Highlights

- Polygon was started as Matic Network, and it is a platform based on blockchain technology to scale and expand the Ethereum infrastructure.

- The MATIC token could have caught the investors' attention as its co-founder Sandeep Nailwal has said that Ethereum will become the global standard.

- The native token of the Polygon platform is MATIC and it can be used for participating in network governance.

The Polygon (MATIC) crypto is getting the attention of crypto trades and it was among the top trending cryptocurrencies. At the time of writing, the MATIC token was trading at US$ 1.11 per token after a surge of 0.6 per cent in the last 24 hours.

According to CoinMarketCap, the one-day volume of the MATIC crypto has surged by 19.2 per cent to US$ 672,548,456. In addition, the market cap has increased by 0.2 per cent to US$ 7.42 billion.

What is Polygon?

Polygon was started as Matic Network, and it is a platform based on blockchain technology to scale and expand the Ethereum infrastructure. The platform can support the development of a variety of decentralized applications.

Meanwhile, the native token of this platform is MATIC and it can be used for participating in network governance, contributing to security via staking and paying gas fees. The advanced layer scaling solutions of the Polygon network is supported by leading cryptocurrency exchanges like Binance and Coinbase.

Also Read: Dromos crypto: Price prediction and everything to know about DRM token

The network aims to accelerate the implementation of cryptocurrencies by finding solutions for scalability problems on a multi-chain system.

Why is the MATIC token’s volume surging?

The MATIC token could have caught the investors' attention because its co-founder Sandeep Nailwal has said that Ethereum will become the global standard sooner or later and it will outperform Bitcoin.

Mr Nailwal has reportedly said Ethereum can become the ultimate settlement layer for decentralized finance (DeFi) infrastructure and Polygon would play an important role in making Ethereum successful.

The Polygon co-founder said that Ethereum can beat Bitcoin as it has a higher number of use cases in comparison. He has said that if the world's oldest cryptocurrency does not expand its utility, it won't be able to compete as a layer-one protocol.

The number of daily active unique addresses on Polygon has outpaced those on the high-fee layer-one Ethereum, said Polygon co-founder Mihailo Bjelic on Twitter. He said that Polygon had 351,000 daily active addresses, and Ethereum had 326,000.

© 2021 Kalkine Media Inc.

Bottom line

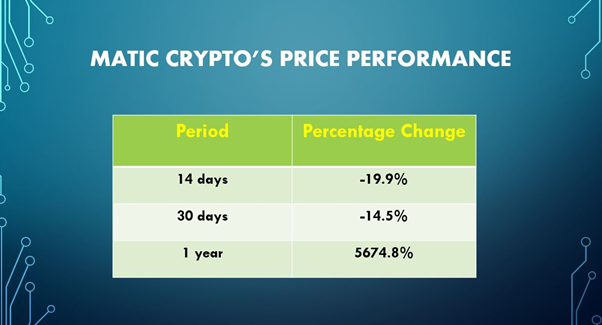

The MATIC crypto had a massive growth of about 5678 per cent in the last 12 months, whereas, it has declined by 7.4 per cent since the past week.

The MATIC token has a circulating supply of 6,672,300,637 tokens and a total supply of 10,000,000,000 tokens.

Also Read: What is Illuvium? ILV coin price prediction as volume soars over 550%

If the cryptocurrency enters a bullish zone, the MATIC crypto could reach US$ 1.4 per token by the end of this year.