US Markets: Broader indices in the United States traded in green - particularly, the S&P 500 index traded 12.75 points or 0.29 per cent higher at 4,356.29, Dow Jones Industrial Average Index inclined by 66.78 points or 0.19 per cent higher at 34,644.15, and the technology benchmark index Nasdaq Composite traded higher at 14,687.50, up by 23.90 points or 0.16 per cent against the previous day close (at the time of writing – 12:10 PM ET).

US Market News: The major indices of Wall Street traded in a green zone driven by the technology stocks. Among the gaining stocks, Whirlpool Corp (WHR) shares went up by about 2.69% after the Company was considered as a “top pick” by JP Morgan. Among the declining stocks, Didi Global (DIDI) shares fell by around 5.56% after the Company would face a cybersecurity review by the Chinese regulators. Tesla (TSLA) shares dropped by around 2.22% due to the ongoing concerns that the Company may face higher scrutiny in China. Visa (V) shares went down by around 0.10% after stating that customers spent more than USD 1 billion on the crypto-linked cards in the first half of this year.

UK Market News: The London markets traded in a green zone driven by mining and energy stocks. Moreover, the UK housing boom cooled down, and according to the lender Halifax, the average UK house price had shown a monthly drop of around 0.5% during June 2021.

FTSE 100 listed BHP Group, Anglo American, and Glencore shares jumped by 3.19%, 3.12%, and 2.63%, respectively, boosted by a rise in the commodity price.

Redrow shares rose by around 3.15% after the Company had projected FY22 revenue to exceed 2 billion pounds, driven by a robust order book and private rental sector project completion.

Pub chain JD Wetherspoon shares dropped by around 1.76% after the Company stated that it expected to make a full-year loss as like-for-like sales continued to drop despite easing Covid-19 restrictions.

Vistry Group shares grew by around 0.62% after the Company had expected to meet consensus estimates for FY21, driven by strong demand across all business segments.

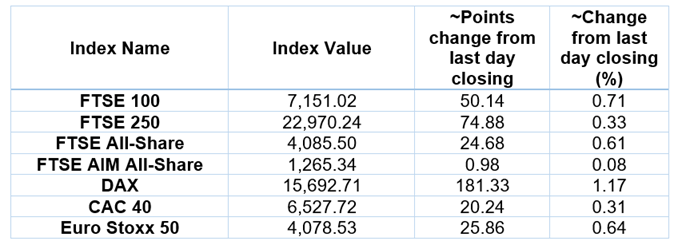

European Indices Performance (at the time of writing):

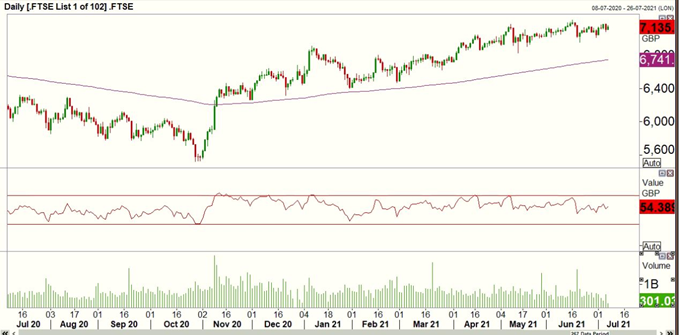

FTSE 100 Index One Year Performance (as on 7 July 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); BP Plc (BP.); Vodafone Group Plc (VOD).

Top 3 Sectors traded in green*: Basic Materials (+2.09%), Utilities (+1.46%) and Real Estate (+1.16%).

Top 3 Sectors traded in red*: Healthcare (-0.42%), Consumer Cyclicals (-0.38%) and Energy (-0.36%).

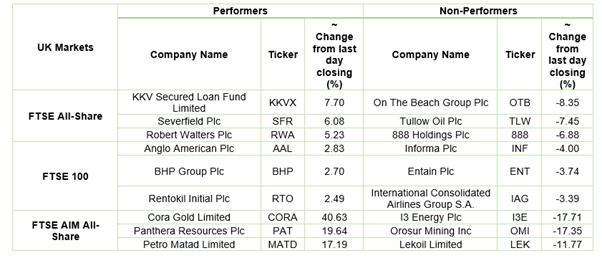

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $73.33/barrel and $72.10/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,805.05 per ounce, up by 0.60% against the prior day closing.

Currency Rates*: GBP to USD: 1.3807; EUR to GBP: 0.8554.

Bond Yields*: US 10-Year Treasury yield: 1.320%; UK 10-Year Government Bond yield: 0.6030%.

*At the time of writing

.jpg)