Summary

- Tesla, the largest company ever to be added in the list of S&P 500, gained 7.8% on Friday, with its market cap hovering around USD 830 billion.

- The Company’s soaring stock price made CEO Elon Musk the new richest man in the world.

- Elon Musk has promised to make his cars more affordable and efficient with further breakthrough in battery technology.

December 2020 marked an important event in the history of the US stock market. Tesla, Inc.(NASDAQ: TSLA) was included in the list of S&P 500 with a market capitalisation of more than US$600 billion. It was historic because no company has ever made into the list with such a huge market cap.

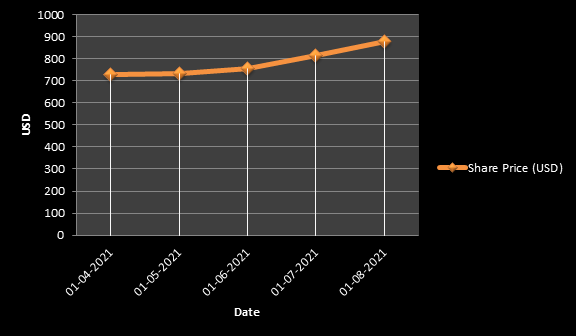

Recently, Tesla achieved another milestone, jumping 7.8% on trade before hitting the US$ 880 range on 8 January 2021. The Company’s shares during the last week surged nearly 20%. The stock begun the week at US$ 719.33 on the charts on 4 January and ended the week at a high note of US$880.02.

Image Source; Kalkine Media Group, Data Source: NASDAQ

Read More: Tesla Boss Elon Musk Dethrones Jeff Bezos To Become World’s Richest Person

What Does Rise in Tesla Share Price Infer?

Tesla, Inc. needs no introduction. CEO Elon Musk remains in limelight due to the endeavours in the field of space exploration to revolutionising public transport through Hyperloop or when it comes to renewable energy business.

The Company is making a series of strides in the fields of battery and energy storage technology. Tesla can be seen as a pioneer for commercial electric vehicles. Though EVs were there for quite some time, they got attention and due market share after the series of plug-in car launches by Tesla.

The Model 3 is considered as one of the best battery-based cars in its segment with more than 500,000 cars sold globally in 2020. The base price for Model 3 has been kept around US$37,990, and Elon Musk has promised that further breakthrough in battery technology will lead to more affordable cars with a base price of US$25,000.

Also Read: Story of Elon Musk: A Dreamer's Journey to Becoming The World's Richest

From electricity generation to storage to final usage-Tesla is a vertically integrated energy company

(Image Source: Image Source - ©Kalkine Group 2020)

Tesla is already the largest battery manufacturer and captures around 18% of the global EVs market share.

The rising share price of Tesla highlights the growing consumer interest and confidence in green energy business. It seems that investors are seeking their share of pie by parking their funds in the future of energy business. Tesla boasts of a large order book and has two factories under construction to fulfill those orders.

Does that mean people are losing interest in gas guzzling motors?

Well companies like BP, Exxon, Chevron and other biggies are investing in renewable. So, if global oil majors are showing interest and investing huge in renewable, why not common people should show interest in cleaner and greener energy.

Prior to the EVs becoming popular, many countries were focusing on running vehicles on natural gas, which is still cleaner than petrol and diesel. Hybrid vehicles also became popular in the meantime. Now, EVs and subsidy by the governments around the world are leading to the growth of the sector.

Recent update: Crude Oil Rallies to 10-Month High After Production Cut Decision

Wait! There is more use of crude oil other than running your car engines.

- Aviation Industry – Battery based passenger planes are far-far from near future. The industry is totally reliant on fossil fuels.

- Chemical Industry – The paints and adhesive industry uses crude oil in large volumes. The chemical industry is hugely reliant on the oil & gas industry.

- Fertilisers – Oil & gas is a rich source of carbon and hydrogen. Many fertilisers use hydrogen and carbon as their feedstock.

- Plastic Industry – It is entirely dependent on crude oil and natural gas.

- Tyre Industry – Crude derivative products are used to manufacture synthetic rubber.

The list is really long and cannot be incorporated in a single article. The transportation sector is huge and is the biggest consumer of crude oil.

Though the advent of EVs is definitely going to put a dent on the oil & gas sector, the era of crude oil is far from getting finished. Only few countries have revamped their infrastructure to support the plug-in vehicles.

Till most of the countries upgrade their infrastructure, enjoy the smokes coming out from the exhausts.

Also Read: What does 2021 hold for Crude Oil?