Today, the company announced the launch of GS Money protocol on the Coalculus platform and successfully tested all four enterprise chains provided by Wise MPay.

Earlier this month, the company also announced plans to raise £1.0 million through a share placing for the expansion of its new businesses based on blockchain technology. Last month, GSTechnologies Limited inked an agreement to acquire Angra Limited, a UK-based foreign exchange and payment services provider.

GSTechnologies’ total income for the year ended 31 March 2021 was US$3.41 million, down by 25.1% from US$4.55 million in 2020, while its total comprehensive loss for the year declined to US$0.33 million compared to the previous year’s loss of US$0.46 million.

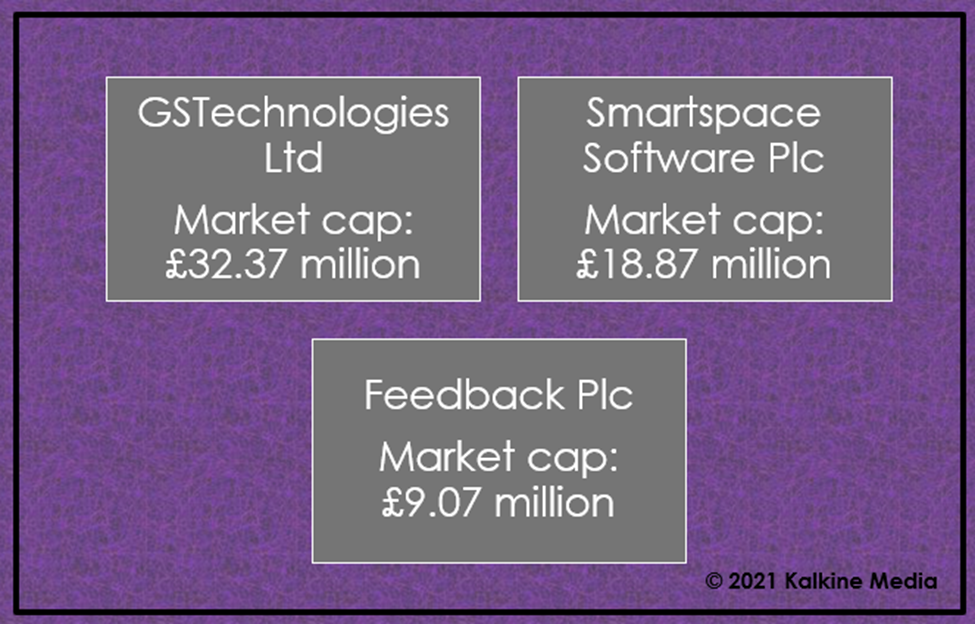

The shares of GS Technologies ended at GBX 2.42, up by 11.01% on Tuesday, 30 November 2021. The market cap of the company stands at £32.37 million.

Smartspace Software Plc (LON: SMRT)

Smartspace Software is an IT service management company and a provider of integrated space management software for commercial spaces and smart buildings. Its customer base as of 30 September 2021 was 4,806 compared to 4,788 as of 31 July 2021. The company’s annual recurring revenue was up by 53% year-on-year to £3.78 million on 31 July 2021, and this momentum continued into H2 with annual recurring revenue at £4.11 million as of 30 September.

Smartspace Software group revenues rose by 8.8% year-on-year to £2.52 million for the six months ended 31 July 2021 compared to the previous year’s £2.32 million.

The shares of Smartspace Software closed at GBX 73.00, up by 11.96% on Tuesday, 30 November 2021. The market cap of the company stands at £18.87 million.

Feedback Plc (LON:FDBK)

Feedback is a medical imaging software firm and provides imaging tools for clinical professionals. The company’s product Bleepa is a medical imaging communications app that serves as a remote communications tool. For the full year ended 31 May 2021, Feedback’s revenue stood at £0.29 million compared to £0.45 million in 2020.

Feedback’s operating loss rose to £2.06 million for the full year ended 31 May 2021 compared to £1.42 million in 2020, on account of headcount expansion and decline in legacy product revenues.

The shares of Feedback closed at GBX 0.85 on Tuesday, 30 November 2021. The market cap of the company stands at £9.07 million.

.jpg)