US Markets: Broader indices in the United States traded on a mixed note - particularly, the S&P 500 index traded 16.83 points or 0.37 per cent lower at 4,518.60, Dow Jones Industrial Average Index dipped by 250.92 points or 0.71 per cent lower at 35,118.17, and the technology benchmark index Nasdaq Composite traded higher at 15,368.00, up by 4.50 points or 0.03 per cent against the previous day close (at the time of writing – 11:50 AM ET).

US Market News: The major indices of Wall Street traded on a mixed note as investors eyed fresh growth catalysts. Among the gaining stocks, Match Group (MTCH) shares rose by around 7.44% over the news that Company would join S&P 500 by September. Spotify Technology (SPOT) shares went up by around 3.73% after KeyBanc upgraded the stock from “equal weight” to “overweight”. Among the declining stocks, PPG Industries (PPG) shares fell by around 3.49% after the Company warned of the adverse impact of supply chain disruptions and higher input costs on the current quarter’s sales. Boeing (BA) shares dropped by about 2.44% after Ryanair had ended the discussions to purchase 737 MAX 10 jets over a price dispute.

UK Market News: The London markets traded in a red zone with FTSE 100 weighed down by the financials stocks. According to the latest data from Halifax, the UK house price had shown a modest monthly growth of around 0.7% during August 2021 as compared to July 2021.

Cairn Energy shares went up by about 1.84% after the Company had anticipated ending 2021 with positive net cash excluding India proceeds. Moreover, the Company had proposed return to a maximum of USD 700 million to shareholders through special dividend and buyback after India tax resolution.

FTSE 100 listed DS Smith shares grew by around 2.67% after it had provided an encouraging trading update. Moreover, the Company remained cautious regarding notable increases in the cost of energy and transportation.

Vistry Group had reported robust growth in the adjusted profit before tax and reinstated interim dividend with respect to H1 FY21. Furthermore, the shares rose by around 1.55%.

McBride shares increased by around 1.53%, even after the Company reported a drop of 17.8% in the annual adjusted profit before tax due to the rising raw materials cost.

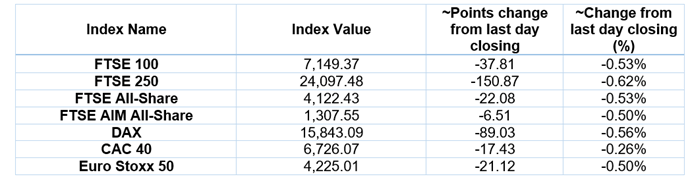

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 7September 2021)

1 Year FTSE 100 Chart (Source: Refinitiv)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group PLC (LLOY); Vodafone Group PLC (VOD); International Consolidated Airlines Group S.A. (IAG).

Top 2 Sectors traded in green*: Basic Materials (+0.77%), Energy (+0.76%), Technology (0.18%).

Top 3 Sectors traded in red*: Healthcare (-1.63%), Industrials (-0.66%) and Utilities (-0.65%).

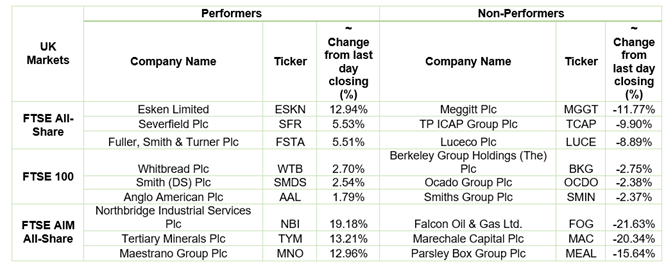

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $71.53/barrel and $68.17/barrel, respectively.

Gold Price*: Gold price was quoting at US$ 1,799.95 per ounce, down by 1.84% against the prior day closing.

Currency Rates*: GBP to USD: 1.3792; EUR to USD: 1.1848.

Bond Yields*: US 10-Year Treasury yield: 1.361%; UK 10-Year Government Bond yield: 0.7420%.

*At the time of writing