Highlights

- Flash loans use DeFi technology to allow the borrower access to cryptos without any collateral

- Flash loans are recorded on smart contracts, and the transaction is reversed if the borrower fails to repay

- Flash loan attacks are an issue, and it has become a tool for manipulators to earn quick profits

Cryptocurrency trading is not limited to purchasing an asset and selling it at an appreciated price. Over the past few years, cryptos have evolved with many features that resemble traditional finance.

One such offering is flash loans. How does flash loan in cryptos differ from other credit products? Let’s find out.

Flash loans use DeFi

First, flash loans are essentially a feature within decentralized finance (DeFi). Ethereum is the leading DeFi enabler. On decentralized exchanges, cryptocurrency holders can stake their holding. This is called yield farming, where revenue is earned by lending, not selling.

The borrower of the loan pays an interest in cryptos, which is the underlying revenue model. Aave and dYdX are two popular Ethereum-based DeFi protocols.

Flash loans are instant

Instant loans have also made it to the traditional financial landscape. These pre-approved loans are given out without any hassles like extensive paperwork or background check.

Flash loans in cryptos have similar underpinnings. A borrower can take out the loan in the desired crypto asset in no time. The transaction is recorded on blockchain’s smart contract.

Also read: Top cheap cryptocurrencies with high market cap

Flash loans require no collateral

The key feature of flash loans is that they do not require any security from the borrower. This reduces the entry barriers for new crypto enthusiasts. They can request cryptos from a lender, without having to demonstrate the capacity to repay.

All you need to know about Flash loans on DeFi

Flash loans are secure

At least in theory, flash loans on DeFi protocols are secured by smart contracts. The entire transaction of lending and repaying is recorded in a single smart contract. The contract promotes self-adherence of the terms, and in the event of breach of promise by any party, the entire transaction is reversed.

This means that the lender is given the cryptos back in case of delinquency on the part of borrower.

Flash loan attacks

Not everything is as glossy as it seems. A BSC-based protocol Pancake Bunny was attacked by crypto scammers that manipulated the market using flash loans.

Also read: Matt Damon’s crypto ad controversy: All you need to know now!

By taking out hefty flash loans, any borrower can manipulate the price of the crypto asset in the wider market. The biggest issue is that the entire transaction is still fulfilled as the manipular repays the loan by keeping the illicit profit made on the deal.

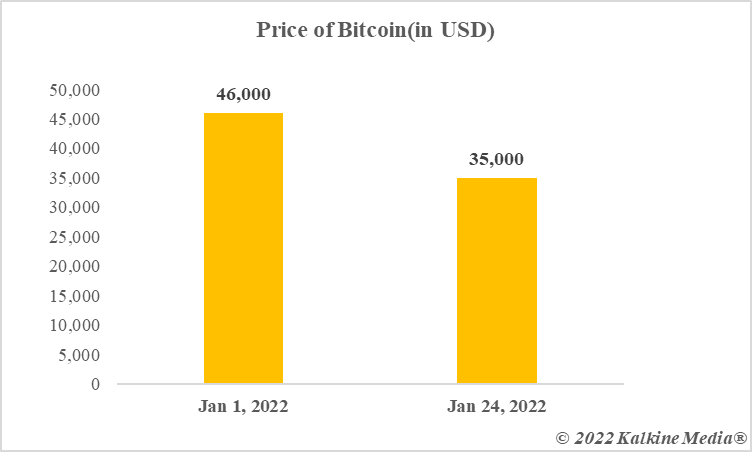

Data provided by CoinMarketCap.com

Are flash loans on DeFi the future?

Instant loans in cryptos sounds like a promising aspect. And by steering clear of collaterals, the entire story sounds more appealing. However, flash loan attacks shine the spotlight on the vulnerabilities. The worst part is that anyone can pull off an attack with ease. If DeFi protocols can figure a way out, flash loans may become a promising arbitrage tool in the hands of crypto investors.