Highlights

- Both these days are have dominated shopping for years, but round the year discounts are now challenging their relevance

- The difference between the two shopping days is also fading away as e-commerce dominates now

- Spenders can also look at the stock market to ‘invest rather spend’ as the year bids goodbye

Black Friday and Cyber Monday are both days of some extra savings for shoppers and additional revenue for sellers. But there is a big difference in the way the people transact – the first is largely related to in-store physical shopping, and the second is predominantly shopping over the internet.

Is the difference fading away?

The pandemic has brought a big shift everywhere, and this is an opportune time for sellers to realize the shift that is underway in the retail industry.

Small businesses have erupted over social media platforms like Instagram. When Instagram and Facebook services suffered an outage in early October and the platforms were down for nearly six hours, many such retailers – selling everything from cosmetics to clothing – suffered revenue losses.

The point is these retailers are doing away with middlemen and are able to give steep discounts round the year by harnessing people's love for social media.

Also read: The trick to save extra 20 dollars every week

Are big sale days still relevant?

The onus is now upon traditional retailers including big physical stores and online marketplaces to appeal to customers with something truly extra – some real tangible benefits over the ones provided round the clock by small sellers selling over social media platforms.

Though Black Friday and Cyber Monday have remained the biggest shopping days in the US for long, their dominance is likely under threat as new small retailers have found new avenues and ways to appeal to consumers.

Also read: Best saving strategy while preparing for any natural disaster

Spending vs. saving in the festive season

The global stock market is in an upbeat mood. Gone are the days when investors pulled out money during the initial phase of the pandemic outbreak. Most of the indices around the world have scaled new peaks in 2021. Tesla, the electric car maker that has made its founder CEO the richest man on Earth, has gained multi-fold over the past one and half years.

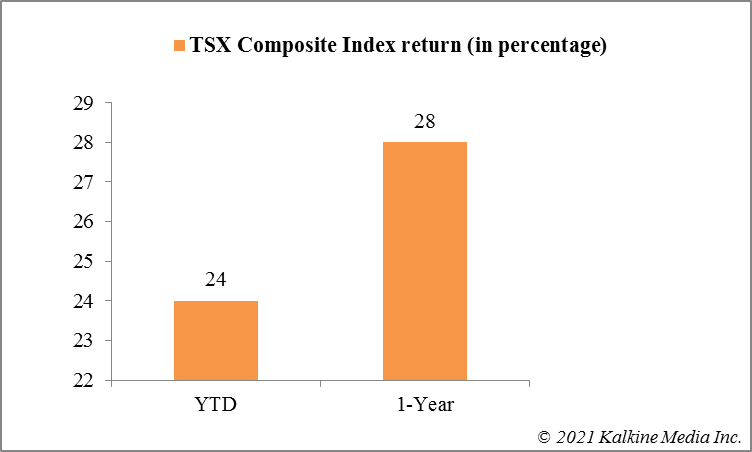

In this light, let us look at the returns of two prominent indices, one in the US and one in Canada.

In the US, S&P 500 Index, literally the heart of the stock market, is up nearly 25 per cent as of now on a year-to-date (YTD) basis. The one-year return of this index is a whopping 31 per cent as of now.

In Canada, the benchmark S&P/ TSX Composite Index has also rewarded investors. The YTD return of this index is over 24 per cent and 1-year return is over 28 per cent.

Also read: Is it the right time to invest in an electric vehicle?

Viewpoint

Black Friday and Cyber Monday are two most closely watched sale days. But, with the proliferation of a new class of sellers that are tapping social media platforms to sell products, the dominance is under threat. These online sellers provide steep discounts round the year by eliminating middlemen.