Highlights

- Year 2022 might be dominated by the blockchain technology, which is democratizing finance

- Cryptocurrencies, which use blockchain, can ride pillion and register some more growth in 2022

- Investors have to take note of both the rise of cryptos like Bitcoin and fall of tokens like Squid Game

Technology is penetrating virtually everything. It’s changing mobility from fossil fuel-powered to lithium battery-powered. In finance, more than anything else, it’s the deep penetration of blockchain-based digital currencies in traditional finance that may remain the biggest disrupter at least in the near-to-medium term.

1. Skyrocketing blockchain

No, blockchain is not just about Bitcoin. It is basically about decentralization in finance.

The world loves decentralization as it gives more power in the hands of individuals. Centralized structure is often equated with authoritarianism. Decentralized structure is often seen as more democratic.

Top fintech trends of 2022: Blockchain to dominate

Blockchain, by distributing the ledger among users, has ushered in decentralization in finance. Industry participants including various blockchain networks like Ethereum and Solana are citing this advantage to appeal to investors. Investors too seem to have heeded this call, and many blockchain networks are today worth multi-billion dollar each.

Though there is a debate over the long-term sustainability of high valuations of Bitcoin and other cryptos, there is a growing consensus over the utility of blockchain tech. As stated earlier, blockchain isn’t about Bitcoin alone. Today, financial institutions are adopting blockchain. IBM, a leading technology company listed on NYSE, is offering open-source blockchain services to clients.

2. Cryptocurrencies to ride the blockchain wave

The world has already shifted from physical, cash-driven transactions to cards and e-wallets. But there was always an intermediary, a centralized authority in this arrangement. Intermediaries delay transactions and make them costlier.

Here, the debate whether blockchain-based digital currencies can make transactions faster and cheaper aside, cryptocurrencies are likely to remain a top trend in 2022. The year 2021 was just the beginning of mainstreaming of cryptos. From S&P indices to SEC's approval for a Bitcoin ETF in the US, the current year elevated cryptos' and blockchain tech's status.

The frenzy is unlikely to fade anytime soon. Though most investors talk about only the price movements in these decentralized digital currencies, billionaires like Elon Musk and Jack Dorsey are bullish on the underlying blockchain tech. Dorsey has even claimed that Bitcoin can become the native currency of the internet. These are the themes that will likely dominate the fintech space.

Also read

Can Bitcoin be termed as the ‘asset of the century’?

Top 11 crypto personalities to keep an eye on as we enter 2022

3. Rise of crypto markets

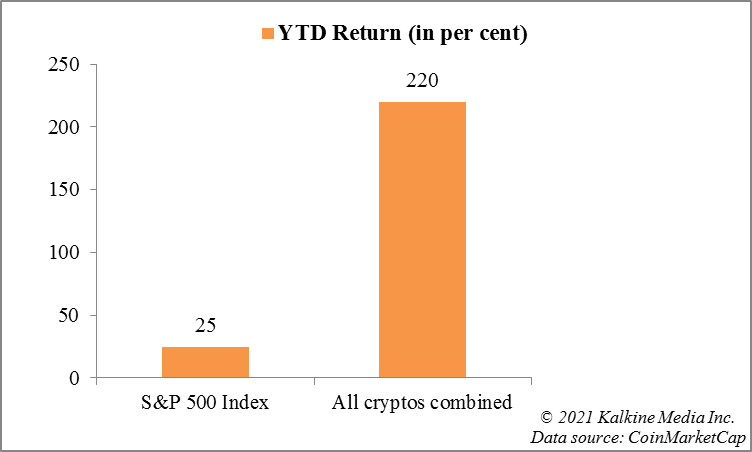

To understand the rise, let’s compare cryptos with the S&P 500 Index.

For now, cryptos have remained an investment asset, although Bitcoin could attain legal tender status in at least one country. The combined market cap of the cryptocurrency space was nearly US$770 billion on January 1, 2021, according to CoinMarketCap. As of now, it is nearly US$2.5 trillion.

The S&P 500 Index – tracked by global investors and cited by Warren Buffett as his favorite of the lot – is up nearly 25 per cent as of now on YTD basis. Though the index has returned well to its backers, it is nothing when compared with the growth in cryptocurrencies in 2021. A few cryptos like Axie Infinity are up more than 20,000 per cent in 2021.

Also read: 5 altcoins investors that may come out on top by January 2022

Viewpoint

There is no doubt that the blockchain technology will remain the fintech trend in 2022, and this is likely to sustain the interest of investors in cryptocurrencies. But there is a need for investors, especially retail, to not liken blockchain to any specific cryptocurrency.

Blockchain is about decentralization in finance, and cryptos are about tokens that can be transferred from one user to the other within a specific blockchain like Ethereum. The returns of cryptos are promising, but some instances like the collapse of the so-called Squid Game crypto also demand attention.

_06_10_2025_01_00_15_274451.jpg)