Summary

- The world’s largest tech companies declared results this week.

- The results of all the five companies have been very robust.

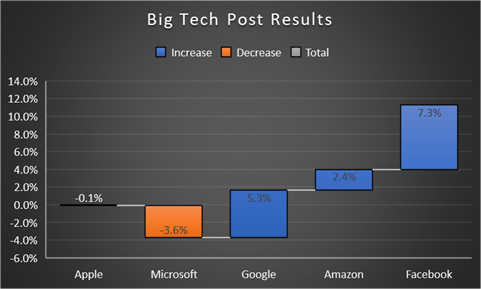

- However, the stock markets have reacted differently to different stocks.

Marked by the results of the biggest five tech giants in the US, this week was probably the most crucial one of the ongoing earnings season. Alphabet, Microsoft, Amazon, Facebook, and Apple – all announced their March quarter numbers this week. The common thing was that results across the companies were way beyond what Wall Street was anticipating.

Source: Kalkine Research

Here is look at how the shares of the big five tech firms have behaved since their results:

Apple Inc (NASDAQ:AAPL): America’s largest company by market capitalisation announced 54% jump in its revenues in March quarter and doubling of its bottomline. It also announced generous dividend payout and an enhanced share buyback programme. Despite the company’s shares surging 3% in the Thursday’s intraday trade after the Wednesday results, they closed 1 basis points lower.

Microsoft Corporation (NASDAQ:MSFT): The company, which is a household name globally, reported its best revenue growth in almost four years on Tuesday -- reporting 19% rise in the topline to US$41.71 billion in the March quarter. However, this hasn’t excited investors much, as the shares of company have fallen by 3.6% in the two trading sessions since then.

Alphabet Inc (NASDAQ:GOOG): The parent company of search engine – Google – on Tuesday announced a massive US$50.0 billion buyback of shares. The company also saw it revenues surge to US$51.18 billion in the March quarter. In the two days since then, the shares of the company have seen massive buying and are trading 5.3% higher.

Facebook Inc (NASDAQ:FB): The social media behemoth on Wednesday reported a surge of 48% in the topline, primarily driven by huge growth in the advertisement revenue despite adverse environment. The shares of the company surged by 7.3% to close at US$329.51 a piece on Thursday, after the results.

Amazon Inc (NASDAQ:AMZN): The revenues of world’s largest e-tailer surged by 44% in the first quarter of 2021, as the company tends to benefit from the pandemic-induced online shopping mania. The company announced its results on Thursday. In the afterhours of market since then, the shares of the e-commerce behemoth have surged by 2.35%.