US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 3.42 points or 0.08 per cent higher at 4,403.18, Dow Jones Industrial Average Index surged by 38.41 points or 0.11 per cent higher at 34,793.35, and the technology benchmark index Nasdaq Composite traded lower at 14,631.20, down by 22.80 points or 0.16 per cent against the previous day close (at the time of writing – 11:45 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note after the US added lower-than-expected jobs during September 2021. Among the gaining stocks, Oatly Group (OTLY) shares grew by around 4.28% after JP Morgan had upgraded the investment stance to “overweight”. Among the declining stocks, Allogene Therapeutics (ALLO) shares plunged by about 43.33% after FDA stopped testing for the Company’s cancer cell therapies. Oshkosh (OSK) shares dropped by around 1.35% after the Company reduced the fourth-quarter guidance. Tesla (TSLA) shares went down by approximately 1.11% after Elon Musk confirmed that the Company would move the headquarters from California to Texas.

UK Market News: The London markets traded in a green zone after a surge in oil price. Moreover, the Brent crude was traded at USD 83.35 per barrel, slightly lower than the three-year high of USD 83.47 per barrel.

TUI AG shares plunged by about 15.22% on the first day of a discounted rights issue. Moreover, the Company planned to raise USD 1.30 billion through issuance to reduce its debt.

Can Global Market rebound on Monday?

Weir Group shares dropped by around 2.73% after the Company issued a profit warning that the profitability could have an adverse impact of about 40 million pounds due to the recent cyberattack.

Royal Mail had bought Canadian logistics company Mid-Nite Sun Transportation for CAD$360 million. Furthermore, the shares went down by around 0.70%.

FTSE 250 listed Electrocomponents shares grew by around 0.09% after the Company had raised annual guidance after reporting interim trading ahead of expectations. However, the Company had warned of the supply chain disruptions.

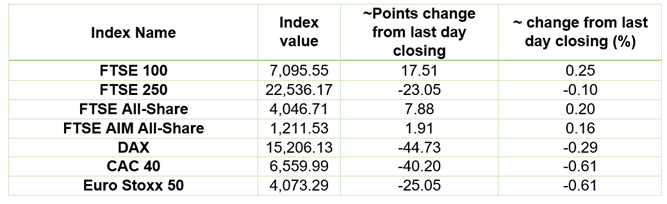

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as of 08 October 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 sectors traded in green*: Energy (2.38%), Basic Materials (0.55%), Financials (0.34%).

Top 3 sectors traded in red*: Utilities (-0.69%), Technology (-0.52%), Real Estate (-0.21%).

Top 3 gainers on FTSE All-Share index*: Pharos Energy PLC (7.88%), Enquest PLC (7.74%), John Wood Group PLC (6.46%).

Top 3 losers on FTSE All-Share index*: TUI AG (-14.93%), RM PLC (-5.56%), Unite Group PLC (-3.92%).

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $82.49/barrel and $79.50/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,760.30 per ounce, up by 0.06% against the prior day closing.

Currency Rates*: GBP to USD: 1.3623; EUR to USD: 1.1574.

Bond Yields*: US 10-Year Treasury yield: 1.598%; UK 10-Year Government Bond yield: 1.1525%.

*At the time of writing