Travis Perkins Plc

Travis Perkins Plc (TPK) is a Northampton, the United Kingdom based company that is engaged in the provisions of building materials to building, construction and home improvement industry. The company operates more than 20 businesses across the United Kingdom that include 19 brands that the company operates through. These brands includes Wickes, which is one of the biggest home retailers in the United Kingdom with around 240 sites across the country and product variety ranging from kitchen and bathroom to paint and timber, BSS, which is one of the United Kingdomâs leading pipelines and heating systems distributor, CCF, which is one of the countryâs leading distributor in building products, Benchmarx, that engages in the business of selling kitchen products, Toolstation, which provides products to the trade, home improvers and self-builders industry in the United Kingdom, Tile Giant, which engages in the business of tile retailing with more than 90 showrooms across the country and Keyline, which is a market leader in trade of civil utilities, drainage products and heavy building materials in the United Kingdom.

TPK Trading Update

On 22nd October 2019, the company announced a trading update for the performance in the third quarter of the year. The company highlighted that the merchanting business segment showed a robust and resilient performance in the midst of trying market conditions. The company reported a total group (excluding Plumbing and Heating) sales growth year on year at 5.2 per cent during the reporting period. The Plumbing and Heating sales growth showed a decline of 1.0 per cent in which the sales performance has been offset by a reduction in revenues for the wholesale business. In terms of sales performance, the total sales growth from the Toolstation business witnessed an increase of 21.3 per cent year on year. The total sales growth of the group has been reported to be around 3.8 per cent year on year for Q3 2019. The company also highlighted that the demerger from the Wickes brand is on track and will be completed by Q2 2020. It was also reported that the company would pause the sale process of plumbing and heating business for the time being, as a consequence of extremely high uncertainty around the business.

Â

TPK Share Price Performance

On 22nd October 2019, at 10:50 A.M., while writing, Travis Perkins Plcâs stockâs current market price was at GBX 1537.50 per share, an increase of 3.19 per cent or GBX 47.50 per share as compared to the previous dayâs reported closing price at GBX 1490.00 per share. The companyâs shares traded at a 52-week high price of GBX 1550.50 per share in dayâs trading session. At the current market price, the companyâs shares were trading 58.07 per cent above the 52-week low price of GBX 972.66 per share, which the companyâs shares set on October 22, 2018. The companyâs market capitalisation (M-Cap) was currently reported at £3.756 billion.

By the time of writing, 619,170 of companyâs stocks had been traded for the day. The average volume of trade, per day, in the last one year was at 1.28 million stocks. The companyâs stock has gained 56.89 per cent in the last one year, from the price of GBX 980.00 per share.

The Beta of the stock has been reported to be at 0.9601, from which it can be inferred that the stockâs price movement, is marginally less volatile as compared to the movement of the comparative benchmark index.

Â

St. Jamesâs Place Plc

St. Jamesâs Place Plc (STJ) is the United Kingdom based Wealth Management company. The company is involved in providing Investment management, protection, retirement planning, intergenerational wealth management, banking and mortgages, business consulting and advisory based solutions and services to its clients. The company has four major segments, through which it provides its different services, which are: Advisory, Investment, Retirement and Protection. Through the Investment segment, the company focuses on the growth of the wealth of the clients by investment in various asset class. Through the Retirement segment, the company provides pension solutions as well as advice on how to make the best of the available retirement opportunities. Protection segment focuses on Insurance and most significantly on life insurance to provide cover to its clients. Banking and Mortgages segments help both the first-time buyers as well as people who are considering downsizing options.

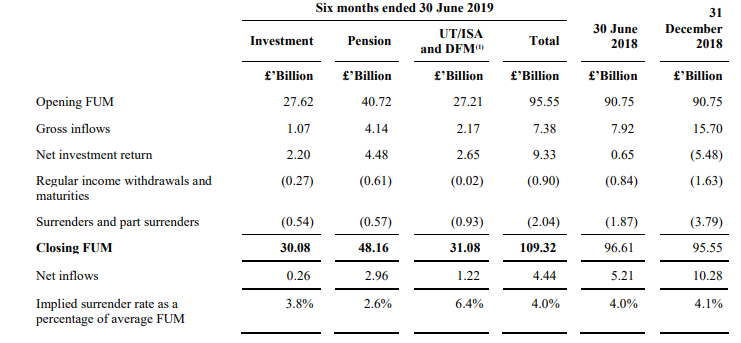

STJ Business Inflows Update

For the quarter ended 30th September 2019, the company on 22nd October 2019, released an update on business inflows and funds under management. The company reported a decline in gross inflows from Q3 2018 at £3.83 billion to £3.74 billion in Q3 2019. The closing funds under management as on 30th September 2019 were £112.82 billion as compared to the closing Funds under management on 30th September 2018 at £100.59 billion. North American equities continue to be the biggest part of the portfolio at 22 per cent of the total Funds under Management. The company reported having retained 96 per cent of the Annualised Funds under management in Q3 2019 as compared to 96.2 per cent that was retained in Q3 2018 (annualised). The company believes that the political and macroeconomic activities can affect the pace at which the funds flow in the company, but it would not have a material effect on the activities of the business for the company to have a continuing need for long term planning.

Source: Company Website

STJ Share Price Performance

On 22nd October 2019, at 11:17 A.M., while writing, St. Jamesâs Place Plcâs stockâs current market price was at GBX 1030.00 per share, an increase of 1.68 per cent or GBX 17.00 per share as compared to the previous dayâs reported closing price at GBX 1013.00 per share. At the current market price, the companyâs shares were trading 14.72 per cent above the 52-week low price of GBX 897.80 per share, which was set on October 03, 2019. This was also 11.97 per cent below the 52-week high price of GBX 1170.14 per share, which the companyâs shares set on April 29, 2019. The companyâs market capitalisation (M-Cap) was currently reported at £5.407 billion.

By the time of writing, 542,880 of companyâs stocks had been traded for the day. The average volume of trade, per day, in the last one year was at 2.11 million stocks. The companyâs stock has lost a marginal 0.43 per cent in the last one year, from the price of GBX 1034.50.

The Beta of the stock has been reported to be at 1.1597, from which it can be inferred that the stockâs price movement, is more volatile as compared to the movement of the comparative benchmark index.

Â

Bushveld Minerals limited

Bushveld Minerals Limited (BMN) is a Johannesburg; South Africa based Mining company that is engaged in the production of integrated vanadium. Vanadium is a ductile and soft high-value metal. The companyâs supply line makes up for 3.5 per cent of the worldâs total Vanadium. The company runs its operations through two main subsidiaries Bushveld Vanadium and Bushveld Energy as well as has investments in some projects directly, such as the PQ Iron and Titanium Project, the PQ Phosphate Project and Afritin Mining Limited.

BMN Financial Performance

On 30th September 2019, the company announced its interim results for the six months ended 30th June 2019. The company reported a revenue of US $78.0 million in H1 2019, as compared to US $83.7 million in H1 2018. The company also reported a decline in EBITDA from US $42.8 million in H1 2018 to US $41.0 million in H1 2019. However, this reduction did not impact the Profit before tax which was reported at a slight increase in H1 2019 at US $30.8 million as compared to US $28.5 million in H1 2018. The company generated a free cash flow of US $23.3 million during the year and the earnings per share (EPS) was reported at GBX 1.92 per share in H1 2019 as compared to GBX 1.57 per share in H1 2018 marking a resilient performance by the company in the first half of 2019.

BMN Share Price Performance

On 22nd October 2019, at 11:53 A.M., while writing, Bushveld Minerals Limitedâs stockâs current market price was at GBX 27.55 per share, an increase of 2.97 per cent or GBX 0.795 per share as compared to the previous dayâs reported closing price at GBX 26.75 per share. At the current market price, the companyâs shares were trading 41.26 per cent above the 52-week low price of GBX 19.50 per share, which was set on August 23, 2019. The companyâs market capitalisation (M-Cap) was currently reported at £299.35 million.

By the time of writing, 10.18 million of companyâs stocks had been traded on the day. The average volume of trade, per day, in the last one year was at 7.16 million stocks. The companyâs stock has lost 3.35 per cent in the last one year, from the price of GBX 28.00.

The Beta of the stock has been reported to be at 0.1206, from which it can be inferred that the stockâs price movement, is significantly less volatile as compared to the movement of the comparative benchmark index.