Highlights

- Shorting a cryptocurrency means selling a digital asset hoping its value will decline.

- It is alleged that the financial holding firms are short-selling Tether.

- Tether, a Hong Kong-based business, has created the stablecoin USDT

Hedge funds are reportedly shorting Tether (USDT), the biggest stablecoin in the world. This has surfaced when the virtual currency market continues to experience extreme volatility following the Luna-Terra debacle.

Shorting a cryptocurrency means selling a digital asset hoping its value will decline, and you can later buy it back at a lower price. Traders then use the differential in the market price to earn money.

Hedge funds are financial holding firms where investors deposit their money in exchange for the promise of active returns from either shorting or holding long positions.

Are hedge funds short-selling Tether crypto?

It is alleged that the financial holding firms are short-selling Tether due to the interest rates hike in an effort to contain inflation. As Tether is tied to the US dollar, hedge funds could be thinking that the current economic situation might affect the Tether stablecoin.

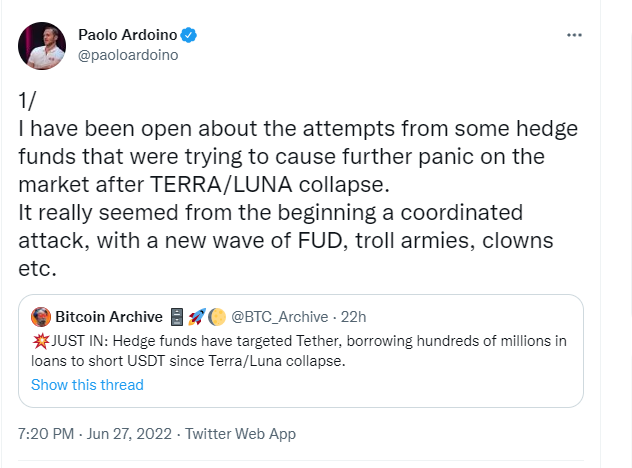

Addressing the reports, Paolo Ardoino, Tether's chief technology officer (CTO), said that the USDT had been the target of a coordinated campaign by hedge funds trying to short-sell the crypto asset.

Twitter @paoloardoino (Paolo Ardoino)

Since the collapse of Terra in May, he claimed on Twitter that hedge funds have taken out millions of dollars in loans to short USDT. Mr Ardoino claimed that hedge funds have been trying to damage Tether's liquidity to repurchase tokens at a much lower price later.

The CTO also accused some hedge funds of supporting the spread of FUD (fear, uncertainty, and doubt) regarding the stablecoin.

Bottom line

It is important to note that Tether might de-peg from its value and lead to another stablecoin meltdown if hedge funds decide to short it. Unlike Terra-Luna, it is backed by tangible assets, as it is not a stablecoin based on an algorithm.

Tether, a Hong Kong-based business, has created the stablecoin USDT, which is pegged to the value of the US dollar.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this web