Highlights

- CML Microsystems’ board declared a special dividend of 50 pence per ordinary 5p share for FY 2021.

- Electrocomponents’ revenue for Q1 ended 30 June 2021 grew by 37 per cent year-on-year.

- Nanoco recorded revenue of £1.0 million for the half-year ended 31 January 2021 compared to £2.9 million for the same period in the previous year.

Semiconductors constitute a fundamental component of most tech today. Even though there were disruption due to the pandemic in the global supply chain, the semiconductor industry continued to thrive, driven by the increased demand for smartphones, PCs, and infrastructure hardware needed for hyperscale data centres.

According to IDC, the global semiconductor market is estimated to grow by 17.3 per cent in 2021 compared to 10.8 per cent in the previous year. Semiconductor stocks are emerging as a popular choice for investors due to the robust growth in the industry to address the rising demands.

(Data source: Refinitiv)

Let us review in detail 3 semiconductor stocks and explore the investment prospect in them.

CML Microsystems Plc (LON:CML)

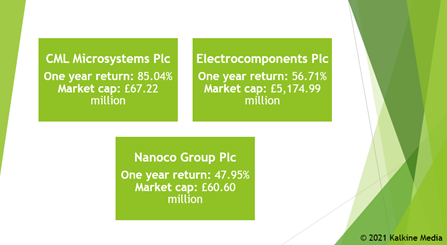

CML Microsystems is a designer, developer, manufacturer, and marketer of microwave, mixed-signal, and RF semiconductors for the communications sector. The shares of the company traded flat at GBX 405.00 at 8:03 AM on 22 September 2021. Its market capitalisation is £67.22 million. The shares of CML Microsystems returned 85.04 per cent in the last one year to shareholders.

CML Microsystems’ revenue was £12.47 million in FY 2021 compared to £14.96 million in FY 2020. It recorded an adjusted EBITDA of £2.73 million in FY 2021 compared to £4.48 million in the previous year.

For FY 2021, CML Microsystems’ board declared a special dividend of 50 pence per ordinary 5p share.

Electrocomponents Plc (LON: ECM)

Electrocomponents is a provider of solutions for builders, maintainers, and designers of industrial operations. Through its trading brand - RS Components, the company provides semiconductors, consumables and tools. The shares of the company traded at GBX 1,109.00, up by 0.82 per cent at 8:02 AM on 22 September 2021. Its market capitalisation is £5,174.99 million. The shares of Electrocomponents returned 56.71 per cent in the last one year to shareholders.

FTSE 250 listed Electrocomponents’ revenue for Q1 ended 30 June 2021 grew by 37 per cent year-on-year. For the year ended 31 March 2021, its revenue increased to £2,002.7 million compared to £1,953.8 million in the previous year.

For the year ended 31 March 2021, Electrocomponents’ board announced a dividend of 15.9 pence per share to shareholders.

Nanoco Group Plc (LON:NANO)

Nanoco Group is a company engaged in the research, development, and manufacturing of semiconductor nanoparticles and heavy-metal free quantum dots for use in lighting, display, bio-imaging and solar energy.

The shares of the company traded flat at GBX 19.83 at 8:01 AM on 22 September 2021. Its market capitalisation is £60.60 million. The shares of Nanoco Group returned 47.95 per cent in the last one year to shareholders.

For the half-year ended 31 January 2021, Nanoco recorded revenue of £1.0 million compared to £2.9 million for the same period in the previous year.

.jpg)