Highlights

- Almost all major cryptocurrencies have regained at least some lost ground over the past week

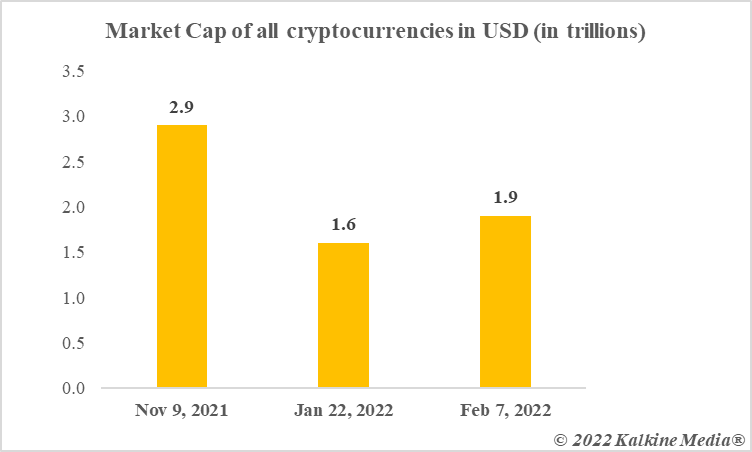

- The total market cap comprising of all crypto assets has emerged from the lows of early 2022

- At least three factors may be shaping this recovery, but a long-term prediction is not possible

The cryptocurrency investment space is not for the faint-hearted. Prices can fluctuate in any direction, and the investor must be exceedingly cautious.

After a dull start this year, crypto assets have generally rebounded. Though most of the top assets like Bitcoin are yet to reclaim their peak prices, the price appreciation lately has cheered backers. The question is why have cryptos been rising now and would this appreciation phase last in the long run? Let’s note the key reasons behind the rally.

The (limited) rebound in stocks

Cryptocurrencies imitated the price trajectory of listed stocks in the first few weeks of 2022. The S&P 500 Index, and Canada’s benchmark TSX Composite Index were both subdued as they entered the new year. Much of the slump was attributed to tech stocks that lead the S&P 500 in terms of market cap. Lately, a few tech stocks have been able to trim losses. Amazon is up marginally, and so is electric car maker Tesla’s stock.

Both stocks and cryptos are considered riskier assets as compared to fixed return investment options. Crypto investors may have taken a cue from the stock market to what analysts call “buy the dip.” Bitcoin and other high market cap cryptos were trading very low and some investors could have heightened the bet on cryptos. That said, if stocks are volatile, cryptos are hyper-volatile.

Also read: Tech stocks in 2022: Will they create wealth for investors?

The Fed’s near-certain rate hikes

The first few weeks of 2022 were dominated by the anxiety around looming rate hikes. There was little certainty about the exact timing of central banks sucking liquidity from their respective economies. The clouds are clear, and most likely the Fed is set to hike rates in March for the first time since the onset of the pandemic. Investors in risky assets that give variable returns may have re-worked their bets and may be no more correction is underway.

Second, the rate hike by the Fed and other central banks may not be steep. In Canada, the economy lost jobs in January and the Bank of Canada might steer clear of upsetting the economy by sucking too much liquidity. There is a near-consensus among analysts that rate hikes will come in phases. This means that interest rates may still sit at a low level in the near-to-medium term.

Also read: Top 5 altcoins to watch in February

The buzz around Web 3.0

After a lot of debate around blockchain, the focus has now shifted toward Web 3.0. Proponents of this concept claim that a decentralized internet is set to replace the internet of today where tech giants like Facebook and Amazon may not hold too much power.

Decentralized finance is making headlines and the economics of tokens in this sort of financial world is a dominating theme. Most projects in decentralized ledger technology have their own linked tokens, and investors may be anticipating a rise in their values as the world warms up to Web 3.0.

Data provided by CoinMarketCap.com

Also read: Meta ceases Diem: What does Facebook token’s end mean for crypto space?

Bottom line

First, as listed stocks have pulled off a limited comeback, it may have lifted the spirits of crypto backers. Second, rate hike anxieties may have settled now. And third, the buzz around Web 3 may be lifting the status of native tokens.