Highlights

- Apple and Microsoft led the dream bull-run of the global stock market in 2021

- Apple is now a US$3 trillion company, which adds more glamor and value to its stock

- Emerging tech like clean energy may, however, become the new favorite of investors in 2022

There are two elements to the debate around tech stocks that must be discussed. Do these mega-market cap companies still have room for growth? And can future streams of tech still be appealing for investors? Both these factors impact tech stock’s ability to create wealth for investors.

Tech giants & the potential for further growth

First, big tech stocks, which include FAANG [Meta (Facebook), Apple, Amazon, Netflix, Alphabet (Google)] stocks and Microsoft remain a close watch.

The broader outlook is that these stocks – regardless of all the noise around privacy issues and market dominance, which Google has in search and Amazon in online retail – may continue to create wealth for their backers.

Also read: 5 top e-commerce stocks of 2021 in Canada

From $1 trillion to $2 trillion to $3 trillion-dollar market cap

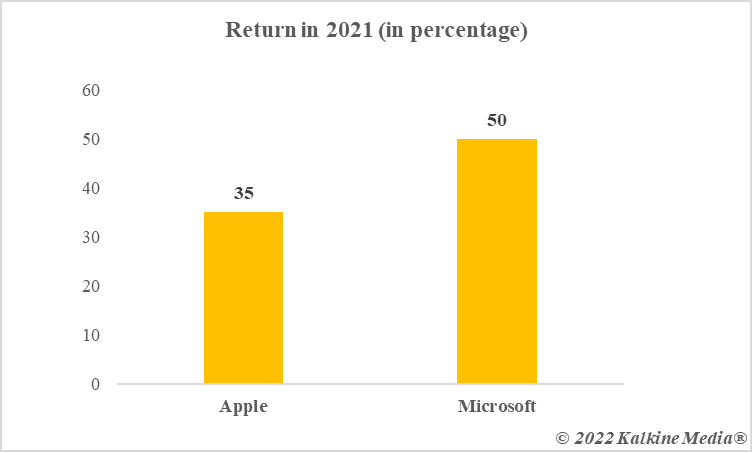

A decade back, it would have been difficult to think of a company worth US$1 trillion. Apple achieved the feat in 2018, and in just two years after this, the company doubled its market cap to US$2 trillion – and now US$3 trillion. In 2021, tech stocks were a good pick, with Apple returning almost 35 per cent. Microsoft returned over 50 per cent last year.

We all know that developed economies grow with a slower pace than emerging economies like China and India. But here we are – these top assets like Apple and Microsoft growing at such a dynamic pace.

One of the reasons behind this is investors’, both institutional and retail, interest in fundamentally strong stocks in the wake of the pandemic that has troubled those companies more which operate on a smaller scale. Tech giants have resilient supply chains, can easily shift to work-from-home regime, and demand is upbeat for their products and services. The pandemic has been a blessing as countries are looking for more computers and people are hooked on online shopping, social media and Netflix.

What to expect at a time when there are talks around when Microsoft would topple Apple again as the world’s most valuable stock? Such headlines and discussions shape investors’ sentiments, especially the retail investor class, and they buy more of these stocks.

Also read: What to do when debt feels unmanageable?

Non-tech giants like Tesla have a chance

Second, there is this theory about any business’s life cycle.

What follows growth is maturity and eventually either stability or decline. Tech is not all about Apple’s iPhone or Microsoft’s operating system. What about clean and sustainable energy and other emerging technologies? What about lithium battery or hydrogen fuel cells? Tesla, the biggest car maker by market cap gained well in 2021. And it also gained superbly in 2020.

It is likely that a few investors of tech giants would reshuffle their bets, with inflows coming to emerging technologies like lithium battery or renewable energy stocks.

Also read: What does Tesla do in Canada?

Bottom line

Tech stocks have all the potential to create wealth, but it is now likely that investors would want to book profits on tech giant stocks and place bets in emerging tech. In this light, clean and green energy seem to have better growth potential, more so when climate change is the key theme of all multi-lateral talks.