Global Markets: On the second trading day of this week, equity indices in the United States were trading higher, with the S&P 500 index was trading at 2,922.40 and was up by 32.73 points or 1.13% in the Tuesdayâs session, the Dow Jones Industrial Average Index increased by 384.75 points or 1.47% against the prior close and quoting at 26,497.28 and the technology benchmark index Nasdaq Composite was trading at 7,970.25 and surged by 125.23 points or 1.60% against the previous close, at the time of writing.

Global News:Â President Donald Trump in a Twitter post said on Tuesday that he had spoken to Chinese President Xi Jinping and they had agreed to start preparations for a meeting at the G20 summit later this month. Amid optimism over the prospect of a more accommodative Federal Reserve and the prospect of talks with China, stocks rallied on Tuesday, with the S&P 500 closing in on record levels. US benchmark 10-year yields fell to their lowest since early September 2017 after ECB President Mario Draghi hinted at more accommodative policy if the blocâs inflation fails to pick up.

European Markets: The Londonâs broader equity benchmark index FTSE 100 traded at 85.73 points or 1.17% higher at 7,443.04, the FTSE 250 index snapped 154.18 points or 0.81% higher at 19,311.79, and the FTSE All-Share Index ended 43.67 points or 1.09% higher at 4,060.63 respectively. European benchmark index STOXX 600 ended 6.32 points or 1.67% higher at 384.78 respectively.

European News: In the race to become Britain's prime minister, Boris Johnson got a fresh boost when former rival Andrea Leadsom declared her support for Johnson. The pound tumbled to a five-month low versus the euro on Tuesday and towards USD 1.25 as signs at arch-Brexiteer Boris Johnson may be a step closer to becoming Britain's next prime minister became clearer. After Mario Draghi raised the prospect of cutting interest rates, government bond yields fell to their lowest since October 2016 and gap between the yields on short-dated and longer-dated British government bonds also narrowed to its smallest since 2008.

London Stock Exchange (LSE)

Top Performers Stocks: KIER GROUP PLC (KIE), PETROPAVLOVSK PLC (POG), and JUST GROUP PLC (JUST) surged by 11.02 per cent, 7.27 per cent and 6.51 per cent respectively.

Top Laggards Stocks: MEDICA GROUP PLC (MGP), SIRIUS MINERALS PLC (SXX), and CARR'S GROUP PLC (CARR) decreased by 6.64 per cent, 6.62 per cent and 6.01 per cent respectively.

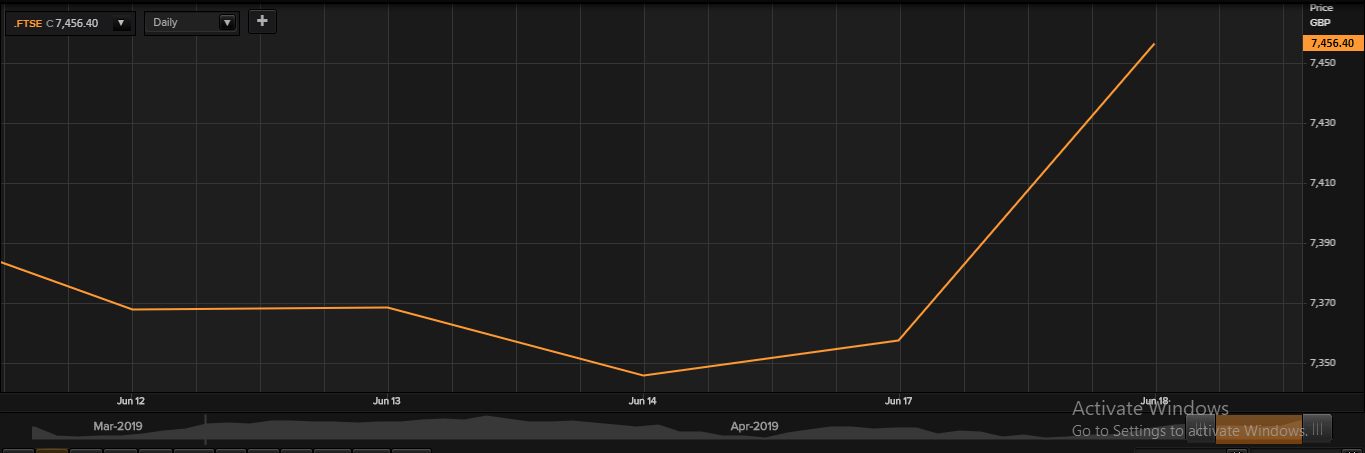

FTSE 100 Index

FTSE100 Index: 5-days Price Chart as on June 18, 2019. (Source: Thomson Reuters)

Top Risers Stocks: ASHTEAD GROUP PLC (AHT), ANTOFAGASTA PLC (ANTO) and SMITH (DS) PLC (SMDS) rose by 6.09 per cent, 4.74 per cent and 3.91 per cent respectively.

Top Fallers Stocks: IMPERIAL BRANDS PLC (IMB), WHITBREAD PLC (WTB) and TUI AG (TUI) reduced by 2.48 per cent, 1.52 per cent and 1.38 per cent respectively.

Top Active Volume Leaders: LLOYDS BANKING GROUP PLC, VODAFONE GROUP PLC, and BP PLC.

Top Performers Sectors: Basic Materials (+2.17%), Utilities (+1.60%), and Healthcare (+1.44%).

Foreign Exchange and Fixed Income

FX Rates*: GBP/USD and EUR/GBP were exchanging at 1.2557 and 0.8916 respectively.

10-Year Bond Yields*: US 10Y Treasury and UK 10Y Bond yields were trading at 2.058% and 0.808% respectively.Â

*At the time of writing