Highlights:

- BarnBridge (BOND) crypto generated significant traction as its price soared by 65 per cent.

- BarnBridge functions as a sort of decentralized finance (DeFi) lego.

- On the BarnBridge network, the BOND crypto is utilized for wagering and rewards.

After a period of the brief rally on July 20, the crypto market dipped significantly on Thursday morning as prices of almost all the major digital currencies declined in the last 24 hours.

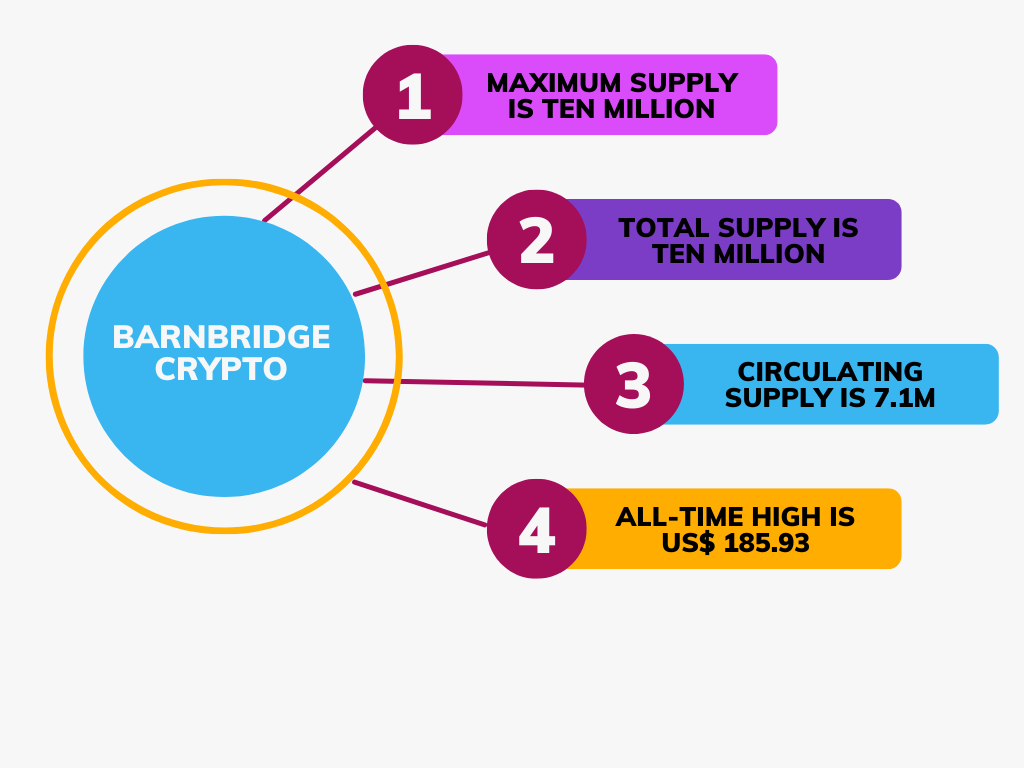

Amid the declining market, BarnBridge (BOND) crypto generated significant traction among investors as its price soared by 65 per cent, and it was trading at US$ 12.96 per token at 3 AM EST.

The rise in the volume of the BarnBridge crypto indicated that it could be gaining investors' attention. Over the last 24 hours, the trading volume skyrocketed 490 per cent to US$ 287.4 million, as per CoinMarketCap.

The sudden increase in the price and volume of BarnBridge crypto has left crypto enthusiasts wondering about what is causing this surge. Let's find out:

Why is BarnBridge crypto rising?

BarnBridge announced on Twitter that its version two (v2) is coming soon and will have pools with shorter maturities. The network said that as the industry is moving at a warp pace, people are uncomfortable with locking their assets for a long time.

Hence, BarnBridge is looking to offer pools with shorter maturities. Notably, BarnBridge is a risk tokenization system that was established in 2019 and later, it debuted in 2020.

BarnBridge functions as a sort of decentralized finance (DeFi) lego, and the BOND crypto is the native token of the network. On the BarnBridge network, the BOND crypto is utilized for wagering, governance, and rewards.

Source: ©Kalkine Media®; © Rizelle Anne Galvez via Canva.com

Any wallet that accepts Ethereum can store BOND, making it simple to access the token. Meanwhile, it is available for trading on major cryptocurrency exchanges like Binance and KuCoin.

Bottom line

BarnBridge crypto is gaining traction despite the fall in the market. However, an investor should research and study the use cases of a virtual currency before buying it.

At the time of writing, the valuation of the crypto market had gone down by 4.7 per cent as high volatility remains in the market. Any cryptocurrency's rising price and volume shouldn't be the only reason to influence an investor's decision.

Before investing in digital currencies, it is important to prioritise research and risk assessment.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.