Highlights:

- KMPG is a British-Dutch multinational company, and it is among the big four accounting organizations in the world.

- The cryptocurrency market was trading in the green with a 1.9 per cent increase in market capitalization in the last 24 hours.

- It appears that crypto market enthusiasts were looking up KPMG crypto on Tuesday, February 8.

The cryptocurrency market often witnesses the debut of new cryptocurrencies. At the time of writing, there were 17,417 cryptocurrencies in the market, according to CoinMarketCap data.

As the market was trading in the green with a 1.9 per cent increase in market capitalization in the last 24 hours, it appears that crypto enthusiasts were looking up KPMG crypto.

KMPG is a British-Dutch multinational company, and it is among the big four accounting organizations in the world. It is a network of professional firms offering services related to Auditing and Taxes.

What is KPMG crypto?

It is important to note that no cryptocurrency is available in the market with the name KMPG. In simple words, KPMG crypto does not exist in the crypto ecosystem.

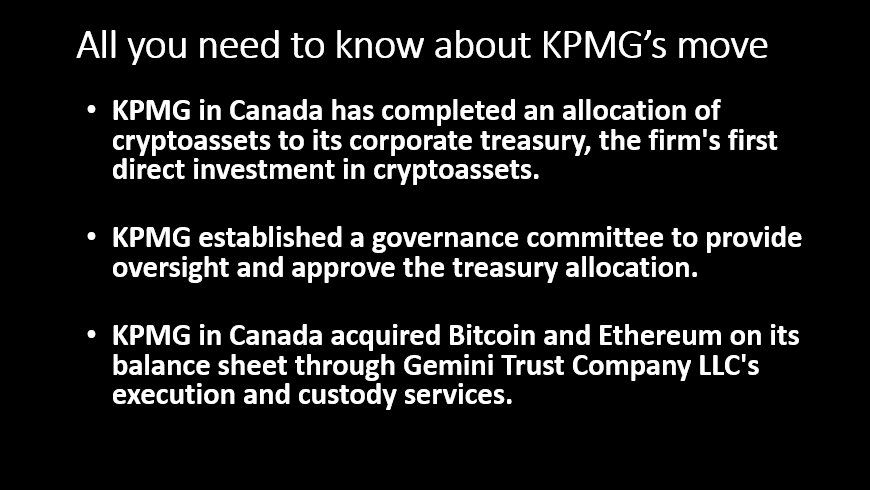

Crypto market enthusiasts could be looking up for this crypto as KPMG Canada said on Monday, February 7, it added Bitcoin and Ether to its corporate treasury.

Under its commitment to asset classes and emerging technologies, KPMG has added virtual assets and is among the largest organizations in this world to invest in cryptocurrencies.

©2022 Kalkine Media®

©2022 Kalkine Media®

The accounting company did not disclose how many Bitcoin or Ether it holds, and the purchases were made through the custody services provider and cryptocurrency exchange Gemini Trust Co.

Notably, KPMG also added carbon offsets to its environmental, social and governance (ESG) commitments as countries try to combat climate change.

Also Read: What is Pawtocol crypto & where can you buy UPI token?

Canada seems to have the potential to become of the leading hubs of blockchain technology and crypto mining. Canadian companies like Hut 8 Mining (TSX:HUT) hold a large amount of Bitcoin and could become one of the world's leading digital asset mining companies.

Due to these reasons, KPMG Canada probably added digital assets to its balance sheet. Although owning virtual currencies could be a risky business due to high volatility in the crypto market, the increasing acceptance of cryptocurrencies could be a reason behind large companies holding digital assets.

Bottom line

As cryptocurrencies and blockchain technology are expected to become mainstream, large companies could be buying Bitcoin and Ether, among other digital assets, for investment and future transaction purposes.

Also Read: Shiba Inu coin buzzes again: Can it reach $1 in 2022?