US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 12.62 points or 0.34 per cent higher at 3,739.66, Dow Jones Industrial Average Index surged by 119.66 points or 0.39 per cent higher at 30,455.33, and the technology benchmark index Nasdaq Composite traded higher at 12,884.06, up by 33.84 points or 0.26 per cent against the previous day close (at the time of writing, before the US market close at 10:45 AM ET).

US Market News: The major indices of Wall Street traded in the green due to the emerging investor confidence on the rollout of Covid-19 vaccine. Among the gaining stocks, Shares of CureVac NV went up by around 5.46% after the company said it is in the process of Covid-19 vaccine trials. JD.Com gained about 1.69% after the e-commerce company is exploring a potential spin-off. AMC Entertainment grew by about 0.44% after the company said it would sell up to 50 million of its Class A shares. Among the declining stocks, Microvision shares fell by about 3.13% after the news that the company may sell up to US$13 million in common shares. Intel shares dropped by about 0.81% after the news that the hedge fund Third Point had taken a significant stake.

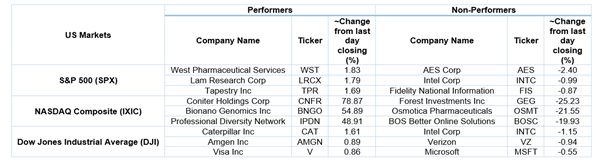

US Stocks Performance*

European News: The London and European markets traded in the red after generating significant gains during the previous trading session. The UK housing prices had jumped by 7.5% in 2020, which is a record growth in the last six years. The Housing prices remained 0.8% higher in December 2020 compared to November 2020. Among the gaining stocks, Shares of Power Metal Resources went up by 1.20% after the company provided a drilling update. Shares of Alliance Pharma surged by 0.69% after the company had completed the acquisition of US Consumer Healthcare firm. Shares of AstraZeneca grew by 0.09% after it had received the approval of Covid-19 vaccine developed with Oxford University. Among the decliners, Kodal Minerals fell by around 13.64% after the company had received a conversion notice regarding its US$1.15 million. Uru Metals Limited was plunged by about 2.17% after the company reported a high loss for its first half. Shares of Fresnillo had dropped the most on the FTSE-100 index.

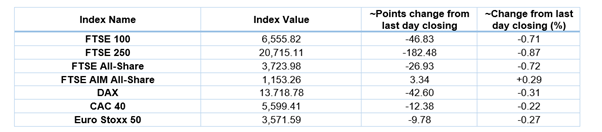

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 30 December 2020)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group SA (IAG); Rolls-Royce Holdings Plc (RR.).

Top 3 Sectors traded in green*: Financials (+0.44%), Real Estate (+0.19%) and Consumer Cyclicals (+0.03%).

Top 3 Sectors traded in red*: Utilities (-1.22%), Consumer Non-Cyclicals (-0.61%) and Basic Materials (-0.59%).

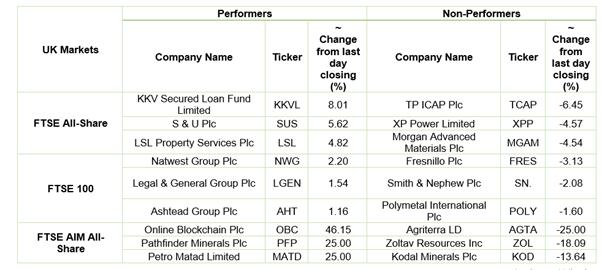

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $51.33/barrel and $48.10/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,893.55 per ounce, up by 0.57% against the prior day closing.

Currency Rates*: GBP to USD: 1.3611; EUR to GBP: 0.9028.

Bond Yields*: US 10-Year Treasury yield: 0.930%; UK 10-Year Government Bond yield: 0.203%.

*At the time of writing