Highlights

- The Ethereum vs. Bitcoin discussion is different from the BTC vs. ETH debate as the latter focuses on cryptocurrencies

- Ethereum’s blockchain is used by multiple decentralised applications that include games, ERC-20 tokens, and NFTs

- Bitcoin’s blockchain, which stores BTC transactions, wins when one talks about its use as legal tender in countries like El Salvador

The Bitcoin vs. Ethereum debate is one of the oldest in the cryptocurrency world. Ethereum, which began years after Bitcoin’s launch in 2009, is used by developers to build ERC-20 tokens, store non-fungible tokens (NFTs), and perform other similar tasks. Bitcoin’s blockchain network, on the other hand, does not have such a wide use in the decentralised world.

That said, what many people overlook is that the Bitcoin vs. Ethereum debate is not the BTC vs. ETH discussion. The latter is about cryptocurrencies, which occupy the top two spots in terms of market cap. BTC is often referred to as the Bitcoin cryptocurrency, while ETH is the native token of Ethereum’s ecosystem. Today, let us explore the differences between Bitcoin and Ethereum’s blockchain without unnecessarily entering into the BTC vs. ETH debate.

Both blockchains are different

Bitcoin has an underlying network, which does not have a different name than the project’s cryptocurrency. This is why many think of Bitcoin as only a blockchain-based currency, not a blockchain network. Bitcoin’s network is a decentralised, public, permissionless ledger that allows participants to record transactions from around the world. Here, participants must have the required computing competence to partake in the process, also referred to as proof-of-work.

Ethereum was a later invention compared to Bitcoin, but it also relied on the same proof-of-work model. However, Ethereum’s main blockchain, also called the mainnet or Layer 1 chain, has supported several decentralised projects, including new cryptocurrency tokens like Shiba Inu and NFTs like Beeple’s Everydays. Ethereum’s network is said to be more scalable than Bitcoin’s.

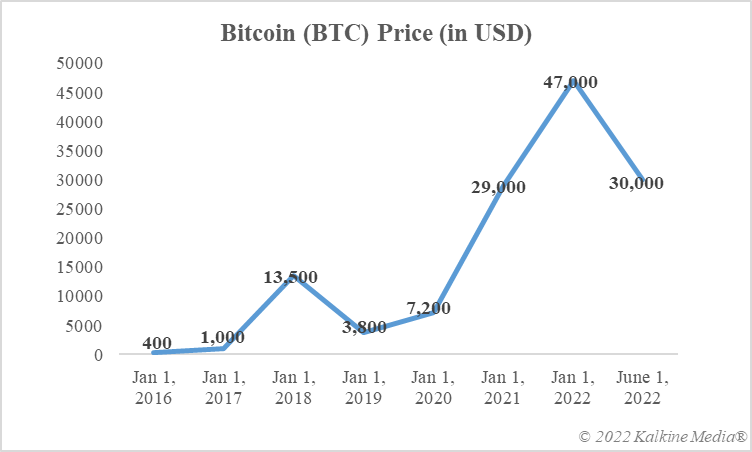

Data provided by CoinMarketCap.com

Ethereum has wider adoption

There is no doubt that Ethereum’s blockchain is the most adopted decentralised network in the cryptocurrency world. Even the Reserve Bank of Australia (RBA) is using the permissioned version of Ethereum to build Australia’s pilot central bank digital currency (CBDC). Bitcoin’s blockchain lacks such broad adoption. However, Bitcoin’s cryptocurrency has been adopted as legal tender by a few countries, which is arguably a bigger success than the government using the Ethereum blockchain.

BTC leads in terms of market cap and per token price, but supporters of the Ethereum blockchain claim that its wider adoption is an evidence that Ethereum is better than Bitcoin. Lately, Ethereum has shifted to the proof-of-stake model, which is said to be lighter on energy consumption. Bitcoin’s blockchain, on the other hand, is often criticised for its high-power needs.

Bottom line

There is no clear winner in the Bitcoin vs. Ethereum debate. In the BTC vs. ETH discussion, the former can be said to be the winner presently, thanks to BTS’ higher market cap and recognition as legal tender in at least some jurisdictions. Ethereum’s blockchain network has broader use than that of Bitcoin’s. However, the blockchain world is yet to completely mature, and hence there is no certainty which would be the top blockchain network in the long run.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.