Summary

- HON’s prices are trading above resistance turned support level on the daily chart and getting support from the 50-period Simple Moving Average (SMA).

- HON outperformed its peer and generated ~42 percent return in the last 9 months.

- HON’s prices are trading above a steep upward sloping trend line support on the weekly chart.

Honeywell International Inc. (NYSE:HON) has rallied from the low of USD 161.35 made on 02 October 2020 to a new all-time high of USD 232.35 tested on 16 April 2021, a gain of ~44 percent in the last 7 months. On Tuesday, the stock prices closed at USD 225.43, up by 1%, and was one of the top gainers of the Dow Jones Industrial Average index.

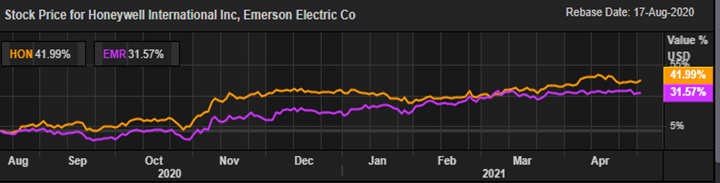

Honeywell International Inc Vs Emerson Electric Co. (Peer Analysis)

HON witnessed a sharp upside momentum with a gain of ~ 41.99 percent in the last 9 months, while its peer Emerson Electric Co. (NYSE:EMR) has delivered a return of ~31.57 percent in the same period. HON outperformed its peer EMR with an impressive margin based on the 05 May 2021 closing. On studying the closing price for both the stocks over the past 9 months, it is very clear that Honeywell International Inc. has delivered alpha over Emerson Electric Co. by a good margin.

Source: Refinitiv, Thomson Reuters

How is Honeywell International Inc. looking on charts?

On the daily chart, Honeywell International Inc.’s price has formed a bullish candle with a long body, indicating buying in the stock. The stock price continues to move in higher tops and higher bottoms formation, which indicates positive bias. Price has broken out of its horizontal trendline (black color horizontal line in the below chart) at USD 216.86 level and post that made an all-time high. The prices are sustaining above an upward sloping trendline support level of USD 220.50 (Orange color line in the below chart) and continuously taking support of the same.

Honeywell International Inc. on the daily chart

Source: Refinitiv, Thomson Reuters; Analysis: Kalkine Group

The price is trading above its 50-period SMA, acting as a crucial support level near the horizontal trendline. The momentum oscillator Stochastic slow is trading above 50 levels, indicating a positive trend for the stock.

Honeywell International Inc. on the weekly chart

Source: Refinitiv, Thomson Reuters; Analysis: Kalkine Group

The stock prices are trading above an upward sloping trendline support level of USD 216 (orange color line in the above chart) and continuously taking support of the same. Currently the price is again approaching its all-time high which is acting as a resistance zone. Furthermore, the momentum oscillator RSI (14-period) is trading at ~65 levels, indicating a good strength in the price move. The prices are trading above the Parabolic SAR indicator, acting as an immediate support zone for the stock. The major resistance level for the stock is at USD 232.35 level.

Based on the above chart analysis and technical outlook, Honeywell International Inc.’s price seems to be in a strong uptrend. Currently, the stock prices are approaching the key resistance zone and as the chart pattern suggests, there might be more action expected in HON if the price breaks the important resistance levels in the coming trading sessions.