Summary

- The US stocks ended lower before recovering on 4 September due to a sell-off of technology stocks that overshadowed the improved unemployment rate data.

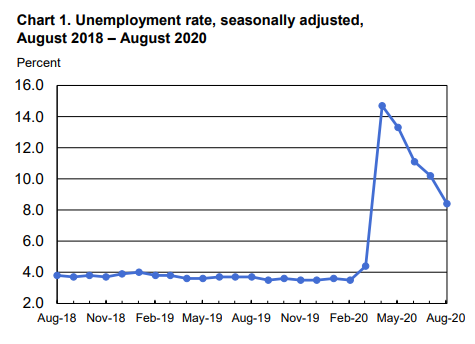

- The US unemployment rate improved after falling to 8.4% in August compared to 10.2% in July due to hiring of new employees at some firms, and temporary hiring for US census supported job figures.

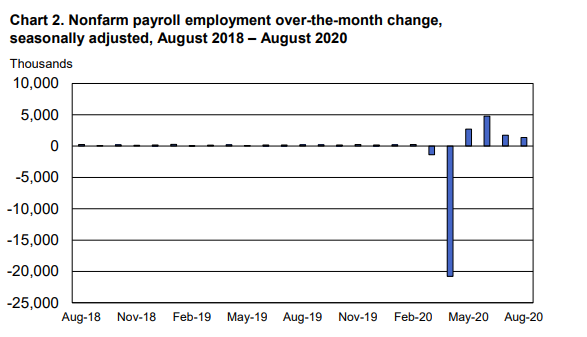

- The US added 1.4 million jobs in August, but the pace of recovery has slowed down substantially as the federal stimulus aid expired.

- Economists have stated that an increase in hiring is not sustainable as substantial uncertainty remains to surround coronavirus situation.

The main indices of Wall street, Dow Jones and S&P 500 fell sharply on 4 September due to technology stocks sell-off, which outshined the unemployment rate data for August reflecting a steeper fall than anticipated. The stocks had initially opened higher after the release of August jobs data, but the market quickly turned negative thereafter.

Did you read; Why NASDAQ Composite index plunged 5%?

The Dow Jones Industrial Average Index fell 0.56% on 4 September, closing at 28,133.31. On the same day, S&P 500 slid 0.81% to 3,426.96, and the tech-heavy Nasdaq Composite lost 1.27% to 11,313.13.

Investors continue to measure the time the economy will take to recover from COVID-19 and how high the stocks can go from here. Further move on stimulus aid package is anticipated widely amongst investors amid fragile recovery.

The 10-year Bond Yield soared after the better than expected jobs report released on 4 September. Further, there have been reports of job losses in a lot of companies. American Airlines Group and United Airlines Holdings to Ford Motor Co. have declared their plains to slash their staff.

US unemployment rate drops

The US Department of Labor released an employment report on 4 September showing that the jobless rate fell from 10.2% in July to 8.4%, sharper than the market prediction of 9.8% while the number of jobless people decreased by 2.8 million to 13.6 million. However, the number is still on the higher side as compared to February.

Source: US Bureau of Labor Statistics, dated: 4 September 2020

Some of the highlights of how the household survey and its measures were affected are as follows:

- The number of people who have been temporary laid-off fell by 3.1 million compared to July to 6.2 million in August, but the number of permanent job losses increased by 534k to 3.4 million indicating that the labour market is still in doldrums

- The labor force participation rate rose by 0.3 percentage points to 61.7% in August

- Unemployment rates are lowest for the white Americans at 7.3%, but stayed above 13% for Blacks, 10.5% for Hispanics and 10.7% for Asian workers showing conflicting outcomes due to COVID-19

- The jobless rate for those who do not have a high school diploma stood at 12.6%, while those with a bachelor’s degree or higher was at 5.3% during August 2020

- The number of Americans who are looking for work or working increased to 61.7% in August from 61.4% in July, which is positive for job growth and economic recovery

The report also revealed that the average hourly earnings increased 0.4% or by 11 cents to $29.47 in August, as compared to July, while the unemployment rate fell, but remained at a high of 14.2% from 16.5%.

Addition of 1.4 million jobs in August

The US economy added a greater than anticipated number of payrolls in August. The US nonfarm employment increased by 1.37 million in August, following the rise of 1.76 million in July, with the numbers being in line with the expectations of economists. The improving numbers showed that economic activity has been resuming continuously after it had been restricted due to COVID-19 induced lockdown.

Source: US Bureau of Labor Statistics, dated: 4 September 2020

The rise in government employment numbers was due to temporary hiring of 2020 census workers, whose rolls grew by 328,000. Noteworthy job advances happened in retail trade (+249,000 jobs), leisure and hospitality (+174,000), professional and business services (+197,000) and education and health sectors (+147,000).

Despite the addition of new jobs in August, the economy still stays about 11 million jobs down from February, before COVID-19 began to disrupt the economy.

ALSO READ: A Discord on the US Recovery: When Optimism Collides with Fear

Economists stated that the hiring might be difficult to maintain as there was substantial uncertainty for employers on the virus situation. Though the daily case count has reduced, still the viral caseload stays on a higher side. Dining out, air travel and many other activities still remain far below the levels before coronavirus.

The data showed inconsistent recovery in the labour market, putting pressure on Congress. The recovery is decelerating as many stimulus actions from the CARES Act like the Paycheck Protection Program for small businesses, and $600 weekly federal unemployment supplement have expired in the past 2 months period. The withdrawal of stimulus has left many Americans sans the additional support that also helped the economy to stay buoyant amid such challenging times. Lawmakers stay stuck over the next stimulus package.

Jerome Powell, Chairman of Federal Reserve, appreciated the August jobs report but stated that the economy would need low-interest rates for years.

DO YOU KNOW: How is the US Election Race Faring? Does it impact your portfolio?

The speed with which more job gain would take place remains contingent on if the US is able to better control the coronavirus situation, and if there comes an end to the deadlock in Congress over another stimulus package. Democrats and Republicans stay at odds over how large the other instalment of relief would be, and what will be its content and on measures of further unemployment aid.

.jpg)