Zoetic International Plc

United Kingdom-based cannabidiol (CBD) and natural resources company, Zoetic International Plc (ZOE) is a provider of products and services in the oil & gas sector. The companyâs area of interest lies in acquiring technology and mineral rights, along with oil & gas producing assets. The company invests in the portfolio of projects which generate stable revenue streams, and which have a potent stimulus for capital appreciation. The company was earlier known as Highlands Natural Resources Plc.

ZOE-Trading update for H1 FY20

On 4th October 2019, the company announced the trading update for the first half (H1) for the Financial Year 2020 period ended 30th September 2019. The companyâs revenue was recorded at £1.15 million in H1 FY20 as against £0.52 million in H1 FY19. The companyâs Zoetic and Chill products are now being stocked in about 67 stores in the US (during the reported period). The company aims to foray into cosmetics in the United Kingdom by the end of the year. The company had cash balances of £1.0 million as recorded on 30th September 2019. The company has initiated discussions on the sale of oil & gas assets with several parties.

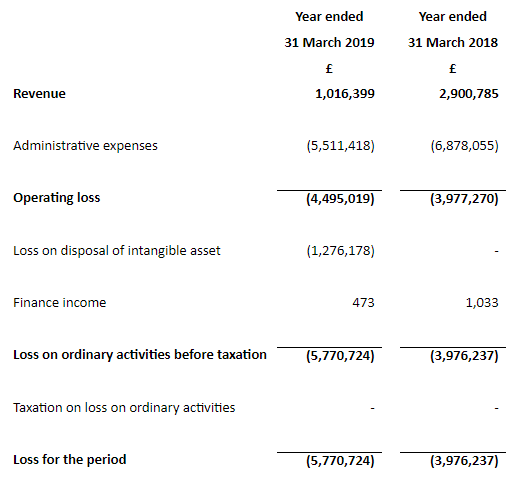

ZOE-Financial highlights for FY19

(Source: LSE)

The company earlier released its results for the Fiscal year 2019 period ended 31 March 2019. The companyâs revenue was recorded at £1.0 million from East Denver Oil & Gas Project in FY19 as against £2.9 million in FY18. The company made six additional wells operational in January 2019. The company is well poised to reap benefits from existing and new wells drilled during FY20. The company discovered rare gas in Kansas post reported period end. The company is looking forward to yielding benefit for the shareholders through establishing CBD business in a rapidly growing market.

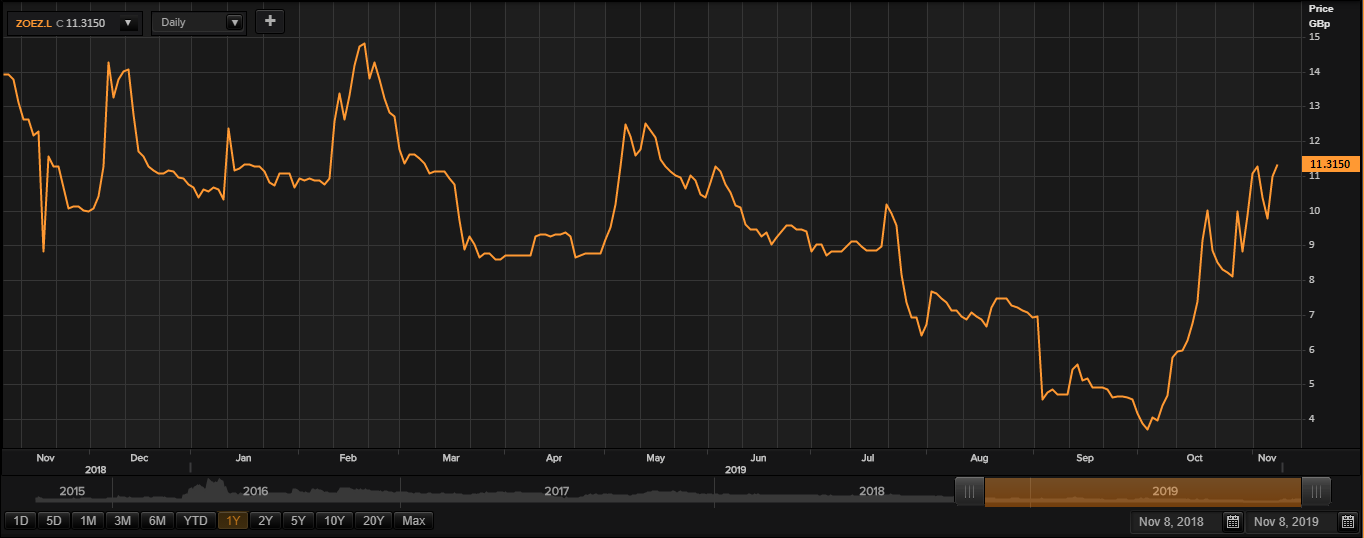

ZOE-Share price performance

(Source: Thomson Reuters)

While writing (as on 08th November 2019, at 10:32 AM GMT), Zoetic International PLC shares were trading at GBX 11.31 per share. The companyâs market capitalisation was around £16.30 million.

ZOE shares have clocked a high of GBX 16.40 and a low of GBX 3.24 in the past year.

In the past 1 month, ZOE shares have delivered a positive return of 177.85 per cent. Also, on a YTD (Year-to-Date) time interval, the stock surged by approximately 0.69 per cent and was up by 49.32 per cent in the last three months.

Purplebricks Group Plc

Purplebricks Group Plc (PURP), formerly known as New Broom Limited, is a real estate agency. The group provides a technology platform that facilitates the process of selling, buying and letting property. It has operations in Australia, the UK, the US and Canada. Purplebricks is headquartered in Solihull, the UK.

PURP-Trading update for H1 FY20

There was a weakening in the overall UK property market as political and economic uncertainty impacted confidence during the period, thereby reducing home sale volumes especially in the South East. The company managed to sustain a market share of 4 per cent overall and looks forward to improvement in the marketing and revenue generation in conjunction as the focus is on being efficient. The Canadian business performed ahead of the expectations. Overall, the companyâs revenue is expected to remain flat as compared to the previous period, though the company was profitable in the first half of the fiscal year 2020. The company is expected to release its interim results for H1 FY20 on 12th December 2019.

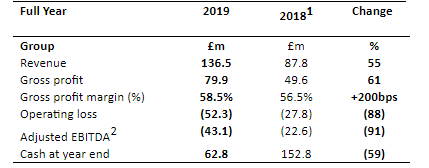

PURP-Financial Highlights for FY19

(Source: LSE)

In the financial year ending 30th April 2019, the companyâs reported revenue increased by 55 per cent to £136.5 million as compared with the financial year 2018 of £87.8 million. UK revenue climbed by 21 per cent to £90.1 million. UK ancillary revenue contributed 44 per cent of total revenue against the 43 per cent recorded in FY18.  Gross profit surged by 61 per cent to £79.9 million as compared to £49.6 million in FY18, while gross margin rose to 58.5 per cent against the previous year data. The companyâs adjusted negative EBITDA stood at £43.1 million in FY2019 versus an adjusted negative EBITDA of £22.6 million in FY2018. With the increase in the administrative expenses and marketing costs for the period, the company reported an operating loss of £52.3 million in FY2019 versus an operating loss of £27.8 million in FY2018. With the significant increase in the financial expenses for the period, the company reported an LBT (loss before tax) of £55.9 million in FY2019 versus an LBT (loss before tax) of £29.2 million in FY2018. The companyâs LAT (loss after tax) stood at £54,861 thousand in FY2019 versus a LAT (loss after tax) of £30,077 thousand in FY2018. The companyâs basic and diluted loss per share was at 18 pence in FY2019 as against a basic and diluted loss per share of 11 pence in FY2018.

PURP-Share price performance

(Source: Thomson Reuters)

While writing (as on 08th November 2019, at 10:35 AM GMT), Purplebricks Group Plc shares were trading at GBX 113.29 per share. The companyâs market capitalisation was around £346.69 million.

PURP shares have clocked a high of GBX 195 and a low of GBX 88.50 in the past year.

In the past 1 month, PURP shares have delivered a positive return of 2.73 per cent. On a YTD (Year-to-Date) time interval, the stock plunged by approximately 23.75 per cent and was down by 2.75 per cent in the last three months.

Bushveld Minerals Ltd

Bushveld Minerals Limited (BMN) is a Johannesburg, South Africa-based development and exploration company dealing in mineral projects. The company has differentiated its operations in four operating segments: Coal Exploration, Vanadium and Iron Ore, Vanadium Mining and Production, and Energy.

BMN-Operational update for Q3 FY19 period ended 30th September 2019

The company successfully acquired Vanchem for US$53.5 million. Vametco's production stood at 561 mtV for Q3 FY19 in the structure of NitrovanTMÂ coming from magnetite mass. Vametcoâs realized record monthly production was of around 310 mtV during the month of September due to improved operational performance and stability. Vametco's production for the nine months ended 30 September 2019 increased by 3 per cent to 1,953 mtV as compared to 1,897mtV in nine months period ended in FY18. As a result of improved operational performance, the company is progressing nicely to meet its production guidance of 2,800 mtV to 2,900 mtV for the fiscal year 2019.

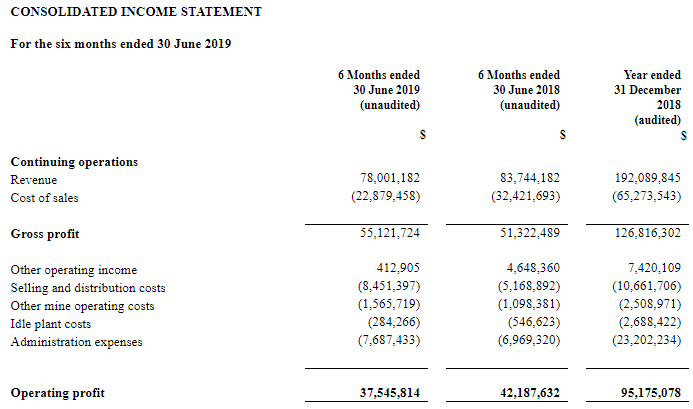

BMN- Financial Highlights for H1 FY19

(Source: LSE)

In the first half of the financial year 2019, the companyâs reported revenue stood at $78 million as against $83.7 million in H1 FY2018. The decline in the revenue was due to lower sales volume for the period. In the H1 FY2019, the gross profit stood at $55 million versus $51 million in H1 FY2018. The companyâs EBITDA was at $41 million in H1 FY2019 versus $42.8 million in H1 FY2018. Driven by higher selling and distribution costs and higher administrative expenses for the period, the companyâs operating profit for H1 FY2019 declined to $37.5 million against $42.1 million in H1 FY2018. The PBT (profit before tax) was reported at $44.7 million for H1 FY2019 versus $41.5 million in H1 FY2018. The companyâs Profit for the year stood at $30.8 million in the first half of the Financial year 2019 against $28.5 million in H1 FY2018. The basic and diluted earnings per share for H1 FY2019 stood at 1.92 cents as against 1.57 cents in H1 FY2018.

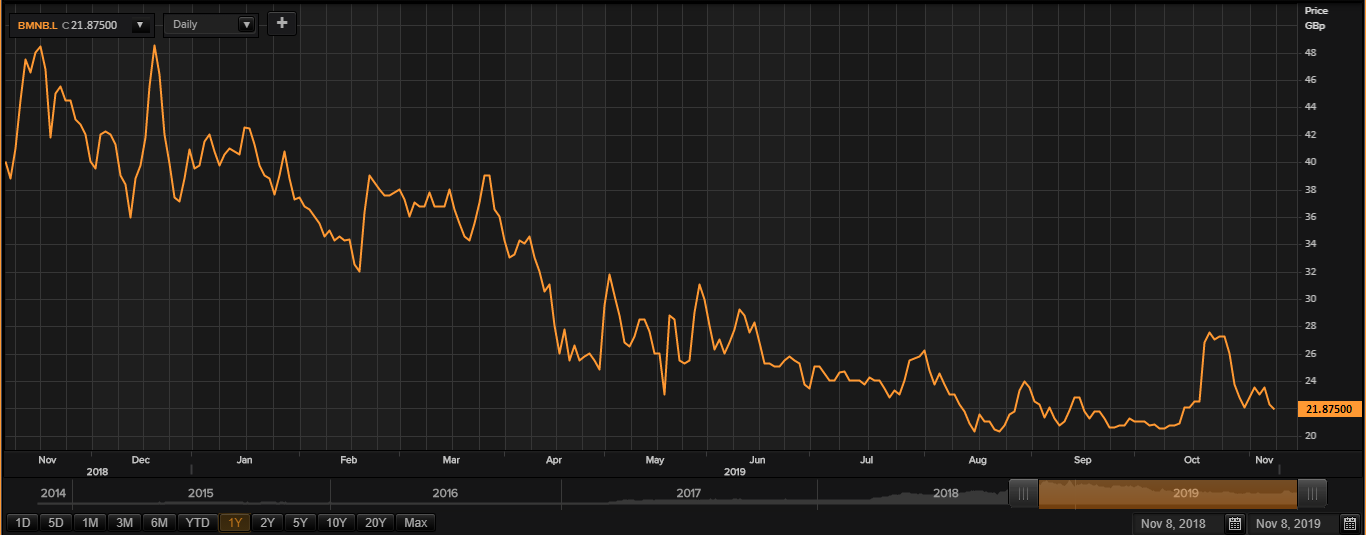

BMN-Share price performance

(Source: Thomson Reuters)

While writing (as on 08th November 2019, at 10:38 AM GMT), Bushveld Minerals Limited shares were trading at GBX 21.87 per share. The companyâs market capitalisation was around £257.28 million.

BMN shares have clocked a high of GBX 50.19 and a low of GBX 19.50 in the past year.

In the past 1 month, BMN shares have delivered a positive return of 6.97 per cent. On a YTD (Year-to-Date) time interval, the stock plunged by approximately 42.58 per cent and was down by 6.32 per cent in the last three months.