Can Kalkine be trusted?

Is Kalkine legit? Is it worth your money? These questions pop up in the mind of many, so read on as we bring you up to speed with this research firm.

Let’s look at few key features: -

Establishment & Leadership: - Kalkine Limited with registration number 07903332 (“Kalkine”) is regulated by FCA as a media firm on the basis that we will disseminate information about our views on investments through research papers and similar materials that are available through subscription . These research papers do not take into account the particular circumstances of our subscribers and therefore are not intended as investment advice which falls within the scope of the FCA Rules relating to suitability. Kalkine primarily operates online, providing investors with recommendations on which stocks to buy, hold or sell along with stock market insights, analysis and financial information. Kalkine has positioned itself as a prominent figure in the world of stock investing and market research. On a global scale, Kalkine Group has around 19k paid subscribers, indicating a level of popularity and trust among investors in different jurisdictions.

Investment Philosophy: Kalkine's investment philosophy centers on identifying well-diversified companies with various investment themes, such as value-investing, growth-investing, momentum-investing, and possibly others.

Decision Making Process: The decision-making process is based on both qualitative and quantitative factors. The goal is to identify research-driven attractive investment opportunities within the market for varied asset classes including stocks, commodities, cryptocurrencies and much more.

Performance Reporting: Kalkine is quite transparent in reporting its yearly performance numbers on the website for respective research products backed by qualified third-party auditors to ensure credibility. The website provides updates on 'Sell' recommendations, enabling the audience to gauge percentage gains or losses incurred in each position.

It's important to note that while the information provided sheds light on Kalkine's claimed position and approach, it's essential for potential users or investors to conduct thorough research, including verifying the accuracy of the claims made and assessing the quality and relevance of the investment recommendations.

So, is Kalkine legit? The answer is an absolute YES.

Kalkine publishes equity research reports as general advice on UK-listed and globally listed stocks identified as the key opportunity areas for investors in this complex world of financial markets.

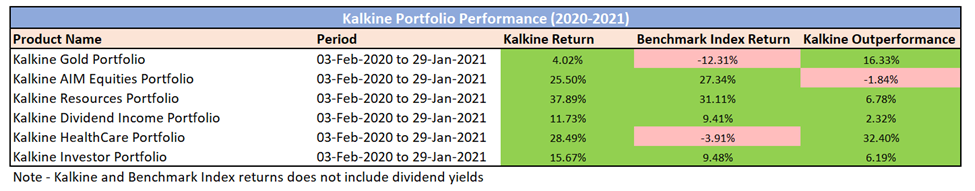

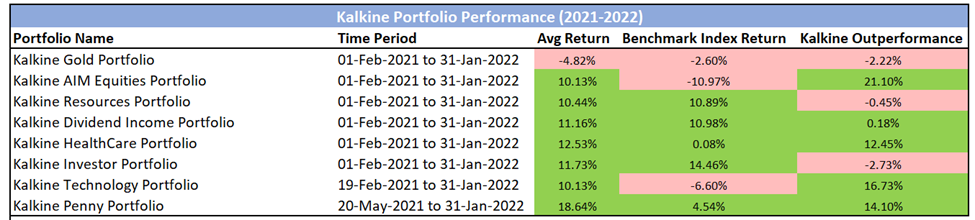

Guided by the core principles of transparency and creditability, Kalkine publishes its yearly portfolio performance versus benchmark index performance as verified by an independent external auditor on the website. The performance summary for the years 2020-2021 and 2021-2022 can be viewed as below: -

Past performance is not a reliable indicator of future performance.

Note 1: The performance numbers do not consider any transaction fees or charges levied

Note 2: Hypothetical performance may differ materially from results or returns ultimately achieved.

Note 3: Kalkine returns refer to the average returns of all the stocks covered during the period including dividend gains if any

Note 4: Kalkine’s Portfolio is hypothetical, and the performance figures are based on recommendations from Kalkine Reports using stock prices at the date of publication.

Note 5: Where a stock has been recommended multiple times, the average BUY price is taken into consideration.

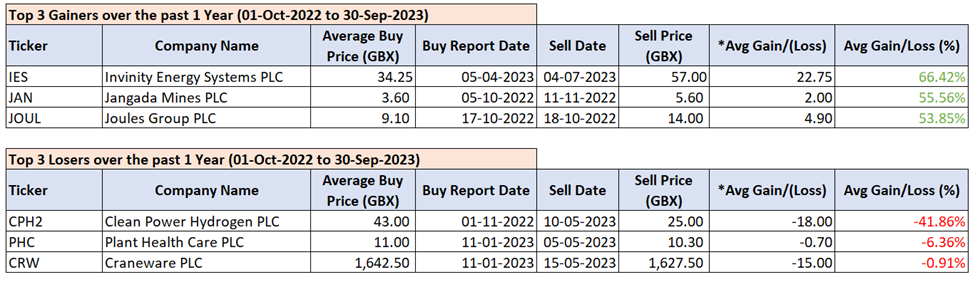

Below are some of the recent winners and losers from Kalkine’s stock coverages in fundamental analysis reports over the past one year. On average the top three gainers yielded 58.61% gains while the top three losers have resulted in -16.38% losses over the period. One of the top performing stocks, Invinity Energy Systems Plc (LON:IES) yielded 66%+ returns in a short span of nearly four months.

Past performance is not a reliable indicator of future performance.

Source: Kalkine

THE BOTTOM LINE - Historical returns should not be viewed in isolation; they should be considered alongside the associated risks and market conditions. In isolation, past performance does NOT guarantee future results, as various factors such as market changes, macroeconomic variables, or management decisions can lead to markedly different future performance.

Kalkine’s in-house research team is the core engine publishing data-driven tech-enabled reports for subscribers. The company’s disciplined approach, extensive fundamental research, and the technical eye is backed by a team of rich experienced analysts with professional background holding qualified certifications such as Master’s in Business Administration with specialization in Finance and or Chartered Financial Analysts (CFA).

So that is how we can conclude that Kalkine is here to help investors make informed decisions in an efficient manner!

_10_11_2023_10_19_16_333920.png)