Source: Copyright © 2021 Kalkine Media Pty Ltd.

US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 13.82 points or 0.36 per cent lower at 3,805.90, Dow Jones Industrial Average Index dropped by 23.73 points or 0.08 per cent lower at 31,246.36, and the technology benchmark index Nasdaq Composite traded lower at 12,865.92, down by 131.83 points or 1.01 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in a green zone ahead of Jerome Powell speech. Among the gaining stocks, Burlington Stores shares jumped by approximately 9.93% after the Company reported quarterly earnings more than the consensus estimates. Among the declining stocks, Vroom shares plunged by approximately 22.44% after the Company had reported a wider loss than the expectation during its latest quarter. Shares of Okta went down by about 5.99% after the Company said it would buy Auth0 for USD 6.50 billion. Marvell Technology Group shares plunged by about 5.41% after the chipmaker posted a disappointing outlook.

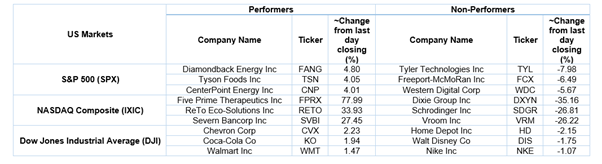

US Stocks Performance*

UK Market News: The London markets traded in a red zone due to ongoing investors’ worries regarding inflation. FTSE 100 traded lower by around 0.37% due to the weak performance of mining stocks amid rising bond yields and volatile U.S. Markets. The UK Construction Purchasing Managers’ Index (“PMI”) came out to be around 53.3 during February 2021 as compared to 49.2 recorded during January 2021.

Housebuilder Vistry Group had reported better-than-expected annual profits and resumed dividend payments due to strong second-half performance. Meanwhile, the shares jumped by about 4.78%.

Britain’s Insurer Aviva shares surged by approximately 3.03% after it had announced the disposal of its Italian business and planned to reduce debt by 800 million pounds.

Ladbrokes owner Entain had reported a profit of 113.8 million pounds during FY20 as compared with a loss of 131.2 million pounds posted during FY19. However, the Company had pulled its dividend despite showing profit growth. Moreover, the shares went down by about 0.08%.

British Bookmaker William Hill shares plunged by around 0.04% after the Company posted a 91% drop in annual adjusted pre-tax profit due to the temporary closure of betting shops. However, the betting shops will reopen on 12 April 2021.

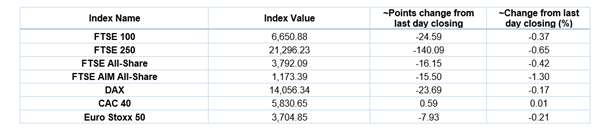

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 4 March 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Vodafone Group Plc (VOD); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in green*: Utilities (+2.49%), Consumer Non-Cyclicals (+1.72%) and Healthcare (+0.96%).

Top 3 Sectors traded in red*: Basic Materials (-5.08%), Financials (-1.72%) and Consumer Cyclicals (-1.15%).

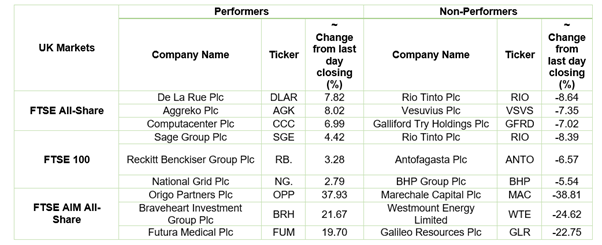

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $67.07/barrel and $64.28/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,697.35 per ounce, down by 1.08% against the prior day closing.

Currency Rates*: GBP to USD: 1.3922; EUR to GBP: 0.8606.

Bond Yields*: US 10-Year Treasury yield: 1.547%; UK 10-Year Government Bond yield: 0.776%.

*At the time of writing