Summary

- FTSE 100 oscillated in red after recovering partially from early morning slump.

- Consumer confidence in the UK soared to -15 in April, which is at a 12-month high.

- Considerable uptick in March retail sales failed to regenerate the momentum.

UK shares traded in the negative region after witnessing a slide in the wee hours on Friday, 23 April, even as the consumer confidence scaled a 12-month peak, the highest reading in the pandemic era. The headline FTSE 100 continued to oscillate in red after staging a partial recovery from the early morning bottoms.

According to the data released by Gfk, the consumer confidence in the UK soared to -15 in April, witnessing a sharp bounce back from the decade-low levels recognised in the same month a year earlier.

In April 2020, the Gfk consumer confidence fell off from the cliff like anything to a 10-year low reading of -34, reacting to the first national lockdown in the UK and the emerging repercussions of the coronavirus pandemic. In the last 10 years, the Gfk consumer confidence remained in the positive territory for all the 12 months of 2015, the period before the Brexit referendum.

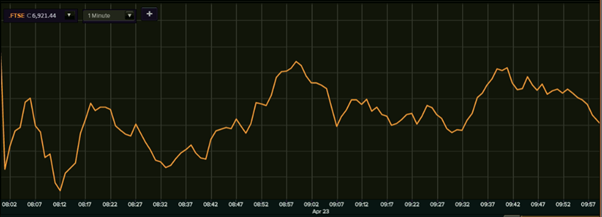

As per the latest data available with the London Stock Exchange, FTSE 100 was trading at 6,926, down 0.18 per cent from the previous close of 6,938.24. The index has mostly fallen after breaching the 7,000 mark after 14 months.

FTSE 100 chart (23 April)

(Source: Refintiv, Thomson Reuters)

The benchmark index seems on track to finish the week on a negative footing as investors remained unnerved with regard to the global developments around the spread of coronavirus and its ever-mutating strains.

However, the domestic market participants have been quite optimistic about the London equities following the ever-expanding roll-out of vaccine in the UK and buoyant exit roadmap plans laid out by the government for the upcoming set of planned easements.

The broader stock market indices including FTSE 250, FTSE 350 and FTSE All-Share shuttled in a largely similar manner. Notably, the losses for all the four market capitalisation based indices were capped up to 0.40 per cent.

Meanwhile, the considerable uptick in the retail sales in March 2021 as against the same period a year ago, as well as last sequential month failed to regenerate the momentum.

According to the data unveiled by the Office for National Statistics (ONS), retail sales in the UK soared by 5.4 per cent in March as compared to February 2021, while it was 7.2 per cent higher from March 2020. This has been the biggest increase since June 2020, when the sales registered an unusual upswing after the government eased certain lockdown restrictions.