Highlights:

- Tornado Cash, built on Ethereum, is a decentralized, non-custodial privacy protocol.

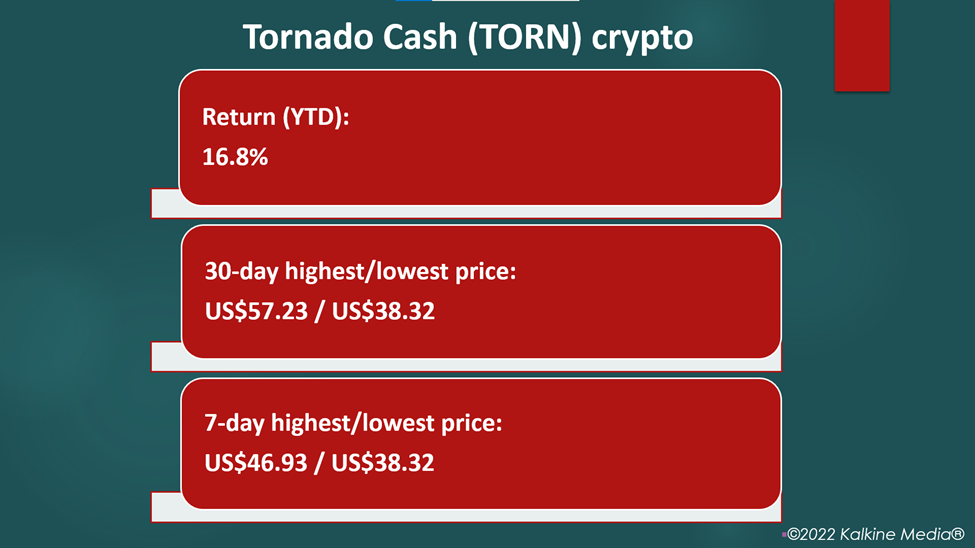

- It returned over 16% gains YTD.

- The TORN token is available on exchanges like Binance, OKX, etc.

The Tornado Cash (TORN) crypto was drawing attention on Friday after it announced using a tool to block crypto wallets sanctioned by the US Office of Foreign Assets Control (OFAC).

The TORN crypto traded flat on Friday morning while its volume slipped over 41%.

Also Read: Is Avalanche (AVAX) crypto rallying on fundraising news?

What is Tornado Cash (TORN) crypto and why it is gaining traction?

Tornado Cash, built on Ethereum, claims to be a decentralized, non-custodial privacy protocol. The company said the protocol enhances transaction privacy by breaking the on-chain link between the addresses of the recipient and destination.

It uses a smart contract that accepts ETH and ERC-20 deposits, which any on-chain address can withdraw. However, when a new address withdraws an asset, the withdrawal cannot be linked to the deposit to secure the assets' privacy.

Also Read: Why is real-estate-focused Propy (PRO) crypto rising?

The protocol uses zero-knowledge proofs (zk-SNARKs) to achieve privacy. While deciding to make a withdrawal, a user should prove that the individual doesn't possess a secret corresponding to one of the deposits' lists of smart contracts. The zk-SNARK technology then allows the proof to verify without requiring users to reveal which exact deposit corresponds to their secret.

TORN is the native governance token of the Tornado Cash protocol. It is a fixed-supply ERC-20 token that allows holders to vote on the protocol's upgrades and fixes. The token is available on exchanges like Binance, OKX, Bitget, etc.

What is Tornado Cash (TORN) Crypto & Why Is It Gaining Attention?

Also Read: Why is Terra (LUNA) crypto catching attention?

On Friday, the company revealed that it uses a tool developed by Chainalysis to block crypto wallets sanctioned by the US Office of Foreign Assets Control (OFAC). The blockade is only applied to the user-facing decentralized applications (DApps) and not to the underlying smart contract, according to one of the Tornado Cash founders.

Also Read: Is Ethereum (ETH) rallying on Merge update? When is it happening?

Data Source: CoinMarketCap.com

Data Source: CoinMarketCap.com

Bottom line:

The TORN crypto was priced at US$42.91 at 10:33 am ET on April 15, up 0.17%, while its volume in the trailing 24 hours dropped by 41.96% to US$6.42 million. It has a market cap of US$47.19 million, and its fully-diluted market cap is US$429.13 million.

It has a max and total supply of 10 million, and its current circulating supply is over 1.09 million. It gave a return of 16.8% YTD.

Also Read: Why is VeThor Token (VTHO) crypto jumped 299% today?

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instruments or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete, or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.