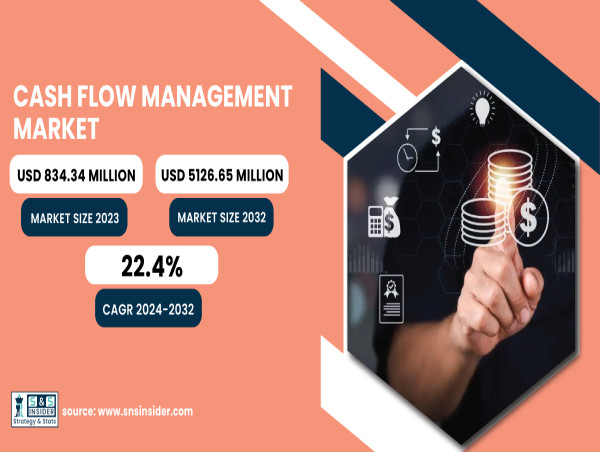

The Cash Flow Management Market, valued at USD 834.34M in 2023, is expected to reach USD 5126.65M by 2032, growing at a 22.4% CAGR from 2024 to 2032.

AUSTIN, TX, UNITED STATES, February 25, 2025 /EINPresswire.com/ -- “The Cash Flow Management Market is growing rapidly, driven by automation, cloud adoption, AI-powered forecasting, and rising SME demand.”

The Cash Flow Management Market Size was valued at USD 834.34 Million in 2023 and is expected to reach USD 5126.65 Million by 2032, growing at a CAGR of 22.4% from 2024 to 2032. This growth is driven by increasing API integration, evolving user demographics, and a rising preference for cloud-based deployment. Additionally, automation is significantly reducing operational costs, enhancing efficiency. Businesses are leveraging advanced cash flow solutions to optimize financial planning, contributing to the market's rapid expansion.

Get Sample Copy of Report: https://www.snsinsider.com/sample-request/3736

Some of Major Keyplayers:

- Intuit (QuickBooks Cash Flow, QuickBooks Online)

- Xero (Xero Cash Flow, Xero Business Finance)

- Anaplan (Anaplan for Finance, Anaplan Cash Flow Planning)

- Sage (Sage Intacct Cash Management, Sage 50cloud Cash Flow Manager)

- Float (Float Cash Flow Forecasting, Float Budgeting & Scenario Planning)

- Panguru (Planguru Budgeting, Planguru Forecasting)

- Dryrun (Dryrun Cash Flow Forecasting, Dryrun Scenario Planning)

- Caflou (Caflou Business Management, Caflou Cash Flow Management)

- Pulse (Pulse Cash Flow Software, Pulse Forecasting Tool)

- Cash Analytics (CashAnalytics Cash Flow Forecasting, CashAnalytics Liquidity Planning)

- Fluidly (Fluidly Intelligent Cash Flow, Fluidly Credit Control)

- Finagraph (Finagraph CashFlowTool, Finagraph Financial Analysis)

- Cashflowmapper (Cashflowmapper Forecasting, Cashflowmapper Planning Tool)

- Finsync (Finsync Cash Flow Management, Finsync Accounting)

- Cashflow Manager (Cashflow Manager Gold, Cashflow Manager Accounting Software)

- Agicap (Agicap Cash Flow Management, Agicap Liquidity Planning)

- Calqulate (Calqulate Cash Flow Forecasting, Calqulate SaaS Financial Planning)

- Cashbook (Cashbook Cash Flow Automation, Cashbook Treasury Management)

- Cash Flow Mojo (Cash Flow Mojo Business Planning, Cash Flow Mojo Budgeting)

- Cashforce (Cashforce Smart Cash Flow, Cashforce Liquidity Forecasting)

By Component, Solution Segment Leads Cash Flow Management Market with 62% Revenue Share, Services Segment Witnesses Fastest Growth

In 2023, the Solution segment led the Cash Flow Management Market, with 62% of the total revenue. This growth is driven by the increasing use of automated software and tools that improve cash flow forecasting, liquidity management, and financial planning. Companies are increasingly using AI-based forecasting and real-time monitoring to make decisions optimally. The transition towards cloud-based solutions is gaining momentum due to their scalability, ease of access, and ease of integration.

The Services segment is witnessing the fastest growth in the Cash Flow Management Market with a staggering CAGR of 23.3% in the forecast period. This growth is driven by the increasing need for consulting, implementation, and support services for cash flow management software. Organizations such as Float, which combine real-time forecasting with professional financial advisory, are at the forefront of assisting businesses in improving liquidity management and financial efficiency.

By Deployment Mode, On-Premise Segment Leads Cash Flow Management Market, Cloud-Based Segment Set for Fastest Growth

The On-Premise segment had the largest revenue share in the Cash Flow Management Market in 2023 due to the preference of organizations towards data security, privacy, and customization. On-premise solutions are favored by large banking, healthcare, and government organizations because of high regulatory requirements and the need for immediate control over financial information. Sage with Sage Intacct Cash Management and Anaplan with Anaplan Cash Flow Planning are some of the leading players providing customized solutions for intricate financial processes.

The Cloud-Based segment would witness fastest CAGR growth rate in the forecast period, led by enterprises moving toward digital-first financial solutions.

Cloud-based cash flow management platforms provide unmatchable scalability, ease of use, and easy integration with other money management tools. Their real-time forecasting, automated reporting, and AI-powered insights are driving adoption, and they are the go-to solution for businesses looking for efficiency, agility, and cost savings in managing finances.

By End-User, SME Segment Leads Cash Flow Management Market with Strong Demand for Scalable Financial Tools

In 2023, the SME segment accounted for the highest revenue share in the Cash Flow Management Market due to the increasing requirement for affordable and scalable financial management solutions. Small and medium-sized enterprises are at greater risks of cash flow disruptions owing to their limited financial resources, rendering the efficient management of cash flow crucial to ensure business continuity and growth. The rise in the use of digital money management tools is also propelling this segment's leadership.

By Vertical, BFSI Segment Dominates Cash Flow Management Market with 24% Revenue Share, Retail Segment Expected to Grow at 24.92% CAGR

In 2023, the BFSI segment led the Cash Flow Management Market with a 24% revenue share, driven by the industry's critical need for precise liquidity management and financial forecasting. Banks and financial institutions are increasingly adopting advanced cash flow solutions to enhance risk management, optimize capital allocation, and maintain regulatory compliance. Leading providers like Sage Intacct and Anaplan offer specialized forecasting and reporting tools, ensuring accurate cash flow tracking and financial stability.

The Retail segment is projected to grow at the fastest CAGR of 24.92% during the forecast period, fueled by the industry's need for efficient cash flow management in a dynamic market. Retailers face challenges like fluctuating sales, seasonal demand shifts, and inventory complexities. To address these, companies like Float and Agicap provide cloud-based cash flow forecasting tools, enabling real-time tracking, liquidity management, and revenue forecasting based on evolving sales patterns.

Cash Flow Management Market Segmentation:

By Component

- Solution

- Services

By Deployment Mode

- Cloud Based

- On-Premise

By End-User

- SME’s

- Professionals

By Vertical

- BFSI

- IT & Telecom

- Media

- Entertainment

- Healthcare

- Retail

- Manufacturing

- Government

- Others

Enquiry Before Buy this Report: https://www.snsinsider.com/enquiry/3736

North America Leads Cash Flow Management Market with 40% Share, Asia Pacific Emerges as Fastest-Growing Region

In 2023, North America dominated the Cash Flow Management Market, holding a 40% market share due to its mature financial ecosystem and rapid adoption of advanced financial technologies. Key players like Intuit, Sage, and Xero are driving market growth by offering AI-powered forecasting and automation tools. Businesses in BFSI, healthcare, and IT are leveraging cloud-based solutions to enhance liquidity management, regulatory compliance, and overall financial efficiency.

The Asia Pacific region is experiencing the fastest growth in the Cash Flow Management Market, with an estimated 25% CAGR during the forecast period. The expansion is fueled by the rise of SMEs in China, India, and Japan, adopting digital financial tools for better cash flow control. Increasing digital transformation, e-commerce growth, and government support for financial inclusion are creating strong demand for cloud-based financial management solutions.

Access Complete Report: https://www.snsinsider.com/reports/cash-flow-management-market-3736

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Akash Anand

SNS Insider | Strategy and Stats

+1 415-230-0044

email us here

Visit us on social media:

Facebook

X

LinkedIn

Instagram

YouTube

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.

![]()