US Markets: Broader indices in the United States traded in red - particularly, the S&P 500 index traded 12.20 points or 0.32 per cent lower at 3,840.87, Dow Jones Industrial Average Index contracted by 176.61 points or 0.57 per cent lower at 30,999.40, and the technology benchmark index Nasdaq Composite traded lower at 13,525.29, down by 5.63 points or 0.04 per cent against the previous day close (at the time of writing, before the US market close at 10:30 AM ET).

US Market News: The major indices of Wall Street traded in the red territory after Joe Biden warned of another 100,000 deaths within a month due to Covid-19 pandemic. Among the gaining stocks, Sierra Wireless shares gained about 11.96% after its CEO planned to retire on 30 June 2021. Among the declining stocks, shares of Intel Corp slipped by 5.46% after it revealed that financially sensitive information was stolen by a hacker. Shares of Seagate Technology went down by 4.5% after it had given disappointing guidance for the third quarter. IBM shares slipped by around 2.57% after it reported a quarterly revenue lower than wall street forecasts. Ford Motor shares dropped by around 0.69% after it had decided to recall 3 million vehicles related to airbag issues.

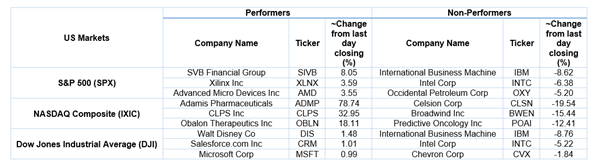

US Stocks Performance*

European News: The London and European markets traded in the red territory due to the disappointing UK retail sales data. The UK retail sales jumped by 0.3% during December 2020 compared to November 2020, remained lower than the forecasted growth of 1.2%. Among the gaining stocks, Treatt shares grew by 24.42% after it had anticipated the full-year profit to be ahead of market expectations. Shares of Kainos Group went up by 16.37% after it had reported strong trading performance towards the end of 2020. Ashtead Group shares went up by 2.43% due to weakening of pound sterling against US Dollar. Among the decliners, Mediclinic International shares dropped by 3.67% although it reported revenue growth of 2.5% during the third quarter. Computacenter shares went down by 1.06% although it had raised its full-year profit guidance. Shares of International Consolidated Airlines Group had fallen the most on FTSE 100.

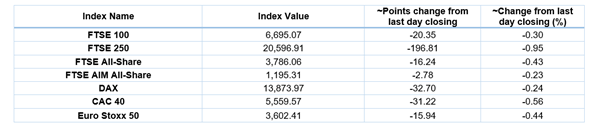

European Indices Performance (at the time of writing):

FTSE 100 Index One Year Performance (as on 22 January 2021)

1 Year FTSE 100 Chart (Source: Refinitiv, Thomson Reuters)

Top 3 Volume Stocks in FTSE 100*: Lloyds Banking Group Plc (LLOY); Barclays Plc (BARC); International Consolidated Airlines Group SA (IAG).

Top 3 Sectors traded in green*: Utilities (+1.30%), Healthcare (+1.01%) and Industrials (+0.59%).

Top 3 Sectors traded in red*: Energy (-1.71%), Basic Materials (-1.57%) and Consumer Cyclicals (-1.16%).

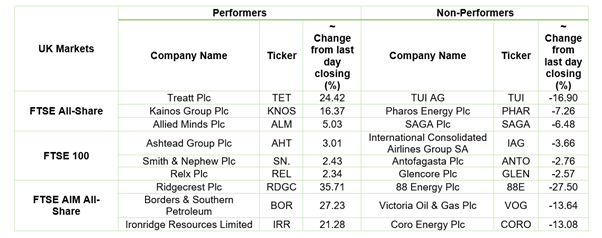

London Stock Exchange: Stocks Performance (at the time of writing)

Crude Oil Future Prices*: Brent future crude oil (future) price and WTI crude oil (future) price were hovering at $55.45/barrel and $52.41/barrel, respectively.

Gold Price*: Gold price was quoting at US$1,854.40 per ounce, down by 0.62% against the prior day closing.

Currency Rates*: GBP to USD: 1.3676; EUR to GBP: 0.8895.

Bond Yields*: US 10-Year Treasury yield: 1.091%; UK 10-Year Government Bond yield: 0.303%.

*At the time of writing