Highlights

- Omega Diagnostics filed for CE-mark on Covid-19 antigen self-test ‘Visitect’.

- Synairgen, last year generated £87.1 million to fund the SG018 Phase III trial.

The exceptional pace of technological advancements over the last few decades has transformed how diseases are treated. These advancements have revolutionised the industry and led to the discovery and subsequent roll-out of vaccines and treatments for some of the most novel diseases.

AIM-listed pharma stocks include smaller pharmaceutical companies. The sector is playing a pivotal role in advancing the quality of life for patients and creating new and attractive opportunities for long-term investors. The COVID-19 pandemic has been instrumental in drawing attention to those pharma firms engaged in developing COVID-19 related testing kits, drugs, and vaccine candidates.

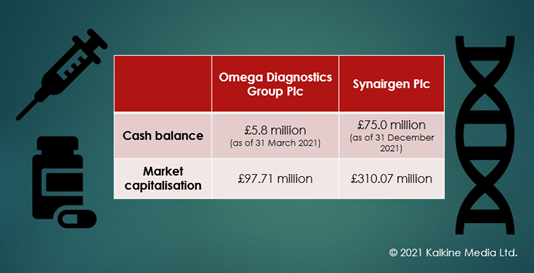

(Data source: Company and Refinitiv)

Here we take a look at 2 AIM-listed pharma stocks and explore the investment prospect in them.

Omega Diagnostics Group Plc (LON:ODX)

Omega Diagnostics Group is a medical diagnostics firm that primarily focuses on the areas of CD4 markers, infectious diseases, and food sensitivity testing. Recently, the company filed for CE-mark on Covid-19 antigen self-test ‘Visitect’.

For the year ended 31 March 2021, Omega Diagnostics Group recorded an 11% year-on-year decline in revenue to £8.73 million (2020: £9.82 million). It recorded a cash balance of £5.8 million as of 31 March 2021 (2020: overdraft of £0.6 million). The company’s EBITDA loss for the year ended 31 March 2021 stood at £2.20 million compared to £0.89 million EBITDA profit in 2020.

The shares of Omega Diagnostics traded at GBX 53.50 at the close of trade on 8 September 2021, and the market capitalisation stood at £97.71 million.

Synairgen Plc (LON:SNG)

Synairgen is a drug discovery and biotechnology company. The company is engaged in the development of inhaled interferon beta (IFN-beta) treatment for viral respiratory diseases, including COVID-19.

Synairgen’s cash balance as of 31 December 2021 stood at £75.0 million compared to £2.5 million as of 31 December 2019. In October 2020, the company generated £87.1 million to fund the SG018 Phase III trial. It recorded an operating loss of £17.7 million for the year ended 31 December 2020 (2019: £4.8 million), which includes R&D expenditure amounting to £15.5 million (2019: £3.5 million).

The shares of Synairgen last traded at GBX 150.20 on 8 September 2021, and the market capitalisation stood at £310.07 million.

.jpg)