Highlights

- Central Asia Metals PLC recorded a total production of 3,661 tonnes of copper in Q3 FY23.

- Its zinc production increased to 5,127 tonnes in Q3 FY23, as compared to 4,847 tonnes in Q3 FY22.

- In H1 FY23, the firm clocked a gross margin of 50.8% beating industry median of 41.1%.

FTSE AIM UK 50 Index-listed Central Asia Metals PLC (LSE:CAML) is a UK-based copper producer with its operations based in Kounrad, Kazakhstan, and Macedonia. For the nine months of FY23, CAML has posted zero Lost Time Injuries (LTIs) at the Sasa or Kounrad mines.

In the third quarter of the fiscal year 2023, the company recorded a total production of 3,661 tonnes of copper, versus 3,380 tonnes Cu in the previous quarter of FY23. Its zinc production increased to 5,127 tonnes in Q3 FY23, as compared to 4,847 tonnes in Q3 FY22. However, CAML’s lead production reduced to 7,039 tonnes in the reporting period, which was 7,116 tonnes in Q2 FY23.

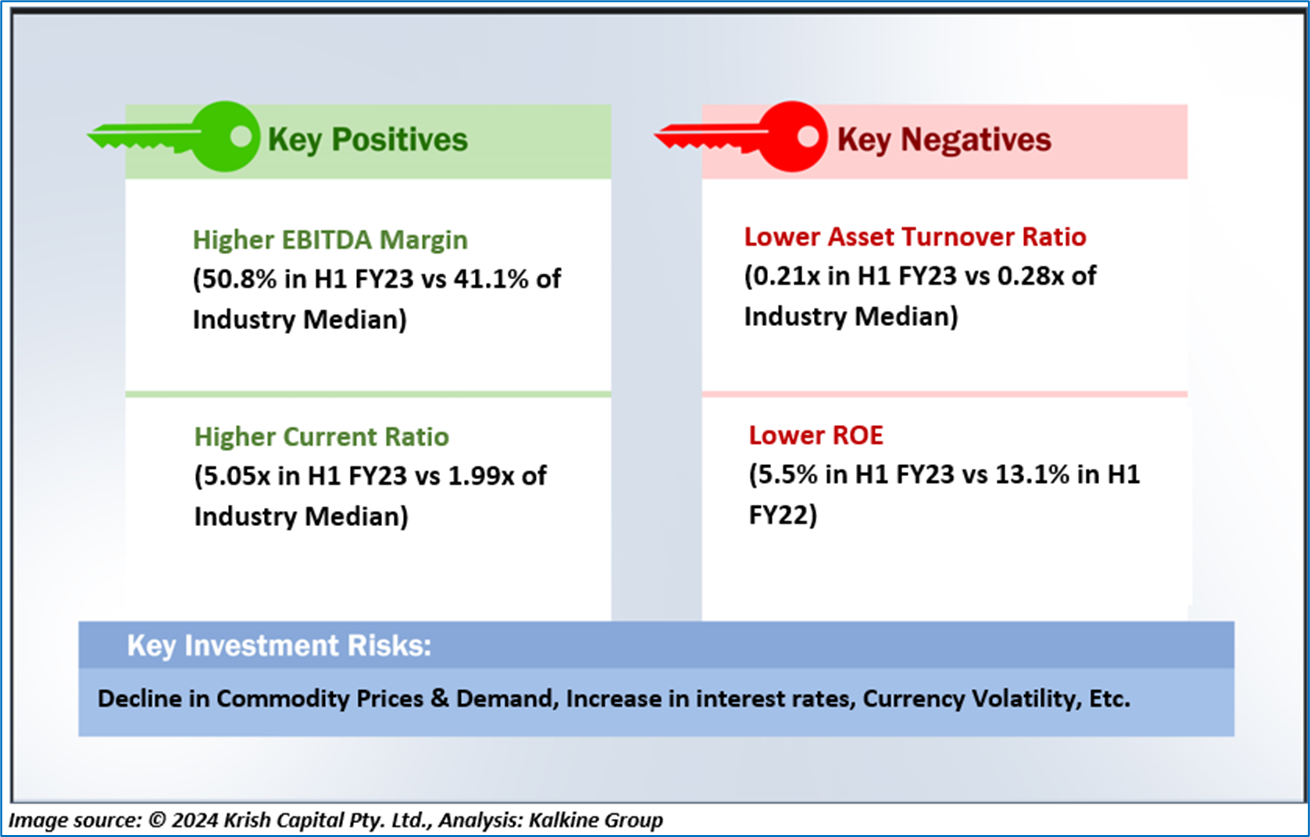

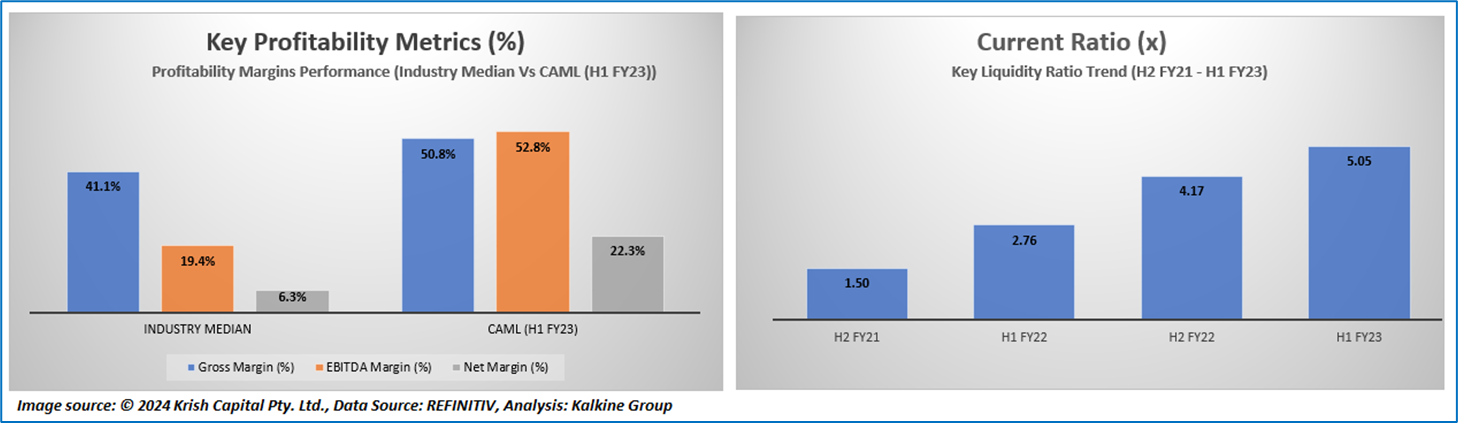

In the first half of FY23, the firm clocked a gross margin of 50.8%, beating industry median of 41.1%. Furthermore, its EBITDA margin jumped to 52.8% in H1 FY23 against the industry median of 19.4%. Its net margin stood at 22.3% for H1 FY23, beating industry median of 6.3%.

Central Asia Metals is expecting to achieve the production guidance of copper of around 13,000 tonnes - 14,000 tonnes in FY23. Its production guidance for zinc in concentrate formis likely to be between 19,000 tonnes and 21,000 tonnes for the full fiscal year. Its production guidance for lead in concentrate form is likely to range from 27,000 tonnes to 29,000 in FY23.

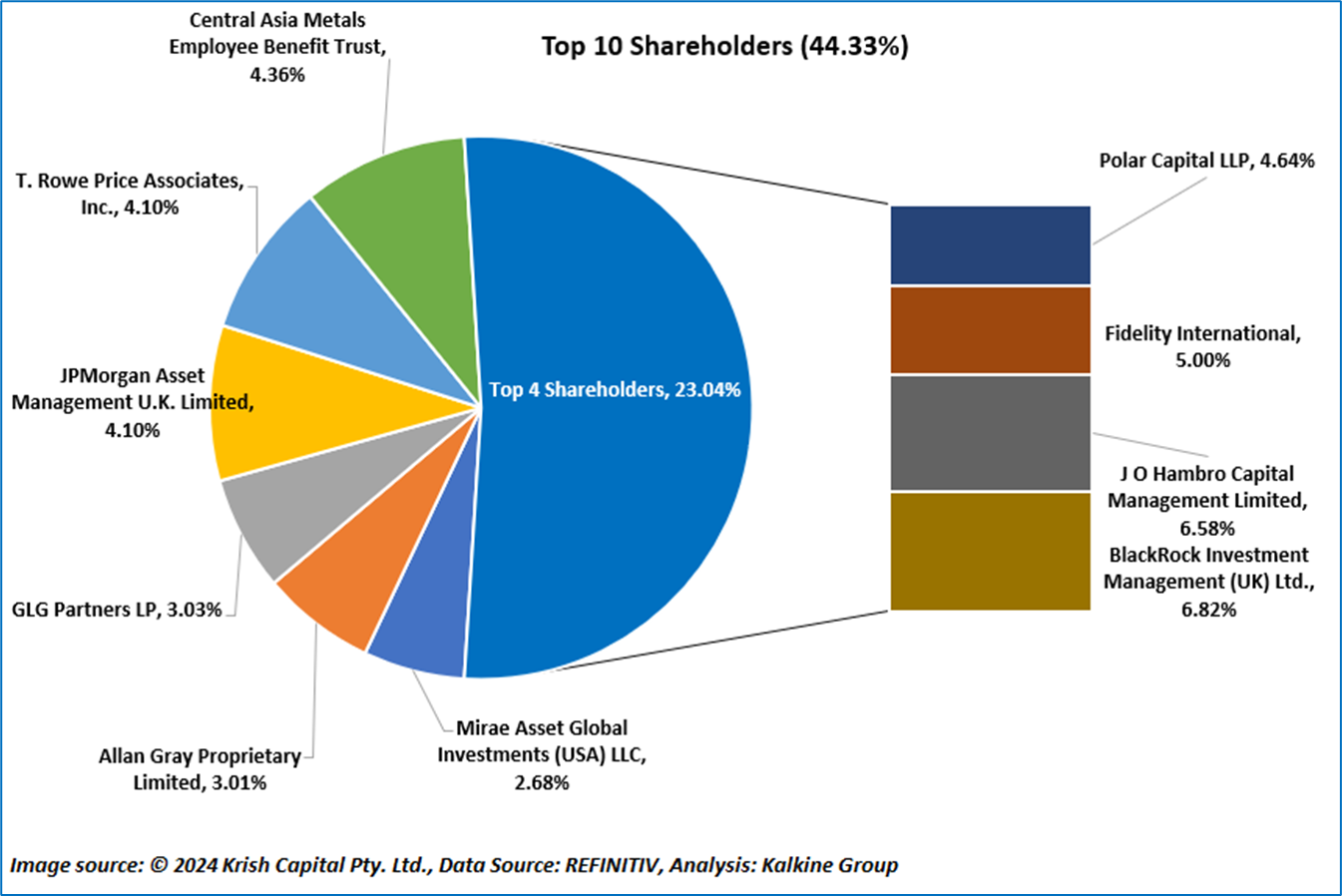

Top 10 Shareholders:

Around 44.33% of the total shareholdings in the firm is held by its top tens sharehoders. While BlackRock Investment Management (UK) Ltd. is the biggest shareholder with 6.82% shareholding, J O Hambro Capital Management Limited is the second-biggest shareholder in CAML with approximately 6.58% shareholding.

Stock Price Performance and Technical Summary:

CAML’s stock price has dropped 0.80% in the past three months. The stock’s 52-week high and 52-week low price stand at GBX 299.00 and GBX 151.20, respectively.

Note 1: Past performance is not a reliable indicator of future performance.

Note 2: The reference data for all price data, currency, technical indicators, support, and resistance levels is 09 January 2024. The reference data in this report has been partly sourced from REFINITIV.