US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 24.82 points or 0.57 per cent lower at 4,327.52, Dow Jones Industrial Average Index declined by 350.14 points or 1.01 per cent lower at 34,436.21, and the technology benchmark index Nasdaq Composite traded lower at 14,632.70, down by 6.60 points or 0.05 per cent against the previous day close (at the time of writing – 11:40 AM ET).

US Market News: The major indices of Wall Street traded in a red zone after Beijing flagged tighter controls on companies listing abroad. Among the gaining stocks, AMC Entertainment Holdings (AMC) shares went up by about 2.19% after the Company had dropped plans to seek shareholder approval to issue 25 million more shares. Among the declining stocks, Didi Global (DIDI) shares plummeted by around 22.82% after the Chinese regulators had announced a cybersecurity review of the Company. 3M (MMM) shares dropped by around 2.76% after Credit Swiss had downgraded the investment stance from “outperform” to “neutral”. Pfizer (PFE) shares went down by around 1.81% after Israel’s health ministry had reported a decrease in the efficacy of the Covid-19 vaccine.

UK Market News: The London markets traded in a red zone as the sterling pound strengthen after Prime Minister Boris Johnson confirmed the UK reopening plans remained on track for 19 July 2021. Moreover, the adjusted IHS Markit/CIPS UK Construction PMI came out to be 66.3 during June 2021, while it was 64.2 for May 2021.

FTSE 100 listed Ocado Group had reported a pre-tax loss of around negative 23.60 million pounds for the six months ended May 2021. However, the group revenue had shown strong growth of around 21.4%. Moreover, the shares dropped by approximately 1.46%.

J Sainsbury shares rose by around 0.76% after the Company had raised full-year profitability guidance after achieving better-than-expected sales for the first 16 weeks of 2021.

PurpleBricks Group shares dropped by around 1.76%, although the Company had achieved a solid financial & operational performance during FY21, with revenue increased by around 13% during the year.

British Land Company shares went down by around 3.49% after the Company was downgraded to “Hold” by Jefferies.

European Indices Performance (at the time of writing):

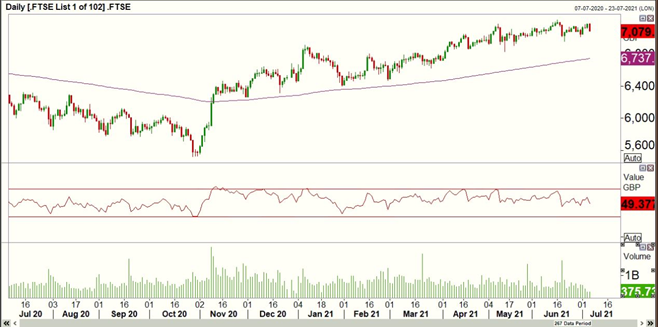

FTSE 100 Index One Year Performance (as on 6 July 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Vodafone Group Plc (VOD); Lloyds Banking Group Plc (LLOY); International Consolidated Airlines Group S.A. (IAG).

Top 2 Sectors traded in green*: Utilities (+0.27%) and Healthcare (+0.06%).

Top 3 Sectors traded in red*: Energy (-2.41%), Basic Materials (-2.26%) and Financials (-1.66%).

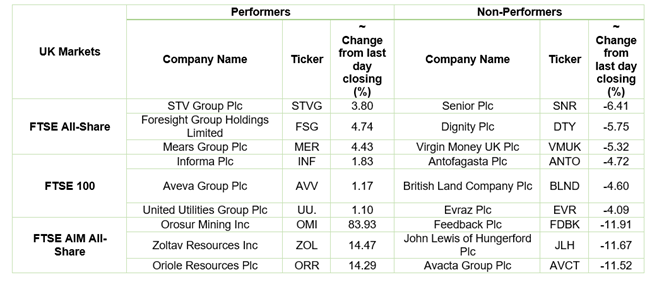

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $74.43/barrel and $73.23/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,795.05 per ounce, up by 0.66% against the prior day closing.

Currency Rates*: GBP to USD: 1.3796; EUR to GBP: 0.8569.

Bond Yields*: US 10-Year Treasury yield: 1.370%; UK 10-Year Government Bond yield: 0.6365%.

*At the time of writing