Highlights

- Incidents of hacking of decentralized finance protocols have made headlines in 2022

- Wormhole, a bridge between blockchains, has become the latest target of a multi-million-dollar heist

- The Wormhole crypto project’s hacking shines the spotlight on the weaknesses of blockchain-based finance

Decentralized finance (DeFi) platforms provide trading as well as lending and borrowing services to crypto holders. Hackers exploiting the weaknesses of DeFi protocols have become a big concern lately.

In a recent attack, a popular blockchain bridge network, Wormhole, is said to have lost over US$300 million. Before we know more about the hack, let’s know what the Wormhole crypto project is.

Wormhole crypto

Though most blockchain projects have a native token, for example, Ethereum has Ether, Wormhole is yet to have an independent token. As of now, the primary field of work is allowing users to harness the potential of multiple blockchains through “chain integration.”

A smart contract on any one of the two popular blockchain networks, Solana or Ethereum, can be moved to the other chain using Wormhole. The project claims every blockchain has a unique ability, for example, its consensus mechanism, and it is rewarding to have apps that can work in any blockchain ecosystem.

Bridgesplit, for example, is a decentralized app that allows users to trade non-fungible tokens (NFTs) across multiple blockchains.

Also read: 5 NFT cryptos to watch in February 2022

Wormhole crypto hack

Experts say that hackers exploited a vulnerability in the network to pull off a US$320 million heist. The modus operandi is comparable to the “Einstein-Rosen Wormhole,” a “speculative” structure that links two distinct points in space-time.

According to one assessment, the hackers used the weakness in the Solana blockchain to artificially show wrapped Ether tokens when they did not have them. Wrapped tokens can be moved across blockchains and they track the value of the original token to which they are pegged to. A wrapped Ether should ideally have the same value as ETH. Similar to the Einstein-Rosen Wormhole, a speculative bridge was built by hackers between Solana and Ethereum.

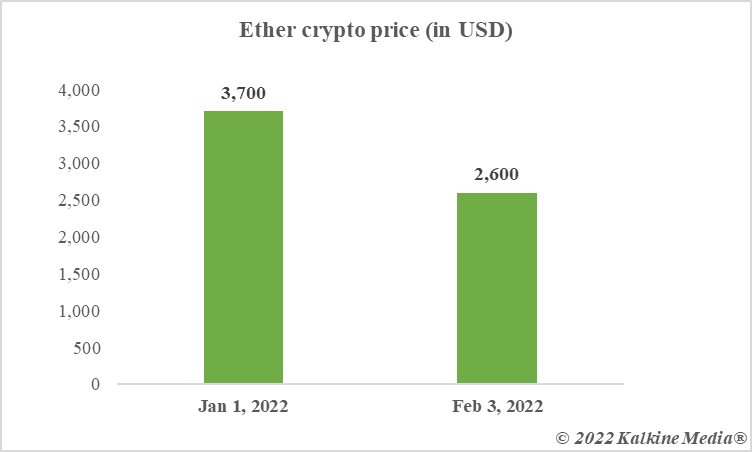

The hackers then moved to the Ethereum blockchain using the Wormhole bridge and could claim ETH. It is being reported that the Wormhole network went short of some 93,000 ETH tokens due to the hack.

Also read: Top 5 altcoins to watch in February

Is DeFi safe?

There is a growing concern that weaknesses within DeFi networks can cost unsuspecting users. Though the promises of staking cryptos and earning yields without having to sell off the asset are a big lure, heists eventually cost users, not the protocol. Based on distributed ledger, DeFi protocols can have decentralized governance and control, which could make them more vulnerable to exploits.

Also read: 5 key crypto predictions for February 2022

One of the most popular categories within cryptocurrencies today, DeFi protocols are gaining in popularity, but the road ahead is not so smooth. DeFi hacks are one of the reasons behind the bearish trend in most cryptos over the past few months.

Data provided by CoinMarketCap.com

Bottom line

Cryptocurrency hacks have existed for long. DeFi protocols are a new target for hackers. These networks may have billions of dollars locked in them.

Wormhole acts as a bridge between two of the most widely used DeFi enabling blockchains, Ethereum and Solana. Wormhole is yet to fully diagnose the attack, and it is yet to be seen if the hackers eventually return the stolen cryptos as we have seen in some past attacks.

Also read: 4 Biggest Crypto Pyramid Schemes that have rocked the market

_01_09_2025_07_01_12_631371.jpg)