Highlights

- Unmanageable debt can be a little painful, but there are ways to overcome the stress

- The debt-to-income ratio is a measure that can tell you if you are accumulating too much debt

- Increasing your income level is not easy, but identifying a debt issue is easy with this ratio

Debt isn’t a bad thing. In fact, the world owes to borrowing and lending for all the progress made so far. Had there been no lending institutions, most businesses would not have been able to even start, and then expand.

Source: Pixabay.com

But it isn’t good in the event of subdued income levels. The ongoing pandemic has hit the economy hard and we have yet to regain lost ground on many counts.

Prices of houses are rising exponentially in the US, Canada and in most developed nations, and then there is inflation on basic goods. Disposable income is under stress and it is time to note a few points that can come handy when debt becomes unmanageable.

Also read: Top fintech trends of 2022: Blockchain to dominate

Identifying the problem

The real problem about debt and its management is that many people may fail to identify the early signs of it becoming unmanageable. Can you cure a problem without identifying it?

A simple solution can be to cut down on your debt and/ or increase your income, but there is more to this than meets the eye. Cutting down on debt once it has been accrued is easier said than done. Yes, there are a few options like refinancing a mortgage debt to scale down the interest rate, but these are just temporary fixes.

Also read: Black Friday or Cyber Monday? Both are under threat

Debt-to-income ratio

In order to ensure that debt remains manageable in the long-term, it is essential to know at all times what your debt-to-income ratio is. Divide your monthly income by debt obligations for the month. Lenders usually prefer a ratio lower than 35 per cent. Don't forget, there will always be other spending and investments aside from debt obligations where you would need to put money.

This easy-to-calculate ratio comes handy in promptly identifying whether you are breaching sustainable debt levels.

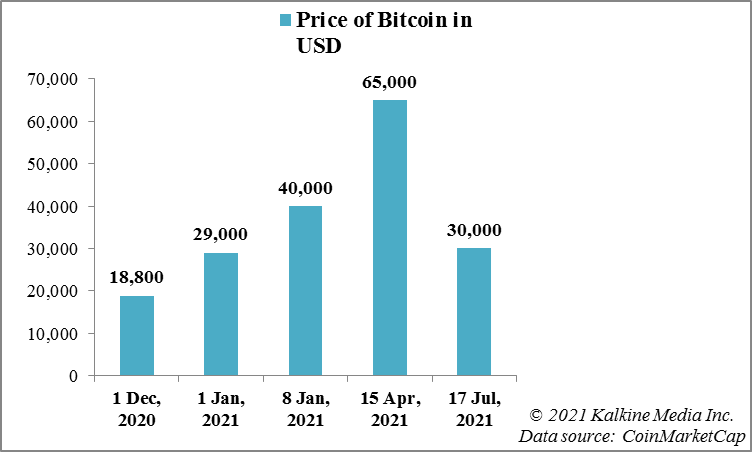

To lower debt when it becomes unmanageable, cut down on discretionary spending like leisure travel and on riskier investments and volatile assets. What some people tend to do is they invest in riskier assets like cryptocurrencies to fund the shortfall in the hope of making quick gains. This, however, can worsen the problem if the timings of investment and profit-booking are not opportune.

Also read: Can Bitcoin be termed as the ‘asset of the century’?

Bottom line

It is not easy to cut down on debt when it has already accumulated. But it is always easy to arrive at your debt-to-income ratio. If it is in the higher trajectory, it is time to cut down on discretionary spending.

_09_03_2024_01_03_36_873870.jpg)