Summary

- Tech-led plunge on Wall Street had an adverse impact on the ASX by the end of the trading session on 04 September 2020. The technology sector was the worst performer with S&P/ASX 200 Information Technology dropping 157.2 points or 5.59%.

- The shares of major tech players including WYC, APX, NXT and APT slipped over 6.5% at the end of the day, making them some of the worst performers on the ASX.

- Other sectors also experienced the cascading effect of the plunge on Wall Street. The drop was driven by the market correction and concerns related to the unemployment rate.

- Tremors of Nasdaq were felt across several geographies globally.

Indices listed on the ASX experienced a significant drop in their values after a massive drop was witnessed on Wall Street’s main index. It is the sharpest decline seen in the index since June 2020 as investors dumped the high rising technology sector. On 03 September 2020, Nasdaq composite dropped by ~5% and settled at 11458.10. Nasdaq 100 index was down 5.25% and settled at 11771.37 while Dow Industrial fell 2.78% closing at 28292.73.

RELATED: Why NASDAQ Composite index plunged 5%?

Big players from NASDAQ 100, including Apple (NYSE:AAPL), Microsoft, Tesla, Amazon (Nasdaq:AMZN), and Nvidia, reported significant declines of 8.01%, 6.19%, 9.02%, 4.63% and 9.28%, respectively. Zoom Video Communications, Inc, which reported strong growth in its revenue, noted a considerable drop of 9.97% in its share on Nasdaq, settling at US$381.32.

Given the index’s decline, Apple’s market capitalisation, which had hit US$2 trillion a few months ago, suffered a drop of nearly US$180 billion in its market capitalisation.

The significant drop in Wall Street could also be experienced on ASX as most of the indices were trading in the red zone. Amongst various indices listed on the ASX, S&P/ASX 200 Information Technology and S&P/ASX All Technology Index slipped by over 5% and were the worst-performing sectors on 4 September 2020. At the end of the session, the S&P/ASX 200 Information Technology was down by 5.59%, while the S&P/ASX All Technology Index was down by 5.2%. Benchmark index is trading at 5,932.4, down 2.95% from the previous close.

From the technology sector, popular stocks like Appen Limited (ASX:APX), WiseTech Global Limited (ASX:WTC), NEXTDC Limited (ASX:NXT) and Afterpay Limited (ASX:APT) were among the worst performers on the ASX closing 7.077%, 7.275%, 6.778% and 6.6671% down, respectively.

Nasdaq has been the leading index for a very long time and is heavily weighted in technology stocks. Most of the technology stocks listed on Nasdaq had attained a maximum level. Hence, the drop was not unexpected and was due to market correction. Many market participants sold most to their holdings on the day.

Apart from the technology sector, other sectors which reported a significant loss in their values include resources, metals and mining, materials, healthcare, and consumer staples. These sectors witnessed a drop of over 3% in their values.

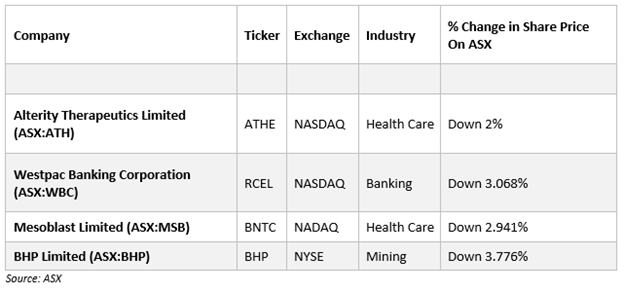

There are several ASX-listed companies which are also listed on Nasdaq and NYSE. The fall in Wall Street had also impacted to performance of these stocks on the day. Let us take a look at some of these companies.

Unemployment Rate and Slower Employment Growth Rate in the US:

The major challenge, which the US citizens are currently experiencing, is the increasing unemployment rate. As per the recent report released by the US Bureau of Labor Statistics on 01 September 2020, the employment is expected to increase from 162.8 million to 168.8 million during the 10-year period 2019-2029. The number indicates that there is a massive drop in the annual employment growth rate of 0.4% in the US. From 2009 till 2019, the Annual Growth Rate of Employment was 1.3%. Thus, the projections seem to have a negative influence on the market. The economic data presented by the US government has raised concerns about a long and difficult recovery. However, a detailed report of the unemployment rate for Q2 2020 would be released on 18 November 2020.

Interesting Read: Fed’s new strategy for inflation and labour market

Impact on Other Geographies:

The implications of the tech-led plunge on Wall Street was visible across other geographies as well. The Asian stock markets witnessed their worst session in two weeks on Friday, 04 September 2020.

The world’s second-biggest economy, China also witnessed a drop in its markets with the blue-chip CSI 300 Index slipping by ~1% to close at 4,770.22 while the SSE Composite Index also fell 0.87% to end at 3,355.37.

Japanese shares also experienced the pressure of the Wall Street plunge due to the massive sell-off of US tech stocks.

JPX-Nikkei Index 400 dropped by 0.97%, reaching 14,606.53. Also, Tokyo Listed Technology Sector in Philadelphia Chip index slipped nearly 6%.