Highlights

- Terra is a blockchain protocol.

- It develops the Terra Luna (LUNA) blockchain and the stablecoin TerraUSD (UST).

- On April 14, Terraform Labs (TFL) donated 10 million LUNA coins to the Luna Foundation Guard (LFG) to support the Terra ecosystem’s development.

On April 14, the Seoul-based Terraform Labs (TFL), the creator of the Terra ecosystem, said it donated another 10 million LUNA tokens to the Luna Foundation Guard (LFG) to support its development.

The foundation supports the Terra ecosystem and its stablecoin TerraUSD (UST). In March this year, TFL donated 12 million LUNA tokens to LFG, worth around US$1.2 billion. Terra CEO Do Kwon announced it on Twitter. Kwon said the tokens would be burned for minting USTs to boost the company’s stablecoin reserve.

After the news, the Terra (LUNA) crypto rose 2.00% to US$85.75 at 7:43 am ET on Thursday.

What Is Terra (LUNA)?

Terra is a blockchain protocol. It uses fiat-pegged stablecoins to power its price-stable global payments systems. Its native token, LUNA, is a governance token and is also used to stabilize the price of its stablecoin, UST.

Terra aims to offer the combined benefits of cryptocurrencies and the price stability of fiat currencies. The protocol keeps the one-on-one peg with an algorithm that automatically adjusts the supply of stablecoin as per the demand.

Founded in 2018, Terra adjusts supply according to demand by offering incentives to LUNA holders to swap LUNA and stablecoins at profitable exchange rates.

Also Read: Is Ethereum (ETH) rallying on Merge update? When is it happening?

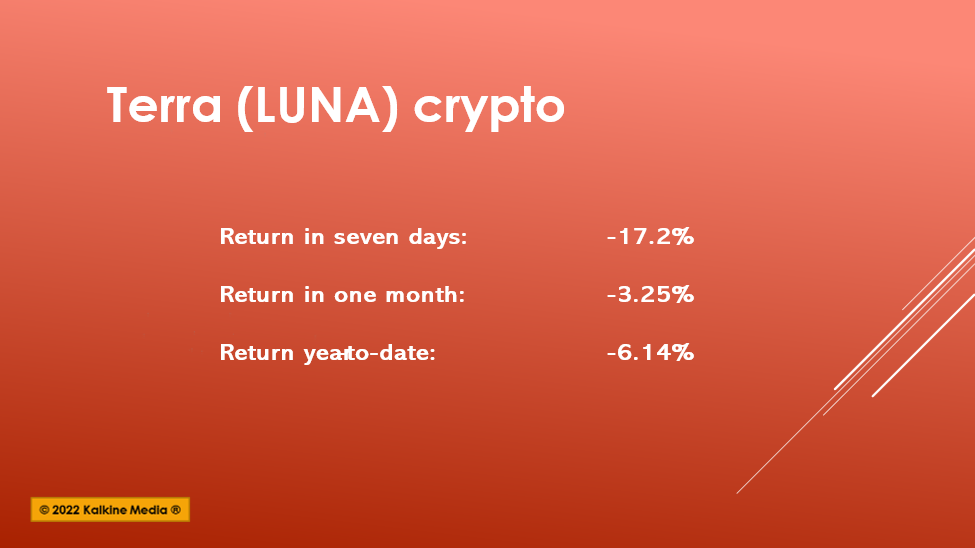

Data Source: coinmarketcap.com

Data Source: coinmarketcap.com

Also Read: Why is GMX crypto gaining attention?

Terra (LUNA) token:

Terra’s two tokens, LUNA and UST, are mutually dependent. LUNA backs UST. The token is burned when the demand for UST rises. Burning US$1 in LUNA means minting US$1 in UST and vice versa. New LUNA tokens are minted to maintain the price of Terra stablecoins. It is done through the protocol’s algorithm.

With a market capitalization of US$30.99 billion, the token is ranked 9th by market capitalization. It has 1435 token holders.

Also Read: Binance (BNB) gets a major boost after nod to operate in Abu Dhabi

The token’s trading volume surged 10.26% to US$1.9 billion in the last 24 hours. Its current circulating supply is 361.6 million out of a total supply of 745 million. The token can be purchased on OKX, Bybit, Phemex, FTX, and Binance crypto exchanges. Recently Binance US has also listed Terra’s stablecoin UST.

Also Read: What is NEXO’s crypto-backed credit card? How is Mastercard involved?

Bottom line:

The crypto market is volatile and prone to hacking threats. Hence, investors should apply due diligence before investing in digital assets.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.