Highlights

- The metaverse is a major sub-category within cryptos, with participants like Decentraland

- Axie Infinity rose to prominence last year, but it could not maintain the lead against a new token, ApeCoin

- SAND has managed to hold onto its position; however, it is down more than 80% YTD.

Axie Infinity, which exploded in popularity last year on the back of metaverse frenzy, is no longer among the top three metaverse cryptos by market cap. The blockchain game uses the AXS native token. However, two other metaverses, Decentraland and The Sandbox, which also benefited from the frenzy, have their place in the top three metaverse assets.

Among the three, Axie Infinity has been the top loser with highest year-to-date (YTD) losses. This has changed the metaverse crypto category ranking. Here are the top three metaverse assets, as of writing.

1. Decentraland (MANA)

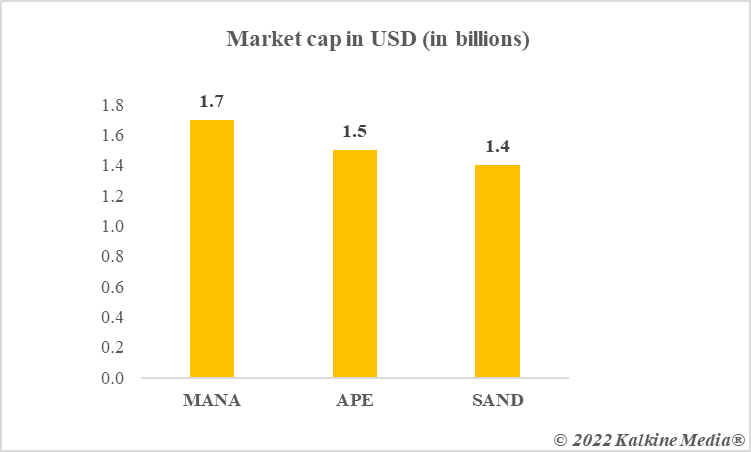

Decentraland’s MANA token ranks at the top, with a market cap of over US$1.7 billion. It is also one of the top metaverse cryptos with respect to 24-hour trading volume.

Decentraland provides virtual plots of land, and it counts big brands like Forever 21, Dolce and Gabbana, and DKNY as its users. These brands are said to have participated in the virtual fashion event organised on Decentraland’s metaverse. Electronics giant Samsung has its virtual store on Decentraland.

The MANA token has lost over 70% of its value so far this year, but it still leads in the category.

2. ApeCoin (APE)

The entrant said to have triggered the ouster of Axie Infinity is ApeCoin. The launch of APE token this year was greeted with much fan frenzy. At one time, ApeCoin even became the largest token in the metaverse category.

ApeCoin is closely linked to a popular NFT project BAYC. BAYC has its own metaverse, which was reported as having sold virtual land at very expensive prices nearly two months back. APE’s market cap is over US$1.5 billion, and it is trading at nearly US$5 apiece.

Also read: Why is Gwyneth Paltrow creating a buzz in NFT world?

3. The Sandbox (SAND)

The Sandbox’s SAND token completes the metaverse trinity alongside AXS and MANA. SAND has managed to hold onto its position; however, the token is down more than 80% as compared to its price at the beginning of 2022.

In 2021, The Sandbox hit headlines when sportwear brand Adidas used it to jump onto the metaverse bandwagon. Similar to Decentraland, The Sandbox also provides access to virtual spaces, often dubbed the ‘virtual real estate’. Rapper Snoop Dogg is also using The Sandbox’s metaverse to provide his fans a metaverse experience.

The market cap of the SAND token is over US$1.4 billion.

Data provided by CoinMarketCap.com

Bottom line

The metaverse is undergoing a change amid the wild price fluctuations of Bitcoin and other native tokens. For now, Axie Infinity will have to make major price gains to regain its position among the top three.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.