Highlights

- Bitcoin is used as the legal currency in a handful of nations, but the results have not been promising

- In Australia and most other countries, Bitcoin and other blockchain-powered virtual currencies are considered commodities/assets

- Bitcoin was considered by many to be a revolutionary product that could change the financial world, but it has so far not delivered on this promise

Bitcoin, which we usually refer to as the world’s first cryptocurrency, has changed its form over the years. Now, many of us wonder whether this so-called decentralised virtual currency is actually a currency. A currency, above everything else, is a medium of exchange, or what we call ‘money’.

Is Bitcoin money or has it transformed into something else? Or, has Bitcoin retained its currency characteristics while becoming other things, such as a speculative investment asset? How is Bitcoin treated by regulators like the Australian Taxation Office (ATO) and the US Commodity Futures Trading Commission (CFTC)? Let us explore these questions in this article.

Bitcoin as a currency

Bitcoin, which operates independently of central banks, such as the Fed and the Reserve Bank of Australia, was proposed as a currency by its creator Satoshi Nakamoto. Nakamoto devised a way of payments by using the decentralised technology blockchain in the late 2000s. In this set-up, a large number of stakeholders, also called ‘peers’, come together to record transactions and run the overall system. In the last decade, Bitcoin’s use as a currency has had mixed results.

For the first time ever in 2021 – almost 12 years after its launch – Bitcoin was accepted as a legal form of money in a country, El Salvador. This move attracted criticism from various quarters, including the International Monetary Fund. Since its acceptance as a legal tender, Bitcoin has not yet demonstrated its efficiency in the payments system. Most other countries, including Australia and the United States, do not favour decentralised currencies.

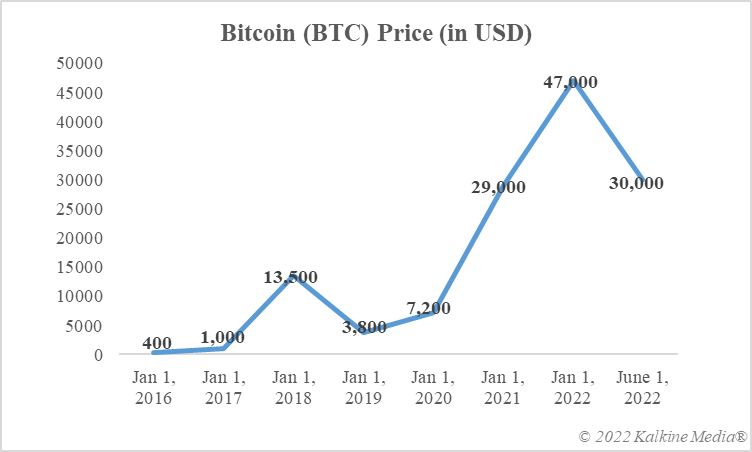

Data provided by CoinMarketCap.com

Bitcoin as commodity or asset

The Commodity Exchange Act – which governs trading in commodities in the world’s largest economy, the United States – recognises Bitcoin and other ‘virtual currencies’ as commodities. The CFTC stresses that although a cryptocurrency can be spent as money ‘in some cases’, it is not a recognised currency in the United States.

The situation is the same in almost every other economy, although in others it is worse, e.g. China, where Bitcoin is totally outlawed. In Australia, the ATO expressly states that crypto assets (the term includes Bitcoin) are ‘not a form of money’. In fact, the ATO recognises Bitcoin and other cryptocurrencies as well as non-fungible tokens (NFTs) as CGT assets. Such assets attract capital gain taxes. By this measure, Bitcoin is more a commodity/asset than a currency in Australia and most other economies.

Bottom line

Bitcoin was launched by its creator as a decentralised digital currency, not a digital asset that was supposed to be traded and treated as a speculative asset. However, with the passage of time, Bitcoin has become a popular speculative asset. What happens to Bitcoin and its peers, such as Ether and Dogecoin, over the coming years cannot be predicted.

Risk Disclosure: Trading in cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory, or political events. The laws that apply to crypto products (and how a particular crypto product is regulated) may change. Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading in the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed. Kalkine Media cannot and does not represent or guarantee that any of the information/data available here is accurate, reliable, current, complete or appropriate for your needs. Kalkine Media will not accept liability for any loss or damage as a result of your trading or your reliance on the information shared on this website.