Source: Andrey_Popov, Shutterstock

Summary

- Australia has been experiencing a significant rise in property prices as the economy continues to recover from the pandemic.

- The recent spike in housing prices has sparked concerns of a further increase in the level of household debt.

- Australian regulators are keeping a close watch on the runaway price rises in the housing market, which can pose risk to the financial stability.

The surge in the Australian housing prices observed during the recent months has piqued the concerns of the government and the central bank. Buoyed by rock-bottom interest rates, the property prices have returned to record levels in Australia, urging the nation to mull measures to cool the overheating housing market.

With the Reserve Bank of Australia (RBA) ruling out a rise in interest rates for the next 2-3 years, economists are calling for the use of macro prudential tools to cope with the red-hot housing bubble. Previously during the global financial crisis, Australia successfully deployed macro prudential tools following a property market boom on low interest rates.

Why is this Housing Boom Extraordinary?

As the economy continues to observe strong recovery from the pandemic, the housing prices are increasing in synchrony nationwide, setting Australia for the “biggest ever property boom”.

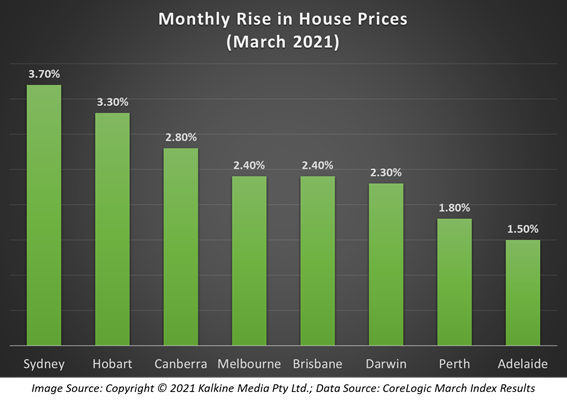

Property consultant CoreLogic’s recently released home prices data suggest that Australian property prices are surging at the fastest pace in 32 years. CoreLogic’s monthly home value index increased by 2.8% in March, marking the largest monthly expansion since October 1988.

Related Read: House price boom driven by low interest rates: RBA

Interestingly, the property values increased by at least 1.4% across every capital city of the nation, with Sydney leading the pack for capital gains.

Soaring property prices across the nation have also been accompanied by increasing home loan finance commitments, which remain strong despite a fall in February 2021.

The Australian property market boom has been stimulated by ultra-low borrowing rates, an under-supply of new houses, improving economic outlook and government initiatives. Concerns are mounting over the fact that the recent spike in housing prices can swell the level of household debt, which is already at worrisome levels.

Rising Housing Prices - A Risk to Financial Stability?

In the recently released Financial Stability Review, the RBA highlighted that a rise in asset prices (including housing) beyond fundamental values, coupled with weaker lending standards and rapid growth in borrowing would be a risk to the nation’s financial stability.

The central bank notes that persistent surge in housing prices could fuel expectations that this rise will continue while increasing borrowing and risk taking by Aussies, particularly in the wake of low interest rates. This could drive property prices above their fundamental values, which could result in a correction in housing prices, exposing lenders to huge losses on higher debt if borrower’s income fell.

Must Read: Housing Unaffordability Rising Faster In Western Countries

Simply put, the Reserve Bank sees a risk of excessive borrowing from rising asset prices and cyclically low interest rates. However, the policymaker also believes that the property market strength has decreased near-future risks to household balance sheets.

The regulatory authorities, including the Australian Prudential Regulation Authority (APRA), are keeping a close watch on the runaway price rises in the housing market over recent months. While APRA does not see the current rise in the house prices calling for an immediate alarm, a further increase in risky lending can invite fresh set of rules for banks to ease asset prices.